I am a romantic. I love love.

But I hate debt.

It destroys lives and wreaks havoc on relationships.

And the harsh reality is that financial stress, not infidelity, is the number one reason marriages fail.

The statistics are astounding. Half of all marriages now end in divorce, and nearly four in 10 people report money problems as the reason.

So if you’re considering marriage, or even if you’re already in a loving union, here are my top five tips for safely navigating your financial love life (without spoiling the mood).

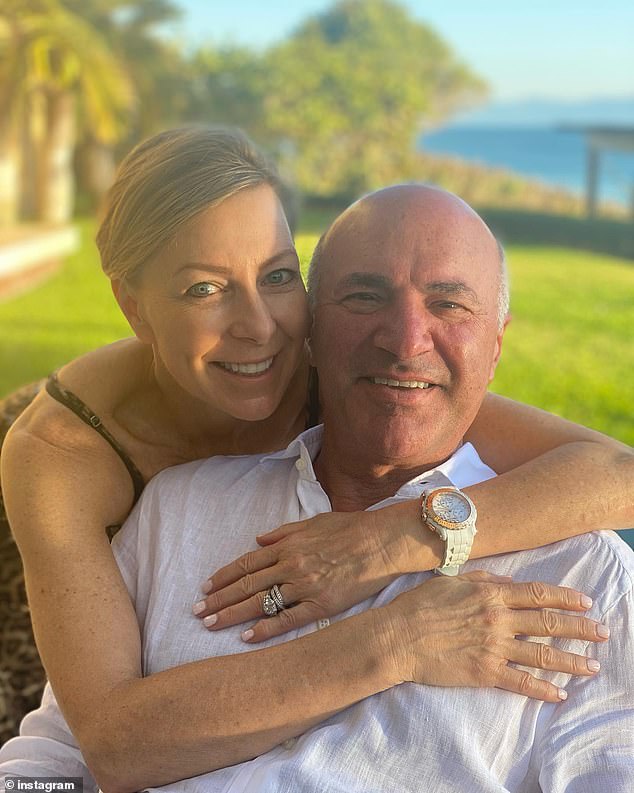

Shark Tank star Kevin O’Leary (pictured with wife Linda) insists he’s a ‘romantic’

ON THIRD DATE AND THIRD GLASS… TALK MONEY

By the time people reach their mid-twenties, most have already built up a substantial financial history.

Don’t assume it’s a good one.

You need to talk about money while looking for Mr. or Mrs. Right – and there is a perfect time to ask this question.

Couples only make it to a third date if there’s mutual interest—that’s when you can slip in some financial due diligence under the warm glow of romance.

Go out for a nice dinner. Share a good bottle of wine. And two and a half glasses in says, ‘Look, I’d like to ask you a few questions, because I’m very interested in you.’

“Have you ever been bankrupt?”

‘How much credit card debt do you have?’

‘How much do you have in savings?’

O’Leary says a pre-nup is ‘the road to success in marriage’

Don’t be afraid to dig. You want to know if there is a problem.

You will probably get one of two answers: ‘Yes, I am financially responsible’ or ‘How dare you ask me that!’

If someone gets defensive, say, ‘Don’t be offended. I’m interested in you and I want to help.’

But if your date still refuses to discuss their financial situation – that’s a flashing red warning sign. I didn’t want a fourth dinner.

Ask yourself: Do you want to hitch your wagon to a partner who is in financial trouble and irresponsible with money?

I would not.

What’s more, this talk sets the tone for the relationship and makes it easier to have even more serious conversations…

The statistics are astounding. Half of all marriages now end in divorce, and nearly four in 10 people report money problems as the reason. Pictured: O’Leary with his wife of 34 years, Linda

SUBSCRIBE BY PROPOSAL

Start the marriage off on the right foot by discussing what will happen in the event of a divorce.

It may seem counterintuitive.

But it is not. By being on the same page financially, couples can relieve themselves of toxic anxiety.

I have invested in prenuptial agreement companies not only because it is a recession-proof business, but because prenuptial agreements are the first step on the road to a successful contractual union.

A prenup forces each person to disclose their net worth, assets and liabilities, and how those assets will be divided in the event of a division. Even if you don’t get married and live with a partner, a marriage is essential.

If one day your lover walks out the door – you have one less thing to worry about. You have your bank account and investments.

Divorce is always difficult – but at least you won’t be destitute.

A prenup is a stress reliever and a marriage stabilizer.

No, it’s not romantic. But it’s an essential part of maintaining your financial identity—something you should do throughout your marriage.

LOVE TOGETHER, USE TOGETHER

I don’t care if you are a newlywed couple or retired grandparents, it is imperative that you never completely abandon your financial identity.

This is my number one tip.

You can have one joint account that goes towards a home loan, children’s education and day-to-day expenses, but always keep separate bank accounts, credit cards and investments.

There is no advantage to combining individual stock and bond holdings. Keep your own advisor and make your own fixed deposits.

I’ve never heard of anyone giving their partner control of their inheritance, why would you hand over your savings?

There is no benefit to that – only the opposite is true.

Most divorces occur between three to seven years of marriage.

If you maintain financial independence, you will be protected.

Only 4 percent of marriages fail after 10 years—so over time, this rule may begin to soften. But in the early years, don’t falter!

And there’s a good way to know your partner can be trusted with the family nest egg…

O’Leary (pictured center with his Shark Tank co-stars) says couples should only have three credit cards between them

CREDIT CARD TROOPS

A married couple should only have three credit cards: one for each partner and a single joint card with a maximum limit of $2,500.

The joint card can be used for joint expenses such as monthly subscriptions, household expenses and entertainment. This card should also have a maximum limit because they are the most used and therefore most likely to be hacked.

And above all else, every card balance should be paid off every month.

This is not only the way to build good credit, enabling couples to secure loans at reasonable rates – it helps maintain financial independence.

Regularly paying off a credit card in your name will maintain your credit score.

The rating companies that calculate credit scores don’t care how much you pay off each month.

They just want to see that you don’t carry debt.

And if your spouse ends each month with a zero balance – then you know you have a responsible partner in the marriage business.

BONUS TIP: GIFT, DON’T LOAN!

Family strife is another potential strain on a marriage – so avoid it whenever possible!

I never lend money to family members because the situation regularly ends badly.

There will always be a cousin, aunt or uncle who needs the money for their latest investment or business.

But no investment is guaranteed, and eight out of 10 startups fail, so you should never expect to be paid back.

Broken promises breed anger.

For this reason I do not borrow.

i gift And only with the recipient understanding that by taking my money they are waiving their right to ever ask me for another gift.

Family and marriage are too important for money to destroy them.

Follow these tips and take that consideration out of the equation.