Shark Tank star Kevin O’Leary has criticized office workers for spending money on coffee and packed lunches.

“Stop buying $5.50 coffee. You have to work and you spend $15 on a sandwich. Are you an idiot?” O’Leary said in a video on his Instagram page.

The businessman, whose net worth is estimated at around $400 million, urged workers to kick the habit and save thousands of dollars.

“Making a sandwich at home and taking it home costs 99 cents,” he explains. “If you start adding that up every day, it’s a lot of money.”

‘Most people, particularly those working in metropolitan cities, are just starting their jobs, making their first $60,000, and they’re wasting about $15,000 a year on stupid things, and that’s what they should stop doing.’

Shark Tank star Kevin O’Leary has criticized office workers for spending money on coffee and packed lunches.

O’Leary’s comments echo statements made by personal finance expert Suze Orman about how much Americans can save by giving up their overpriced daily coffee.

In particular, he highlighted how young people can start putting money aside for their retirement and begin to build up a healthy nest egg.

The financial advisor and former CNBC host said Gen Z Americans could amass a staggering $1 million in savings for their future life simply by giving up their daily $6 Starbucks.

Talking with MSNBC Host Mika Brzezinski and Orman highlighted the power of small investments over everyday discretionary spending.

If a 25-year-old puts away a small amount each month into a retirement account, compound interest will cause this amount to snowball over 40 years, he explained.

“You’re all throwing a million dollars away. I’ve never bought a Starbucks in my life,” he said.

In the March interview, Orman recounted what she had told Oprah on her show when she asked her what people spend their money on.

She told Brzezinski: ‘I said, Oprah, do you know what would happen if you were 25 years old and you bought a Starbucks every day and instead of doing that, you put $100 a month into a Roth IRA, a retirement account, and you did that every day until you were 65?

‘You guys made an average of 12 percent of your money over all those years. Do you know that by the age of 65, you’d have a million dollars? So you’re all throwing a million dollars away?’

Giving up a $6 coffee and putting it into a retirement account with a 10 percent rate of return could grow to more than $1 million over the course of 40 years.

Personal finance expert Suze Orman revealed how kicking your overpriced coffee habit could save you a fortune in retirement

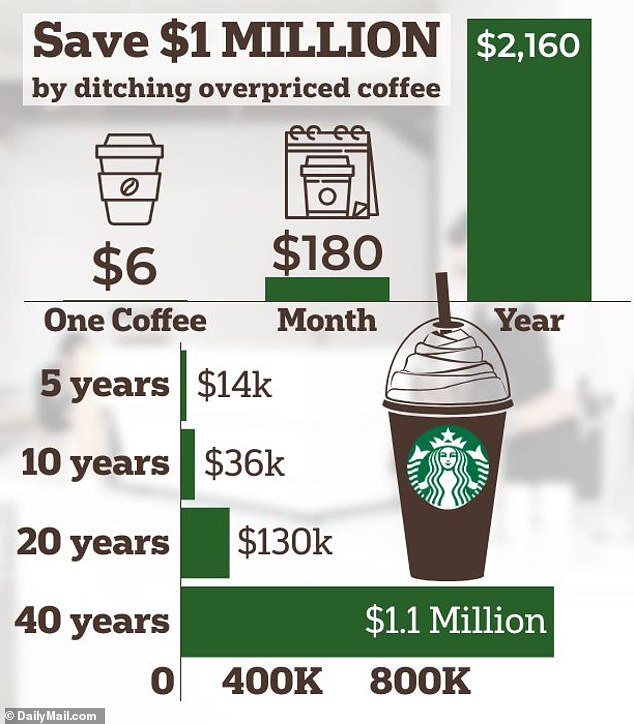

Analysis by DailyMail.com shows that giving up a $6 coffee would save $180 a month.

If those savings are placed in a retirement account with an average rate of return of 10 percent, the funds would grow to $14,070.91 in five years and $130,497.61 in 20 years.

With the help of compound interest, this pot would grow to a whopping $1,007,209.33 over the course of 40 years.

Investment adviser Patrick Donnelly previously told DailyMail.com that resisting the temptation to buy a cold brew or latte and making it at home could mean you have more resources to fall back on in later years.

Donnelly of Donnelly Financial Services said, “That’s real money that can dramatically change your timeline to retirement and can dramatically change your retirement stability.”

He noted, however, that it can be difficult for people to give up all their discretionary spending.

The key, she said, is to consider your spending habits as “guilty pleasures” and pick one thing you could do without but that is detrimental to your savings in the long run.