By the end of the second day of Donald Trump’s secret trial, seven potential jurors had survived a 42-question questionnaire, a 30-minute interrogation by prosecutors, followed by another 30 minutes of investigation by the defense .

Some had had their social media posts scrutinized or had been glared at by the accused.

Their prize is a front-row seat at one of the most momentous trials in American history.

No wonder some of the final six jurors looked terrified as they walked to the jury box to take their seats and be sworn in.

“This will be his permanent seat for the duration of the trial,” said Judge Juan Merchán, who rejected the defense’s repeated delays to be installed at the end of Tuesday’s process.

Six jurors were sworn in Tuesday afternoon. Now the court must find another six (plus six substitutes who will also hear all the evidence in case they need to be exchanged later)

Donald Trump sits among his lawyers in Courtroom 1530 of Manhattan Criminal Court as jury selection continues into its second day Tuesday. But in the end, six jurors had been sworn in.

A seventh was sworn in at the end of the day.

Merchan must find five more jurors plus six alternates on Thursday and Friday (the court does not meet on Wednesdays) if he is to reach his goal of making opening statements on Monday.

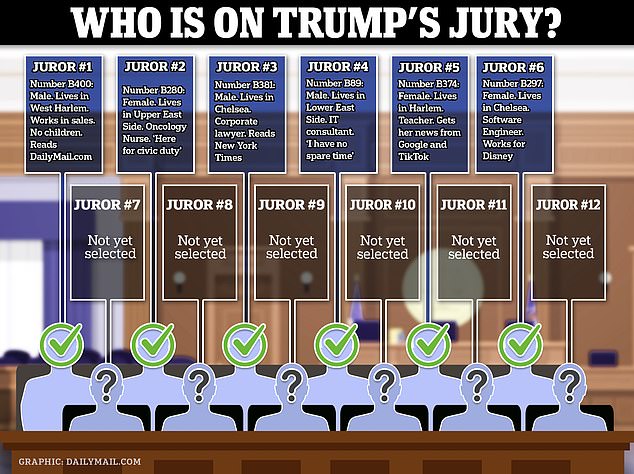

These are the seven jurors (identified only by jury number) seated so far:

B400 Fox News and Daily Mail Reader

A man originally from Ireland who now lives in West Harlem will occupy the number one seat in the jury box. He said he works in sales and was previously a waiter.

In his free time he likes to do anything “outdoors”.

He lives with his spouse and (like many of those who appeared in court) has no children.

One of the challenges for the defense has been finding jurors in liberal Manhattan who don’t get all their news from the New York Times or NPR.

Juror B400 said he reads the Daily Mail and watches Fox News, as well as the New York Times and MSNBC.

The defense and prosecution spent a day and a half trying to oust anyone who had strong feelings about the country’s most famous defendant.

B280 – The Oncology Nurse

The second-place juror said she had lived on the Upper East Side for the past three years.

She lives with her fiancé who works in finance and enjoys spending time with friends and taking her dog to the park.

He provoked a moment of laughter when defense attorney Todd Blanche asked him what his views were on Donald Trump.

“I didn’t even know I was getting into this,” he said, sparking a wave of laughter in a packed courtroom where reporters and members of the public watched a video. “I thought I was going home.”

She insisted that she could be impartial in her judgment.

‘I am here because of my civic duty. “I’m here to hear the facts,” she said.

Trump aide Jason Miller is seen arriving at the courthouse. He sat at the back of the court.

B381 The Oregonian

An Asian-looking man with black hair, between 20 and 30 years old, according to reporters in the courtroom. He will occupy seat three.

He is originally from Oregon and has lived in Chelsea for five years. He said that he is a corporate attorney at Gunderson Dettmer and that he likes to walk and run.

Trump listened intently as he gave his answers to the questionnaire, holding his own copy close to his face as he did so.

Later that day, during the 30-minute ‘voir dire’ session in which the lawyers had their turn to ask questions, he was asked if it was possible to decide someone’s intention from their actions.

“I don’t think you need to read someone’s mind to read their intentions,” he said.

B89 The Trump Watcher

Juror number four is an older man, with increasingly gray hair, originally from Puerto Rico.

He lives on the Lower East Side and works as a self-employed IT consultant.

“I don’t have free time,” he said when asked about his past times. “I guess my hobby is my family.”

Later that day, the defendant smiled approvingly when asked his opinion of Trump.

“Fascinating,” he said, like a naturalist about a wild animal. ‘He walks into a room and makes people angry.

“He makes things interesting.”

Blanche, the defense attorney, was nearly speechless as Trump leaned back in his chair, smiling in approval. “Umm, okay,” the lawyer said. ‘Thank you.’

In this courtroom sketch, former U.S. President Donald Trump sits as his attorney Todd Blanche, right, speaks during the second day of jury selection.

Trump gives a thumbs up as he returns from a break during the second day of his trial.

A Trump supporter drives a van past Manhattan Criminal Court on Tuesday

B374 The Harlem Master

A young black woman from Harlem, she describes herself as a New York native and works as an English language arts teacher.

He said he lives with his brother, who is a basketball coach. And she explained, while going over the questionnaire Tuesday morning, that she got her news from Google and TikTok.

That may not have sounded promising to Trump and his team, except for one other detail she revealed.

Both his mother and godfather were retired from the NYPD; he had been a homicide sergeant.

He also said he could be impartial.

“There was a division in the country and I can’t ignore it,” he said. “However, I never compared that to a single individual.”

B297 – The software engineer

A young software engineer who lives in Chelsea with three roommates and is an employee of Walt Disney.

He said his interests include plays, restaurants, dancing and watching television.

And he said he gets news from the New York Times, Google, Facebook and TikTok.

He said his sister is getting married in September. Would that be a problem?

“If we were still here in September, that would be a big problem,” Judge Merchan said.

She will occupy seat number six in the jury box.

B269 – The Late Addition

After six jurors were sworn in as a group in mid-afternoon, a seventh was sworn in after a quick round of questioning late in the afternoon.

Juror number seven presents himself as white, tanned, and middle-aged. He has very short hair, is balding, and wears glasses and a blue shirt with buttons open at the collar.

He lives on the Upper East Side. And he said that he works as a civil litigator at Hunton Andrews Kurth.

Would that be a problem, asked Deputy District Attorney Susan Hoffinger.

“Yes, I’m a civil litigator, which means I know virtually nothing about criminal matters,” he said.

“I also don’t know anything about electoral or financial law.”