- Prescott claims he received a ‘blackmail letter’ asking for $100 million

- His accuser’s lawyer told DailyMail.com that Prescott ‘is a rapist’

- DailyMail.com provides all the latest international sports news

<!–

<!–

<!–

<!–

<!–

<!–

Dallas Cowboys quarterback Dak Prescott has sued a Texas woman and her lawyers in response to an alleged $100 million racketeering scheme centered around what his lawyer claims is a ‘completely fabricated’ sexual assault allegation.

In January, Prescott received a letter from attorneys Bethel and Yoel Zehaie on behalf of their client, Victoria Baileigh Shores, according to a lawsuit filed in Texas’ Collin County and provided to DailyMail.com by Prescott’s attorney, Levi McCathern. The letter contained the allegation that Prescott sexually assaulted Shores in the back of an SUV on February 2, 2017, following his rookie season in the NFL.

‘Ms. Shores has had to live with this pain and trauma for 7 years,” the alleged letter addressed to Prescott by Shores’ attorneys read. will require future therapy and counseling. She has suffered mental anguish unimaginable as she deals with the trauma of being a sexual victim.’

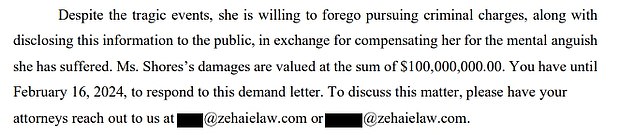

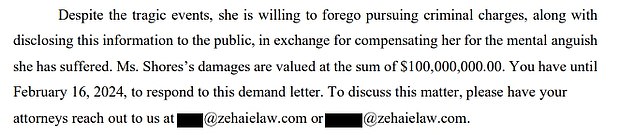

The letter informs Prescott that Shores ‘is willing to forgo pursuing criminal charges, along with disclosing this information to the public, in exchange for compensating her for the mental anguish she has suffered’.

Prescott is then told that ‘Ms. Shores’ damages are assessed at a sum of $100,000,000.00′ and he had ‘until February 16, 2024’ to respond.

Dak Prescott claims he received a ‘blackmail letter’ asking for $100 million

In the alleged letter from Shores’ lawyers to Prescott, he offers a chance to pay her $100 million.

For some inexplicable reason, Mississippi State University, Prescott’s alma mater, is named as a third party in correspondence from Shores’ attorneys.

to us to say that they want to come forward. we are also filing our own lawsuit.’

In a statement, Prescott’s attorney denied Shore’s allegations of sexual assault and accused her of extortion.

‘Sir. Prescott – a new father of a baby girl – has great empathy for survivors of sexual assault. He strongly believes that all perpetrators of such crimes should be punished to the fullest extent possible, McCathern said in a statement to DailyMail.com. ‘To be clear, Mr. Prescott never engaged in non-consensual sexual conduct with anyone. Lies hurt. Especially malicious lies. We will not allow the defendant and her legal team to profit from this attempt to extort millions from Mr Prescott.’

Prescott also reported the alleged extortion scheme to authorities, according to McCathern.

In a message to DailyMail.com, Yoel Zehaie confirmed that Shores is his client and vowed to file his own lawsuit against Prescott.

“Dak is a rapist,” read Zehaie’s message to DailyMail.com. ‘And our story will be heard. Our client files a police report today in Dallas for aggravated sexual assault. More women have reached out

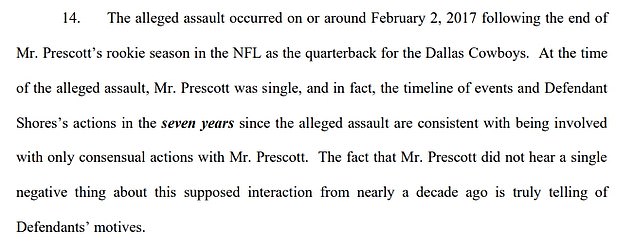

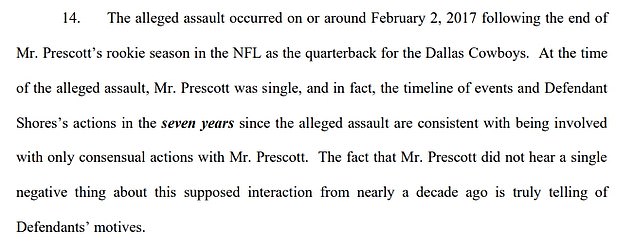

Prescott does not deny having intercourse with Shores, but insists she never raised any concerns

Prescott’s filing explains he was ‘single’ at the time of the alleged assault, and does not deny the two had intercourse. It goes on to suggest that Shores’ conduct over the past seven years is ‘consistent with engaging in only consensual acts with Mr. Prescott.’

“The fact that Mr. Prescott did not hear a single negative thing about this alleged interaction nearly a decade ago is truly telling of the defendant’s motives,” the filing read.

The countersuit is also valued at $100 million, although McCathern said any price would be donated by Prescott to the Joyful Heart Foundation, which helps victims of sexual assault.

Prescott, 30, led the NFL in touchdown passes last season before finishing second in MVP voting behind Baltimore Ravens quarterback Lamar Jackson.

Prescott is entering the final season of his four-year, $160 million deal. He has earned over $160 million over eight NFL seasons.

He and his girlfriend, Sarah Jane Ramos, recently announced the birth of a baby girl.