The alleged mastermind of an $8 million crime ring defaulted on his loans and was kicked out of at least one of his homes before he even became a cosmetic theft “queen.”

Michelle Mack failed to repay the nearly $200,000 loan she took out to run her Mesa, Arizona-based novelty wholesale business, according to 2013 court documents obtained by DailyMail. com.

Former friends said the glamorous blonde had always been keen to make a quick buck and was already running a small business even before she married Kenneth Mack in 2007.

Before being sued in 2013, Mack ran an online business selling hand-painted wine glasses and delicate glass/crystal nail files imported from the Czech Republic.

“It was actually a very big operation even before I arrived in 2015 or 2016 and it employed over 10 people,” one former employee, Michelle Hermann, told DailyMail.com.

“At the time, hand-painted wine glasses were very popular and we sold them in bulk to many other stores.

Hermann added: “As far as I know, she was running a legitimate business at the time, so I was quite shocked when I learned why she was recently arrested.”

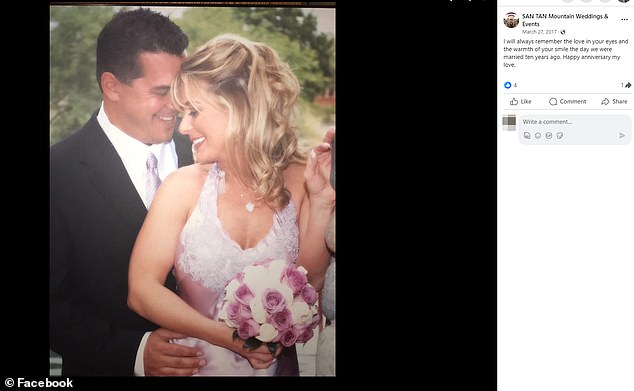

Michelle and Kenneth Mack at their wedding. The California couple was arrested in December for allegedly running a nationwide theft ring that employed others to steal cosmetics and other items from stores including Ulta, Sephora, Bloomingdales and LensCrafters.

Mack, 53, has pleaded not guilty to the charges. She was arrested at her home in Bonsall, California.

Police described the transport as a “mini market” after discovering it was fitted out in a warehouse style at the 4,500 sq ft mansion in Bonsall.

Ulta was one of several stores hit by the ‘California Girls’ criminal operation

The mother of three, arrested Dec. 6, faces several federal charges for allegedly paying others to steal cosmetics from stores like Ulta, Sephora and Bloomingdales.

Mack then allegedly resold the stolen goods at deeply discounted prices, up to 50 percent, on his Amazon online store, which has since been closed.

Amazon told investigators the company has made $8 million in sales since 2012, including nearly $2 million in 2022 alone.

Mack’s gang, nicknamed the “California Girls” by investigators, operated in more than a dozen states and targeted at least 231 Ulta stores.

Investigators said they found more than 100,000 items in the Macks’ Bonsall garage, worth about $387,000, when they were arrested in December.

Mack, her husband Kenneth and seven others were also charged in connection with the robbery scheme.

Hermann said Michelle was “barely around” when she owned a nail file and wine glass business in Arizona around 2015.

“She was very nice when I worked for her, doing billing and other things, but she wasn’t in the office much,” Hermann said of Mack.

“A lot of people have double lives that we don’t know about, but she definitely wasn’t selling makeup or anything like that back then.”

However, financial problems started earlier for the Macks.

In 2010, Michelle defaulted on loans she took out for her Arizona home, according to court documents obtained by DailyMail.com.

The Macks were evicted in July 2010 from their home in Chandler, Arizona, after failing to pay their mortgage.

They nearly lost another home about a month later in Higley, Ariz., after defaulting on another $200,000 loan, according to court records.

The bills continued to pile up for the couple.

In 2013, a judge ruled that they had to pay the nearly $200,000 that Michelle had borrowed to operate her fancy wine glass and nail file business.

Before running her California crime syndicate, Michelle Mack operated a business that sold fun hand-painted wine glasses.

One of Mack’s first business ventures also sold delicately painted glass and crystal nail files. She sold the business in 2017 and began renting out her home in Gilbert, Arizona, for weddings.

Hermann said she ultimately purchased the glass and crystal nail file business portion of 95 & Sunny Inc. from Mack around 2017.

Meanwhile, the entrepreneurial couple turned to another business — San Tan Mountain Weddings & Events — and used their new 4,447-square-foot mansion in Gilbert, Arizona, to rent out for weddings and events. other events.

The five-bedroom house had a sprawling backyard nestled between picturesque desert hills.

The Macks’ wedding business, including decorating and renting their spacious five-bedroom home

The Macks’ wedding and event planning business was run from their estate in Gilbert, Arizona.

In addition to renting out their home, the Macks also offered all-inclusive wedding packages for decorations and alcohol, another source of income for the struggling couple.

A 2017 Facebook post from their wedding company showed a photo of Michelle and Kenneth smiling at their own nuptials:

“I will always remember the love in your eyes and the warmth of your smile on our wedding day ten years ago. Happy anniversary my love.

However, the wedding rental business eventually failed and the couple moved their family to a suburb of San Diego, California.

A wedding tribute posted on the San Tan Mountain Wedding & Events Facebook page, run by Michelle Mack

The Macks would later attempt to replicate their wedding business at their $2.75 million Bonsall, California mansion and winery property, which they rented out on Airbnb.

The Bonsall house, which is now up for sale, was the main hub of the makeup theft operation, according to a criminal complaint and federal search warrants obtained by DailyMail.com.

An aerial photo of the Macks’ $2.75 million property in Bonsall, Calif., which includes a 3 1/2-acre vineyard, winery and private stone chapel.

Hermann said she was still shocked after watching news video footage of Michelle, still dressed in pink and white pajamas, being led out of her Bonsall mansion in handcuffs.

“It made me sick to my stomach because she has kids,” Hermann said.

“I feel for her children and, from what I have heard, the children were there when she was arrested.

“She definitely wasn’t involved in anything like that when we were working together because I would never get involved in something stupid like that. I’m still in shock.

Investigators found more than 10,000 stolen items from the Macks’ garage in Bonsall, California.