Table of Contents

The products presented in this article are independently selected by This is Money’s specialized journalists. If you open an account using links that have an asterisk, This is Money will earn an affiliate commission. We do not allow this to affect our editorial independence.

Savings deals have been hit since the Bank of England made the first base rate cut in August, and experts predict this trend is only going downwards.

Data from rates tracker Moneyfacts Compare reveals that leading fixed-rate savings deals have slumped in recent months as providers prepare for another rate cut in November.

But there is a silver lining in the fact that savers can still find top savings deals paying 5 per cent or more if they are willing to move away from traditional providers at the big banks and building societies – a rate that exceeds more than the current inflation rate.

We ran the rule on three of these savings offers: an easy-access Isa, a one-year solution and an easy-access savings account.

The best things come in threes – there are only three savings offers that pay 5% or more

At a time when savings rates are falling at every turn, trading and investment platform Trading 212 has bucked the trend by boosting its easy-access cash Isa to a market-leading 5.1 per cent.

This is the best overall rate for an easy-access cash Isa, with the next best Isa paying 4.84 per cent.

The average Easy Access Isa pays a rate of 3.27 per cent according to Moneyfacts Compare.

It can only be opened by downloading the Trading 212 app. There are no limits to the number of times you can withdraw your money and Trading 212 will not reduce your interest rate to access your money.

Trade with 212 Easy Access Cash Isa* It is a flexible Isa, which means you can Dive into your boat and, as long as you pay the money back during the same tax year, you won’t lose your tax-free wrapper or eat up any of that year’s Isa allowance.

This is a huge benefit for savers with the financial power to maximize their Isa limit each year, and can be a useful tool to ensure you keep as much of your savings tax-free as possible.

Any cash deposited into a Trading 212 Isa is fully protected by FSCS up to £85,000. Trading 212 Isa funds are held in bank accounts associated with Barclays, NatWest and JPMorgan.

Customers can see the percentage of the cash they have at each bank in interest on the cash tab in the Trading 212 app.

It means that if you already have money in a Barclays, NatWest or JPMorgan account, you will need to be careful not to go over the £85,000 limit if you keep money in Trading 212.

> See This is Money’s cash Isa best buy tables

Prosper now offers the best savings deals for one-year fixed rate savings accounts

Savers can now get the best one-year savings deal* by opening an account on savings and investment platform Prosper.

Prosper has increased the rates on its savings accounts, taking its one year solution* to a better purchase.

The push is a platform increase on the interest offered by the underlying banks and, unlike some rivals, Prosper is increasing the rates paid rather than offering a cash sign-up bonus.

Savers can get a 5.05 percent solution for one year with Prosper*with Al Rayan as deposit account provider.

This beats the current best buy for a one-year solution offered by Union Bank of India and pays 4.95 per cent.

Al Rayan will pay a rate of 4.8 percent on the one-year fixed rate account. Prosper will then pay an additional 0.25 percent increase upon account maturity to your designated bank account.

A saver who deposits £10,000 into the Prosper account would earn around £517 in interest after a year.

The one-year fixed rate account has a minimum deposit of £20,000 and a maximum balance of £1 million.

Prosper is regulated by the FCA and savers have Financial Services Compensation Scheme savings protection of up to £85,000 under Santander International.

Money in a Prosper holding account rather than a savings account is protected by HSBC and Barclays.

Prosper is a savings and investment platform launched in 2022, with a mission to offer cheaper investments and better savings for customers. Prosper’s investment platform currently offers completely free investments in 30 index funds.

Its founder and chief executive, Nick Perrett, and founder and chairman, Ricky Knox, worked together to launch challenger bank, Tandem, while its co-founder, Phil Bungey, was chief operating officer at Nutmeg.

> The best fixed rate accounts: These are the money savings tables

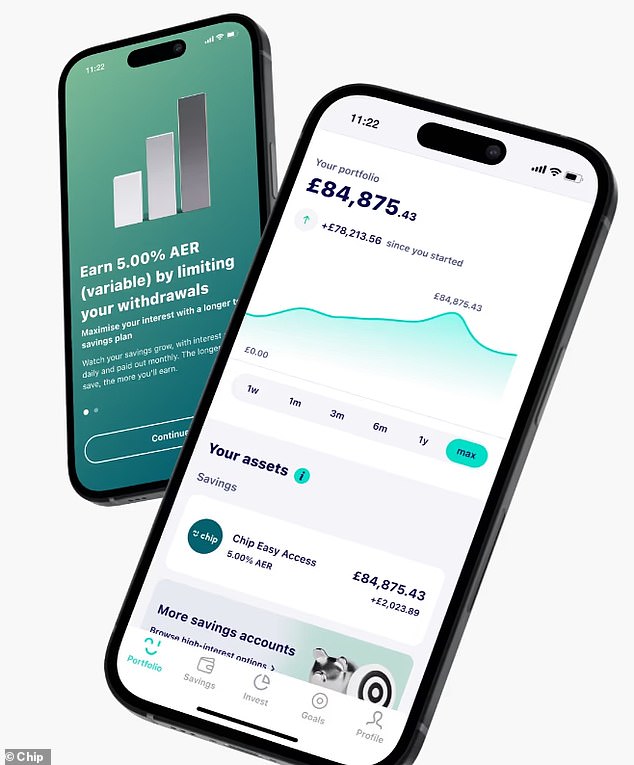

Chip Easy Access Account Offers 5% Higher

The rate has increased by 5 Percent Chip Easy Access Accountlaunching it to the top of best buy charts.

This account can be opened with just £1 and savers must download the Chip app to open an account and start saving.

The rate includes a bonus rate of 0.94 per cent for 12 months, with the underlying rate being a variable rate of 4.07 per cent.

The 0.93 percent increase applies to customers who opened the account after September 20, 2024.

The variable underlying rate is 1 percent below the Bank of England base rate. This means that if the base rate were to increase or decrease, the Chip rate would reflect it by one percent lower.

Experts widely expect the base rate to drop to 4.75 percent in November. If this happens, the underlying rate on this account will fall to 3.75 percent or 4.68 percent with the bonus increase.

One of the disadvantages of this account is that you can only make three withdrawals in a 12-month period before being penalized.

After withdrawals within a 12-month period, the rate will return to 3.9 percent (which is the underlying rate with the boost applied) or 2.97 percent (variable tracker without the boost) for the remainder of the year. period of 12 months from opening. the check.

SAVE MONEY, MAKE MONEY

Investment boost

Investment boost

5.09% on cash for Isa investors

5.05% solution after one year

5.05% solution after one year

Prosperous momentum for Al Rayan

free share offer

free share offer

No account fee and free stock trading

4.84% cash Isa

4.84% cash Isa

Flexible Isa now accepting transfers

Trading Fee Refund

Trading Fee Refund

Get £200 back in trading fees

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.