Pension savings: People fall far short of the average target of building a £250,000 pot, survey finds

Savers aim for a pension of £250,000 on average, but actually end up with just over half that amount, new research reveals.

People have an average of £131,000 when they reach retirement, a huge shortfall in the amount they expected to have available to buy an annuity or invest to generate an income.

A pot of £250,000 can buy an annuity, which provides a guaranteed income for life, worth £12,091 a year at the current exchange rate, according to Standard Life.

Currently, a £131,000 fund can provide you with an annuity of £6,332 a year.

Many people are now taking advantage of pension freedom to keep their fund invested in old age, giving them the opportunity to continue growing their fund as they make withdrawals.

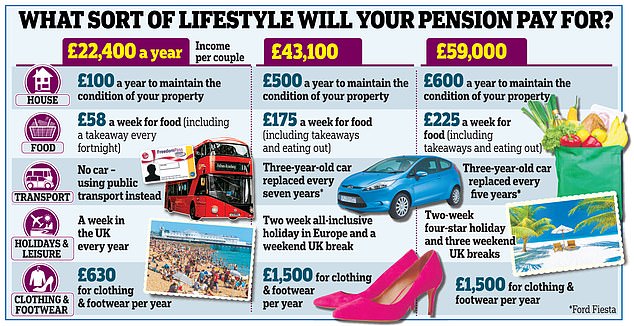

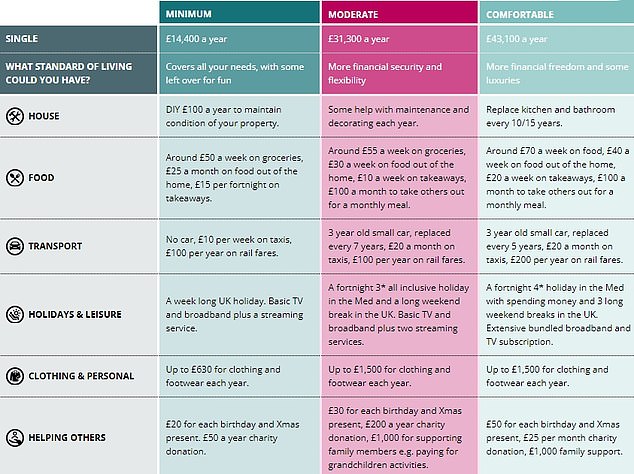

An influential industry report looking at what individuals or couples need for a minimal, moderate or comfortable retirement shows that costs have risen significantly across the board over the past year.

According to research by the Pension and Lifetime Saving Association, a couple now needs £59,000 a year to be comfortable in their old age.

A single person needs to save even more and achieve an income of £43,100 to cover meals out, holidays, trips to the theater and a car, as well as daily needs.

> What to do if you fear your pension is falling short: scroll down for a checklist

The PLSA figures assume you qualify for a full state pension, which rose to £11,500 this month, but the income figures do not include income tax, housing costs (if you rent or are still paying a mortgage) nor the costs of care.

See below what lifestyle you can have in terms of food and drink, transport, holidays, clothing and social outings at different income levels.

Single-income household: Having one state pension instead of two means you need to save a larger work or private fund before you retire

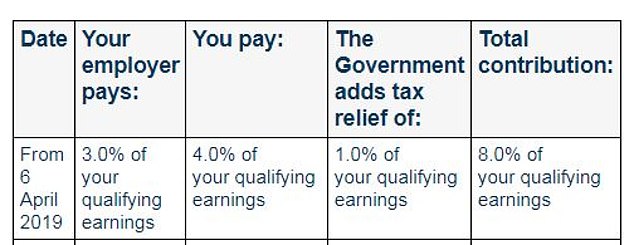

Recent independent research from comparison website Finder showed that saving through auto-enrolment will provide just £22,800 a year after tax for people entering the workforce today.

Finder’s figures also assumed someone would receive a full state pension and were otherwise based on an employee contribution of 5 per cent of salary (including the Government’s pension tax relief), a contribution from employer of 3 percent and annual investment growth of 5 percent. and rates of 0.75 percent.

Who pays what: Breakdown of contributions to minimum pensions by self-enrolment. (Qualifying income is between £6,240 and £50,270 salary)

Standard Life found that half of retirees regret their financial preparation: 53 per cent wish they had started saving sooner and 42 per cent would have received financial advice or guidance.

Pensions is a government-backed organization that offers free retirement planning appointments for people over 50, or see the box below for help finding paid financial advice.

Standard Life surveyed 6,350 UK adults and the results were weighted to be nationally representative based on key demographics.

“It can be difficult to estimate how much you need to save to achieve your desired standard of living in retirement, especially early in your career,” says Dean Butler, the company’s managing director of direct retail.

‘It’s even harder to stick to, as everyday expenses and one-time costs that come up in life constantly threaten to push long-term savings down the list of priorities.

“There is clearly a large gap between what people expect to save and what they actually make; this is not surprising, particularly when viewed during a cost of living crisis; however, the result can be a significantly reduced standard of living during The retirement. .

“Ultimately, contributing as much as possible and as early as possible is the key to a good retirement outcome.”

Dean Butler offers the following advice and scroll down for our guide on organizing your pension.

– Make sure you are taking advantage of all the benefits of your pension plan and your employer’s offers.

If your employer offers a matching plan where, if you pay additional contributions, your employer will match them, consider paying the maximum amount your employer will match to get the most out of it.

– Deciding to pay part or all of your bonus into your pension plan could save you big tax and Social Security deductions. Which means you could keep more of it long-term and could be a great way to give your pension savings a boost.

– If you can, think about contributing a little more to your pension when you get a raise or have a little extra savings.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.