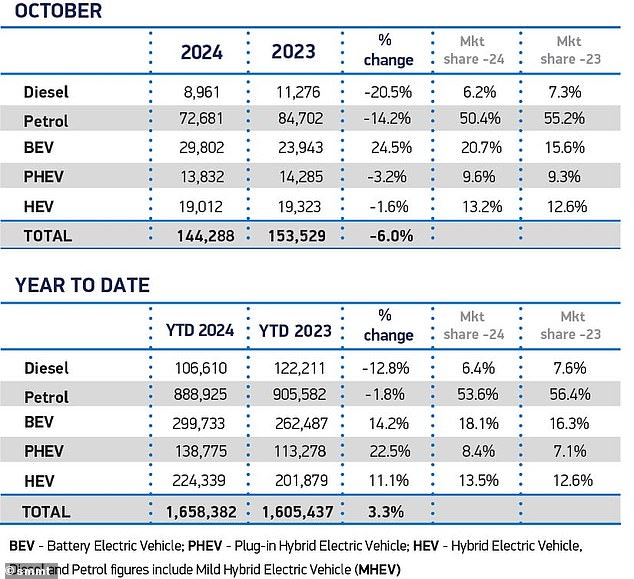

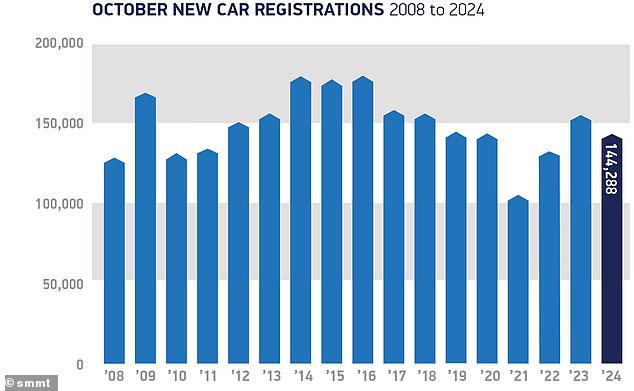

New car sales fell 6 percent in October, only the second time registrations have reversed this year.

Deliveries of gasoline and diesel decreased significantly, while electric vehicles (EV) were the only fuel type to see an increase in demand, a strong sign that the current market manipulation to encourage people to buy electric cars It’s working.

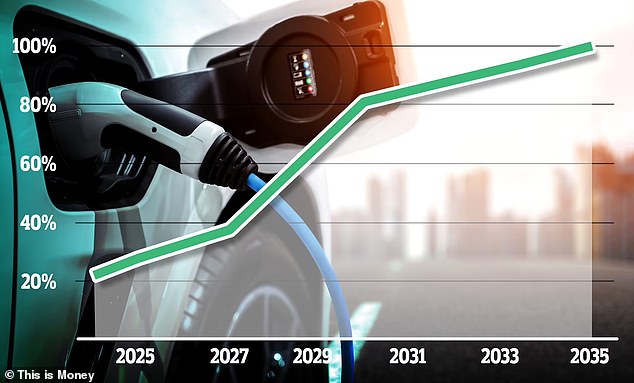

With the Budget confirming that the ban on new petrol and diesel vehicles has been reinstated by 2030 and manufacturers facing increasing EV sales targets each year until then, the market faces increasing pressure to reach government sales figures.

UK new car sales fell six per cent in October, the second time the new car market has contracted this year.

In October, companies, fleets and private buyers registered 144,288 new passenger cars, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT), a figure lower than that of the same month in 2023.

The monthly drop in total market value equated to a sizeable turnover loss of £350m.

This was partly due to a decline in fleet sales, which fell 1.7 percent year-on-year (only the second drop in this market this year), while low-volume business registrations also fell 12.8 percent. most significant percent.

So far this year, gasoline sales are down 1.8%, while 84,742 new gasoline cars were sold last year, compared to 72,681 last month, a drop of 14.2%. Sales of hybrids and plug-in hybrids also fell in October, by 1.6% and 3.2% respectively.

While the rest of the new car market saw declines, electric vehicle registrations rose by a quarter. The trade body attributed this to a greater choice of new battery-powered vehicles.

Sales of gasoline, diesel and hybrids fall; only the demand for electric vehicles grew

With the end of the year approaching and government EV sales targets (and fines for not meeting them) approaching, the new car market in October hints that manufacturers will put a lot more pressure on their EVs.

The month saw double-digit drops in gasoline and diesel deliveries, likely due to market tactics aimed at boosting sales to meet Zero Emission Vehicle Mandate goals, forcing major brands to increase its share of electric vehicle sales to 22 percent by the end of 2024.

Thus, registrations of gasoline cars fell by 14.2 percent, while diesel car registrations – which have been in free fall since 2015 – fell by 20.5 percent.

So far this year, gasoline sales are down 1.8 percent (although they still account for more than half of the new car market), while diesel is down 12.8 percent.

Sales of hybrids and plug-in hybrids also fell in October, down 1.6 percent and 3.2 percent respectively, after seeing big increases in demand throughout this year.

Electric vehicles are the only fuel type to see growth, rising by almost a quarter (24.5 percent) in October, taking over a fifth (20.7 percent) of market share .

Experts say a spate of new electric models entering the market has helped spur demand, and new car buyers can now choose from more than 125 different electric vehicle models.

This is a huge 38 per cent increase in the availability of new electric vehicles in the UK in just the last 10 months.

While it remains true that the average electric vehicle has a higher initial cost than its internal combustion engine equivalent, expanding choice and huge discounts from manufacturers mean that around one in five BEV models now have a lower purchase price than the average petrol or diesel car, especially for buyers able to take advantage of schemes such as salary sacrifice.

Mike Hawes, chief executive of SMMT, said: “Huge investment from manufacturers in model choice and market support is helping to make the UK the second largest electric vehicle market in Europe.”

Mike Hawes, chief executive of SMMT, explained why October had been so good for electric vehicles: “Massive investment from manufacturers in model choice and market support is helping to make the UK the second largest market for electric vehicles. largest electric vehicles in Europe.

Electric vehicle challenges ahead for the industry

While ministers will welcome the rise in the electric vehicle market, behind the bigger numbers lies a big challenge ahead for the industry.

While almost 300,000 new BEVs hit the roads in 2024, this represents 18.1 percent of the market, an increase from 2023.

However, this is still well below the target of 22 per cent for this year – and the 28 per cent to be achieved in 2025 – under the Vehicle Emissions Trading Plan.

Hawes said: ‘Market-wide fleet renewal remains the fastest way to decarbonise, so slowing overall adoption is not good news for the economy, investment or the environment.

“Electric vehicles already work for many people and businesses, but changing the entire market at the pace required requires significant intervention in incentives, infrastructure and regulation.”

The ZEV mandate requires major automakers to increase their share of electric vehicle sales each year until new gasoline and diesel models are banned. The minimum requirement to avoid fines in 2024 is 22%, which will increase to 28% next year and 33% in 2026

While the Budget expanded existing incentives for electric vehicle businesses and fleets, changes to vehicle excise duties and company vehicle taxes discourage the purchase of low-carbon vehicles and fleet renewal in general. , which risks delaying the overall reduction in road transport emissions.

Ian Plummer, commercial director at Auto Trader, commented: “Manufacturers are making significant efforts to close the price gap with electrics, as evidenced by the 12 per cent discounts on the Auto Trader site in October, but the market is still It is not reaching the necessary volumes.

“With the 2030 ban date on the sale of new petrol and diesel vehicles re-established, we urgently need to make the positive case for electric vehicles to ensure a larger, healthier new car market.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.