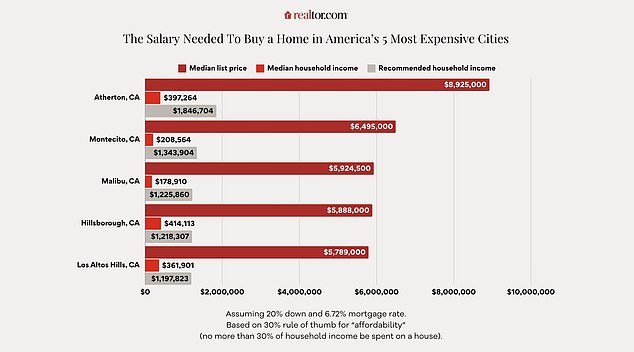

Americans would need a salary of well over $1 million to buy a home in the country’s five most expensive cities.

This is evident from new research Realtor.comwhich determined how much a novice homeowner would have to earn to purchase a typical property in the most expensive cities, all of which are in California.

The study assumed a buyer would make a 20 percent down payment, and the calculations applied a mortgage interest rate of 6.72 percent.

To calculate the required salary, economists at Realtor.com used the so-called 30 percent rule.

This is the idea that Americans should spend no more than 30 percent of their income on housing.

Atherton, California, needed the highest salary to afford a typical home while maintaining this benchmark: a whopping $1.85 million.

That’s because the average property in the city cost $8.9 million last year.

“A typical home would require more than three times the average household income,” says Hannah Jones, senior economic research analyst at Realtor.com.

Atherton, California, required the highest salary to afford a normal home – a whopping $1.85 million (Photo: A House in the City in 2020)

Atherton, a suburb of San Jose, is one of the wealthiest zip codes in the US, with a median household income of $397,264, according to Realtor.com.

Zoning regulations in the city mean that only one single-family home can be built per acre, meaning many of the properties are large and expansive.

The city is home to NBA star Steph Curry, and Eric Schmidt, a former Google CEO, sold his home there earlier this year for $22.5 million.

According to the study, an American who bought a median-priced home in the city would have a monthly mortgage payment of $46,168.

The second most expensive city to buy a home in is Montecito, California, where stars like Oprah Winfrey and Gwyneth Paltrow own properties.

If you want to have these A-listers as neighbors, you’d have to earn a salary of about $1.3 million, according to Realtor.com.

The average sales price this year in the city that Prince Harry and Meghan Markle also call home was a whopping $6,495,000.

Third on the list is Malibu, which is known for its beautiful beaches and famous residents.

This year, Americans would need to earn more than $1.2 million to afford a home in the luxury coastal city.

According to Realtor.com, if you were to purchase a median-priced home in Malibu at 20 percent down at current rates, your monthly payment would be $30,647.

The study assumed a buyer would make a 20 percent down payment, and the calculations applied a mortgage interest rate of 6.72 percent.

The second most expensive city to buy a home in is Montecito, California

The average sales price this year in Montecito, which Prince Harry and Meghan Markle call home, was a whopping $6,495,000.

This year, Americans would need to earn more than $1.2 million to afford a home in the luxurious coastal city of Malibu

Next on the list is Hillsborough, a wealthy city close to San Francisco and Silicon Valley that is popular with technology workers.

This year, the average sales price in the city was over $5.8 million, meaning you would also have to earn over $1.2 million to buy a home there.

In Los Altos Hills, which ranked fifth on the list of expensive cities, the average home sold for just over $5.7 million this year.

Located just five miles south of Stanford University, the affluent city is an exclusively residential community where commercial zones are prohibited.

To buy a home there, you would need to earn $1,197,823 and have a monthly mortgage payment of $29,945, according to Realtor.com.

It comes as house prices have continued to rise this year due to a historic shortage of homes for sale.

Mortgage rates are still high, which is keeping homeowners from moving and letting go of lower deals.

However, economic research analyst Jones points out that many ultra-wealthy homebuyers don’t take out a mortgage at all, but instead buy with cash.

“If so, they will make a more substantial down payment than the usual 10 to 20 percent,” she said.