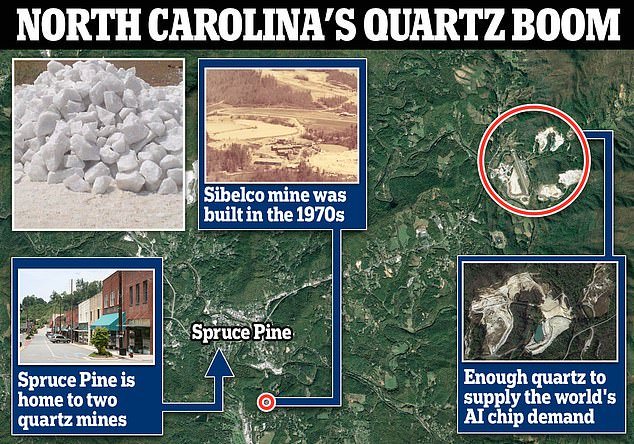

A desolate North Carolina town will now become a powerhouse for the global AI revolution.

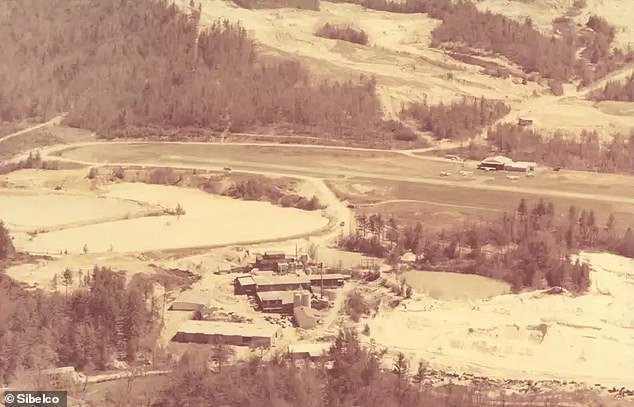

Sibelco mines have been extracting quartz at Spruce Pine since the 1970s, but its $500 million investment between now and 2027 will boost global demand for semiconductors, a market valued at $530 billion but expected to increase as AI becomes more prominent.

High-purity quartz is a vital component in the construction of semiconductor chips that helps AI-powered software process large amounts of data quickly and accurately and is used in mobile phones, laptops and other electronic devices.

The quartz must be of high purity because if there are imperfections it can impair the efficiency, speed and precision of the semiconductors.

Spruce Pine is the leading producer of high-purity quartz needed to make AI chips

The Sibelco mine is located in Spruce Pine, North Carolina, and is the world’s leading producer of high-purity quartz.

The mines produce a rare type of quartz that can be used to make AI semiconductor chips also found in laptops and cell phones.

Spruce Pine is a small town located in the foothills of the Blue Ridge Mountains, northwest of Charlotte, and is home to a population of 2,200, up from 2,700 residents in 2018.

The city has seen a drop in revenue as the number of tourists visiting the area has slowly dried up, causing some major retailers and restaurants to close their doors.

After a renowned chef closed his restaurant called Knife & Fork, local media questioned whether he was part of a growing trend.

But now a long-closed movie theater and empty storefronts line the streets downtown, leaving the two mines as the predominant leaders in the city.

The city relies on its forested areas and picturesque streams to attract tourists, but residents complained that not enough was being done to protect the river’s water quality.

Sibelco has boasted which is “in an excellent position to respond to market demand and increase production sustainably thanks to our customers’ appreciation for our high-quality products.”

The company also stated that the expanded mining area will create valuable new jobs in North Carolina and “ensure that Spruce Pine remains the world’s leading source of HPQ.”

The value of the global quartz market reached $8.5 billion in 2022 and is expected to reach nearly $18.7 billion in 2031, with China overtaking other countries as the largest customer.

Spruce Pine is the only known location in the U.S. that can meet the growing need for semiconductor chips, which is increasing at an annual rate of 5.6 percent.

Quartz must be of high purity to make AI chips because any impurities can cause them to work slower and with less precision.

Sibelco will expand its mine and invest a total of 700 million dollars until 2027

The facility is located in the foothills of the Blue Ridge Mountains.

The Sibelco mine opened in the 1970s (pictured)

Many shops, restaurants, and movie theaters in Spruce Mine have closed since the mine opened.

The expansion of the mines marks the second announcement in less than a year, with Sibelco confirming that it was investing $200 million in April 2023 and that the mine is scheduled for completion in 2025.

In 2019, the company was set to renew its DEQ permit and residents pushed for the permits to be changed after a nearby quarry, called Quartz Corp., illegally dumped hundreds of gallons of hydrofluoric acid into the nearby North Toe River.

Quartz is extracted from the earth by first using explosives in open pit mines to expose the deposits; However, the mineral is sensitive to sudden changes in temperature and could be damaged if mined too quickly.

Once the quartz veins are exposed, miners work to extract the mineral using excavators to remove the surrounding dirt and clay.

Miners use hand tools to remove the crystals which are then crushed and ground into a fine powder.

Other minerals found in the area include mica, kaolin and feldspar which have been mined from the area for centuries.

Mining for these valuable minerals began 380 million years ago, when Native Americans dug tunnels in mountain slopes to extract mica, a mineral powder used today as insulation for electrical cables and as a filler for asphalt and cement. .

Kaolin is a type of white clay used to make rubber, paper and paint, while feldspar is used as a glaze for making glass and ceramics.

Geologists have estimated that the Spruce Pine mining district was created when Africa and North America collided millions of years ago, causing intense friction, generating heat that reached about 2,000 degrees Fahrenheit between nine and 15 miles below the Earth’s surface. .

The combination created a mineral-forming liquid, which over 100 million years cooled and crystallized, and as the plate beneath the Appalachian Mountains moved, the climate eroded the rock, leaving valuable minerals near the surface.

The lack of water at the friction point prevented the quartz from developing impurities, making it the high-purity mineral needed to make AI chips.

Impurities in quartz are incredibly common and roughly affect the TK of the mineral, making it useless for creating semiconductors.

“I have evaluated thousands of quartz samples from around the world,” said John Schlanz, chief mineral processing engineer at the Minerals Research Laboratory in Asheville. CABLING.

“Almost all of them have contamination trapped in the quartz grains that you can’t get out of.”

As of October, the global quartz market is valued at $4.8 billion, but is expected to reach $7 billion by 2030, according to a rational statistics analysis.

Dailymail.com has contacted Sibelco for comment on its expansion.