Table of Contents

- The rich could leave the UK if Rachel Reeves goes ahead with her tax barrage

- The costs to society at large of squeezing the rich: some of them create jobs

- Kicking out such people runs counter to the growth agenda Reeves claims to pursue.

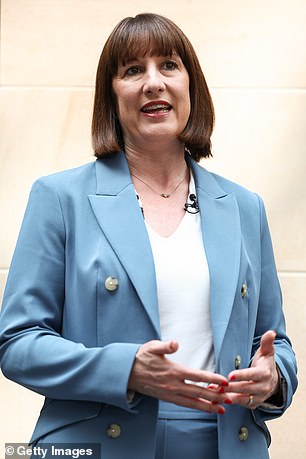

Big Ideas: Chancellor Rachel Reeves

Hundreds of thousands of wealthy people are likely to leave the country over the next four years if Labour Chancellor of the Exchequer Rachel Reeves pushes ahead with the tax avalanche on her “to do” list.

In its recent Global Wealth Report, Swiss bank UBS predicts that 500,000 millionaires will leave Britain by 2028.

This may seem like a secondary thing in most of our lives. Some will even cry “bon voyage” and argue that it is wilful blindness to worry about estate taxes when there are so many difficulties.

It is absolutely true that many British families find themselves in a fragile financial situation, with very little savings and struggling to pay household bills.

It is also true that millions of clearly non-rich people are paying significantly more in taxes because of a covert raid, carried out by freezing thresholds and allowances.

So you can understand the appeal, from a Labour perspective, of attacking the rich. This war on the rich is not confined to the UK, or even to left-leaning governments. The Conservatives, who will attack Reeves for attacking the rich, had no qualms about doing so themselves. Jeremy Hunt was attempting to clamp down on the undomiciled, a move that Labour has enthusiastically embraced.

In Italy, populist leader Giorgia Meloni recently doubled the flat tax rate on foreign income of wealthy new residents to 200,000 euros, much to the alarm of those who had been flocking to cities like Milan. She, like Reeves, wants to raise revenues to ease pressure on public finances. The rich seem easy targets.

Even in Switzerland – that Alpine paradise of the super-rich – there is debate about imposing new inheritance taxes on billionaires.

One senior City figure told me he is particularly concerned about moves to impose levies on businessmen’s inheritances that could force heirs to sell family businesses.

A top-class British education for children used to be a big draw, but the vindictive plan to impose VAT on private school fees will put that in jeopardy.

He says fears of such tax grabs are already prompting his firm’s clients to consider moving to places like Dubai. The emirate, which does not levy personal income tax, is not without its problems.

But it has much to offer beyond a generous tax regime: its raw energy and entrepreneurial spirit contrast sharply with an increasingly resentful and work-averse Britain. Of course, healthy tax systems should be progressive. Those who can afford it should pay more.

But this must be balanced against the reality that the tycoon classes with nothing to do can easily move to a friendlier jurisdiction. Attacking them may not raise as much money as hoped.

Squeezing the rich has a cost to society at large: some of them innovate and create jobs. Driving these people away runs counter to the growth agenda Reeves claims to pursue. Once the principle of attacking wealth has been established, the danger is that it will trickle down.

This is already happening. Moderately well-off people whose incomes are barely into the six figures (a school principal or a high-ranking doctor, for example) already pay an effective tax rate of 60 percent on a portion of their income.

Focusing on the rich has superficial appeal, but it will do nothing to fix public finances or help disadvantaged and disaffected communities.

The risk is that aspiration and talent will be punished, thereby hindering the growth that the entire country so desperately needs.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.