- The upcoming elections have led many to turn to gold

- The British buy the precious metal as a safe haven

Britons are flocking to buy gold and other precious metals following the announcement of the general election, says The Royal Mint.

Prime Minister Rishi Sunak set the July 4 election date for May 22, and the news has sparked a gold rush in recent days.

Gold is a popular haven for investors in times of political uncertainty, as the price of the precious metal is almost completely removed from political or economic developments in the rest of the world.

The theory is that if the election has any negative economic effects – such as higher taxes or a weakened economy – any money held in gold will sit there, smugly, unaffected.

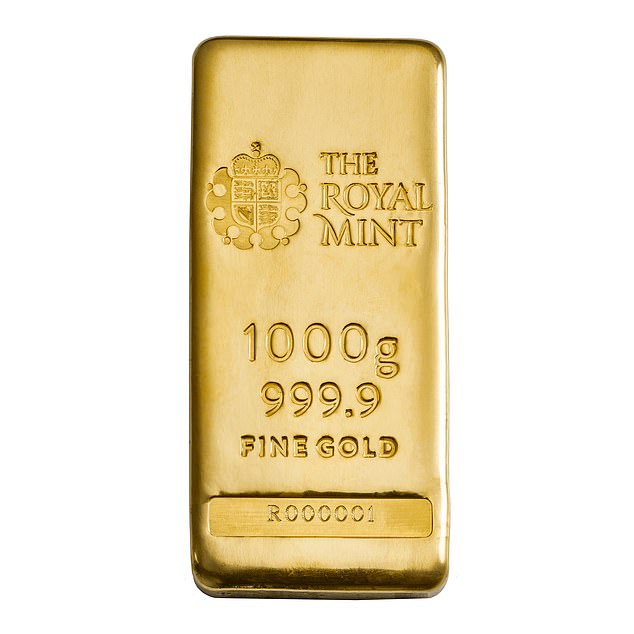

Banned for life: Investors are buying gold bars like this, which cost more than £61,000, in the hope the metal will be a safe place to leave their money during the election.

The same goes for platinum and, to a lesser extent, silver.

The Royal Mint said it had seen a 49 per cent increase in the number of customers buying precious metal bullion since the election was called.

The volume of gold purchased through the Mint increased 117 percent in the week after the election, and bullion spending increased 145 percent.

The election also appears to have pushed many to invest in precious metals for the first time, with 10 per cent of recent Royal Mint customers having never bought gold, silver or platinum before.

Royal Mint’s Stuart O’Reilly said: “The surge in precious metals investment we have seen over the past week appears to have been driven by ‘safe haven’ buying by investors who are attempting to mitigate the risks associated with the current uncertainty.

‘The elections raise greater questions about the future of the economy, taxes and security, which may lead to spikes in investment activity and increased interest in precious metals.

‘Due to gold’s safe haven status and lack of correlation with other assets, we tend to see surges in the purchase of gold coins and bars when investors are unsure about the future.

“In addition to the general election, investors are closely monitoring whether and when interest rates will fall, as well as looking ahead to the US elections in November.”

Almost half (42 per cent) of recent precious metals purchases through the Royal Mint were to members of Generation X, aged 44 to 59.

The most popular products were 1 ounce gold and silver Britannia coins, large gold bars and sovereign coins.

Good as gold: One of the most popular items among investors is the 2024 1oz gold sovereign, which costs £1,926 at the current gold price and is sold through the Royal Mint.

Some investors may choose gold for reasons other than the impending election.

Jason Hollands, managing director at wealth manager Evelyn Partners, said: “A high gold price driven by central bank buying will undoubtedly attract the attention of many investors and this is likely to be compounded by geopolitical tensions and perhaps the concern that valuations in some parts of the US stock market are also excessive.

‘If you are an investor with an Isa or Sipp, the easiest way to invest is through a gold exchange-traded product such as Invesco Physical Gold ETC.

‘However, one of the reasons why the Royal Mint may be experiencing a particularly strong rise could be related to taxes.

‘This is because gold coins produced by the Royal Mint are considered legal tender and are therefore not subject to capital gains tax. However, prices are high to reflect the craftsmanship involved.

“What could be happening here is that some people who have decided to invest in gold outside of tax-free Isas and pensions are doing so through the Royal Mint in case capital gains tax increases under a government Labor”.

The price of gold rose about 21 percent last year, with most of the gains coming in the last six months. In five years, it has increased almost 80 percent.