Table of Contents

The investment trust Rockwood Strategic It is a rare breed: a fund that buys some of the smallest UK-listed stocks whose shares are plunging in the expectation that they will recover.

It is an investment strategy that requires a lot of due diligence and the support of the companies that are later acquired.

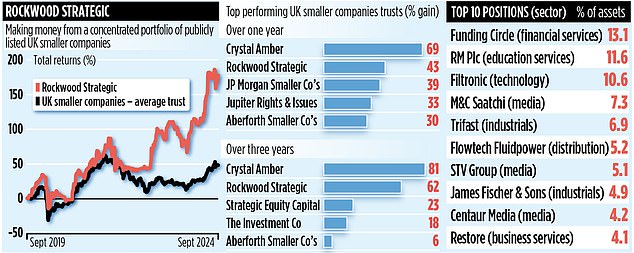

But it works wonders, judging by the performance figures. Over the past one, three and five years, it has generated total returns of 43, 62 and 167 percent.

To put these figures into context, the average UK small business trust has recorded respective returns of 20 per cent, a loss of 9 per cent and 46 per cent.

Excitingly, manager Richard Staveley believes this run of good investment practice may continue, helped in part by the continued attractive valuations of many companies in the sector of the UK stock market he focuses on, and the prospect of lower interest rates going forward (which is good for UK companies).

“I think of what I do as hunting for truffles in a big forest. I’m constantly looking for investment gems, companies that are chronically undervalued and under-appreciated, but where I see an opportunity for a big turnaround and future appreciation in the share price,” he says.

Stock selection is key: the trust has just 22 holdings, and the top ten positions account for almost three-quarters of assets.

While Staveley says his approach is one honed over 25 years of involvement in fund management, he also draws on the wisdom of legendary investor Warren Buffett.

‘Buffett has a view on the value of managing concentrated investment portfolios,’ Staveley explains.

“It also encourages investors to avoid market hype and remove emotions from the investment equation. These are all things I do.”

Staveley focuses on companies with market capitalisations of less than £250m, often referred to as “microcap” stocks. This is a segment of the market that few fund managers are interested in.

He says: ‘It’s an inefficient part of the UK market, which means there are plenty of opportunities.

‘I find companies that are mispriced by the market and have business problems they haven’t yet addressed, and then I encourage them to do the things they know they need to do to recover.

“We expect that within a period of three to five years the result will be a recovery in earnings and a revaluation of the shares.”

The incentive Staveley speaks of is reinforced by the fact that in 15 of the companies, the trust owns more than five per cent of the shares, allowing it to call extraordinary general meetings to push through changes it believes will improve a company’s fortunes.

Recent success stories include a stake it bought in lending platform Funding Circle earlier this year.

Staveley said: ‘The company floated on the UK stock exchange six years ago at a valuation of £1.5bn. When we bought the shares in January this year, they were worth £130m and rival fund managers had lost interest in the company.

“But, encouraged by us, the company has cut costs, sold loss-making operations, made board changes and bought back shares.”

Over the past six months, Funding Circle shares have risen more than 386 percent.

Staveley, who works for investment firm Harwood Capital, owns shares in Rockwood Strategic, giving him “skin in the game” and so has a vested interest in delivering stellar returns.

The current annual charge is 1.2 per cent (source: Hargreaves Lansdown) and the trust’s stock ticker is BRRD5L6. The stock symbol is RKW.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.