<!–

<!–

<!– <!–

<!–

<!–

<!–

Activist investors are aggressively campaigning for change at major British and American companies. You can think of these larger-than-life personalities as “bullying billionaires.” But you also have to wonder if they are not only making mischief, but also making money for other investors.

The key players in the game are American hedge fund managers. The most famous among them is Nelson Peltz, boss of the Trian fund, enemy of “woke” and father-in-law of David Beckham’s son, Brooklyn. Peltz recently admitted that he may be a bully billionaire, but sees himself as a “constructivist” and not an activist. He is currently making his presence known at Unilever, the Dove soap and Marmite group.

He is also seeking board representation at the Walt Disney empire. This bitter campaign reaches a showdown on April 3.

The equally combative Paul Singer, boss of Elliott Investment Management, has taken a 5% stake in Scottish Mortgage, the FTSE 100 tech trust where private, unlisted companies make up 30% of the portfolio.

Singer’s other investments include the Waterstones bookstore. He also owned the AC Milan football team. His bid for electronics chain Currys has just been rejected. Drug company GSK and the Alliance Trust are among his previous British targets.

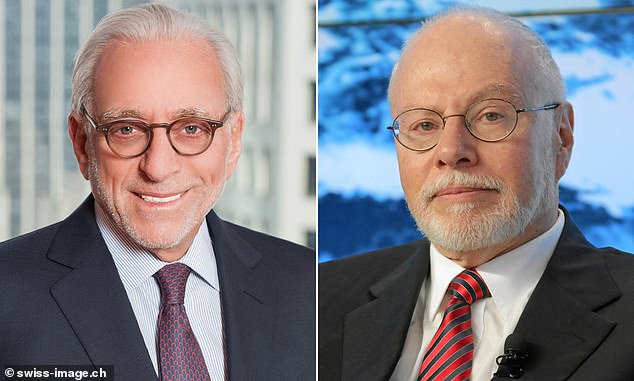

Agitating for change: Nelson Peltz (left) and Paul Singer

Gerrit Smit, manager of the Stonehage Fleming Global Best Ideas Equity fund, argues that activists can be a force for good.

But a study by asset manager Lazard of traditional US activist campaigns, which examined the years from 2018 to mid-2023, found that they generated short-term outperformance of 2 percent in the first week after the campaign was announced. But long-term outperformance has been elusive, with the average share price down 8.6 percent over the subsequent twelve months.”

Against the backdrop of this skepticism, Peltz appears to be gaining respect. Unilever’s share price is up 4 percent this year, indicating confidence in a Peltz-like revival for the company.

As part of Unilever’s overhaul, Magnum and Ben & Jerry’s £15 billion ice cream division will be launched in Amsterdam. Peltz, 81, should be pleased. Some claim that his dislike of Ben & Jerry’s progressive activism was the reason he took a 1.4 percent stake in Unilever.

Peltz takes issue with the cost and woke tone of recent Marvel films at Disney. He faces opposition from film director George Lucas and other Hollywood heavyweights who support Disney CEO Bob Iger.

Peltz turned his attention to Disney in early 2023, acquiring shares for around $92. The price now stands at $118, after unveiling a $5.5 billion restructuring program. Analysts at Barclays have set a price target of $135.

As a shareholder, I’m not sure if it will be a happily ever after when Peltz joins the board, but I’m going to relax in my chair (maybe with some popcorn) and watch the story unfold.

Even more uncertainty surrounds the outcome of Singer’s Scottish mortgage excursion. But again, as an investor I’m going to wait and see, hoping that he will make a positive difference – fairly quickly. The Alliance saga lasted seven years. Scottish Mortgage’s share price has recovered to 894p, after peaking at 1515p in October 2021. Singer claims that buying back the trust shares would give the shares a boost – and narrow the discount between the price and the net asset value. But critics fear this would be financed by selling listed companies, increasing the size of the unlisted portion.

FundCalibre’s Darius McDermott also questions Elliott’s distaste for these holdings. “Private companies are inherently less transparent than publicly traded companies,” he says. ‘But some of Scottish Mortgage’s properties are established companies such as ByteDance, owner of Tik Tok, or Elon Musk’s Space X.’

Some may be tempted to bet on Disney, Scottish Mortgage or Unilever. But those who bought BT or Vodafone when French activists arrived on the scene are disappointed

Patrick Drahi owns a 24.5 percent stake in BT. Xavier Niel has 2.5 percent at Vodafone. BT’s share price is 109.65p, below its level in June 2021 when Drahi started buying. Vodafone’s price is also reversed.

I’d suggest a different strategy: sit back and enjoy the fun of having cash in UK stocks.

The arrival of Peltz and Singer suggests that British markets are undervalued and that these activists could spur even more action.