- Meta shares plunged in after-hours trading Wednesday after the company warned that profits would decline over the summer.

- Increased spending on AI also worries investors

Meta shares plunged in after-hours trading Wednesday after the company warned that summer revenue would be lower than expected.

Dismal sales prospects in the second quarter, from April to June, overshadowed better-than-expected results for the first quarter.

Meta also warned that its 2024 expenses will be much higher than planned as it pours money into new AI products.

Meta shares are up 116 percent in the past 12 months and more than 45 percent so far this year. That had catapulted boss Mark Zuckerberg to number three on Bloomberg’s rich list.

But on Wednesday at 5:15 p.m. ET, shares fell 17 percent to $412 as Wall Street mulled the results. This affected Zuckerberg’s wealth, which before the earnings report amounted to $166 billion. It is believed to have fallen by more than $15 billion.

Mark Zuckerberg was the world’s third-richest person before shares fell as much as 13 percent on Wednesday, according to the Bloomberg Index.

Meta says it will see second-quarter revenue between $36.5 billion and $39 billion. Estimates indicated $38.24 billion.

The stock also took a hit after Meta said it expects overall expenses this year to be higher than it previously forecast, as Facebook parent company spends heavily to roll out new AI products and beef up infrastructure to support them. .

The company expects 2024 capital spending in the range of $35 billion to $40 billion, up from its previous forecast of $30 billion to $37 billion.

It also raised its total spending forecast to $96 billion to $99 billion, up from $94 billion to $99 billion.

The news comes as Zuckerberg, 39, undergoes a midlife makeover.

Mark Zuckerberg has revamped his outfit, donning gold chains and fur coats while moving away from his standard T-shirt.

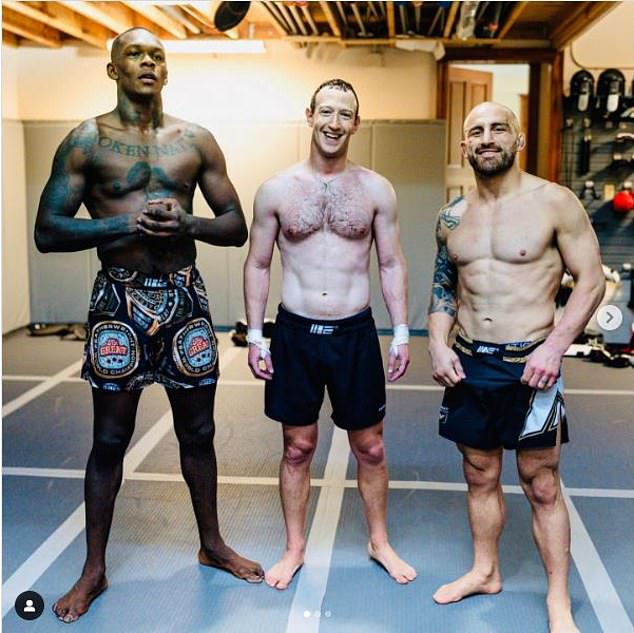

Mark Zuckerberg (center) trained with UFC champions Israel Adesanya (left) and Alex Volkanovski (right)

Known for his gaunt, pale, sandal-wearing exterior, Zuckerberg is now reinventing himself with fur coats, diamond chains and a ripped body.

Zuckerberg peaked on Thursday when he posted a video showing off Meta’s artificial intelligence technology, revealing a scruffy, bearded appearance.

The public had an overwhelming reaction to Zuckerberg’s AI-generated appearance, with one person saying: “[He] It went from Mr. Steal Your Data to Mr. Steal Your Girl.’