- State Senator Faith Winter arrived late and drunk to a public meeting Wednesday.

- He slurred and scrolled through his phone in the halfway house hearing.

- Winter apologized Thursday and said he will get help for substance abuse.

<!–

<!–

<!– <!–

<!–

<!–

<!–

A Democratic Colorado state senator announced she is receiving substance abuse treatment after arriving late to a public hearing, appearing intoxicated, slurring her words and scrolling through her phone as community members spoke.

Senate Deputy Majority Leader Faith Winter arrived nearly 10 minutes late Wednesday to a community hearing in Northglenn on a plan to open a sex offender rehabilitation center near an elementary school.

When she walked in during opening remarks, Winter, who was a co-sponsor of the bill proposing housing, seemed unaware that she was supposed to be sitting with the panelist.

Once seated, the senior Democrat made brief, halting comments. ‘Most people who go to prison, leave prison. And we have to decide how, when and where we will handle the problems of each local community,” Winter said.

At one point during the meeting, an audience member yelled at Winter for scrolling on her phone while people shared their concerns about the facility. She responded with a garbled speech that she was using it to look up statistics.

Democratic Colorado State Senator Faith Winter announced she will receive substance abuse treatment a day after showing up drunk at a public meeting.

She arrived 10 minutes late and seemed not to realize she was supposed to be sitting with the panelist.

At one point during the meeting, an audience member yelled at Winter for scrolling on her phone while people shared their concerns.

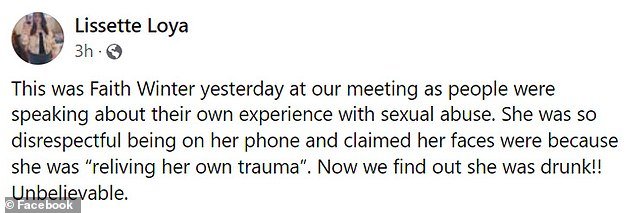

Audience member Lissette Loya posted a video on Facebook of Winter looking at her phone during the meeting.

‘This was Faith Winter yesterday at our meeting as people talked about their own experience with sexual abuse. She was very disrespectful when speaking on the phone and she claimed that her facial expressions were because she was “reliving her own trauma.” Loya said.

On Thursday, Winter revealed to The Colorado Sun seeks medical treatment for substance abuse and resigns as chair of the Senate Energy and Transportation Committee.

‘I deeply regret my behavior last night. I made a mistake and I am truly sorry for any inconvenience or inconvenience I caused. “I take full responsibility for my actions and am committed to doing things right,” he said.

‘I especially apologize to the town of Northglenn and the citizens who attended; I care deeply about your thoughts and your community. I am now under the care of medical professionals and receiving treatment for my substance abuse disorder.’

Sources told The Colorado Sun that her colleagues in the Senate were concerned about her drinking and encouraged her to seek help.

Senate President Steve Fenberg said Denver Post He was “encouraged to see” that Winter is getting help for her alcoholism.

‘Sen. “Winter is an important and valued leader in the Senate Democratic caucus and I know that, with the support of her friends and family, she will overcome this challenge,” Fenberg said.

Winter said Thursday that she will seek medical treatment for substance abuse and will resign from her position as chair of the Senate Energy and Transportation Committee.

Winter suffered a head injury following a bicycle accident that required brain surgery in September.

Winter suffered a head injury after a bicycle accident that required brain surgery in September.

in a statement Posted on Twitter, the state senator said she crashed into a curb while trying to avoid a large truck. Although she was wearing a helmet, she suffered a head injury and had to undergo surgery to relieve the pressure on her brain.

She revealed in August 2022 that she discovered he had an autoimmune disease that caused pulmonary hypertension after he fainted while trying to board a plane.

Winter was elected state senator from District 25, representing Adams, Broomfield and Weld counties in 2018. She was re-elected in 2022 and her term ends in January 2027.

Before that, she was a Westminster City Council member and was elected to the state House in 2014.