The so-called ‘American dream’ is the reference point that many people hope to achieve throughout their lives.

Many people aspire to get married, buy a house and a car, raise children, and then settle into a comfortable retirement.

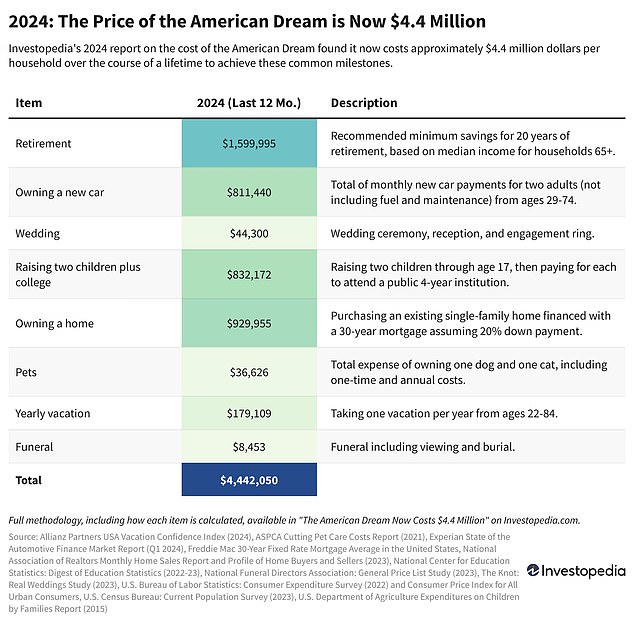

but new analysis has revealed that achieving these milestones now costs a staggering $4.4 million, putting it even further out of reach for most Americans.

Not only is this much more than most people will earn in their lifetime, it is also $1 million more than the estimated cost of the American Dream a year ago.

The cost of saving for 20 years of retirement is the biggest burden, according to Investopedia’s analysis, at nearly $1.6 million.

A new analysis has revealed that achieving the so-called “American Dream” now costs a staggering $4.4 million.

The second highest cost, according to the analysis, is that of owning a home.

Investopedia estimates that purchasing a single-family home financed with a 30-year mortgage—and assuming a 20 percent down payment—would cost $929,955 over a lifetime.

While this calculation includes homeowner’s insurance and property taxes, it does not include maintenance or HOA fees.

This figure is substantially higher than in 2023, when Investopedia estimated homeownership at $796,998.

In the year since, home prices have continued to rise in many places in the United States, while home insurance rates have increased between 10 and 23 percent in some states.

The cost of car ownership has also skyrocketed in recent years amid high interest rates.

Over a lifetime, the study estimates this will cost the average American a whopping $811,440.

This is for monthly new car payments for two adults ages 29 to 74, and it doesn’t even include fuel or maintenance.

While the Federal Reserve cut interest rates from a 23-year high in September, years of high interest rates had made borrowing more expensive for consumers.

The cost of raising two children, traditionally seen as a key component of the American dream, is also among the highest living expenses.

The analysis estimates that the total cost of raising two children to age 17 and then paying for each to attend a public university for 4 years is $832,172.

Investopedia also puts the cost of a wedding at $44,300, lifetime ownership of a pet at $36,626, and an annual vacation for nearly 60 years at $179,109.

Finally, it included the cost of a funeral, which is $8,453 on average, according to data from the National Funeral Directors Association.

The cost of raising two children, traditionally seen as a key component of the American dream, is also among the highest living expenses.

The cost of saving over 20 years of retirement is the biggest burden, according to Investopedia’s analysis, at nearly $1.6 million.

Investopedia also puts the cost of a wedding at $44,300, lifetime ownership of a pet at $36,626, and an annual vacation for nearly 60 years at $179,109.

Investopedia’s total cost to achieve the American dream is more than $1 million more than most people earn in their lifetime.

However, he noted that it is not out of line with what some dual-income households could earn.

The average bachelor’s degree holder in the U.S. earns about $2.8 million over their career, with women earning $2.4 million and men earning $3.3 million, according to analysis by the Center for Education and Georgetown University Workforce from the US Census Bureau American Community Survey.

Looking at the data by household, the average American household of two people with bachelor’s degrees has lifetime income of $5.6 million, Investopedia said.

But he added that the $4.4 million represents the cost of a lifestyle associated with the American dream, more than the reality for most people.

It doesn’t take into account other crucial living costs, including food, healthcare, auto insurance, transportation, and other basic needs.