The holiday destinations around the world where sterling will stretch the most and the least have been revealed – and it is Argentina that is currently offering the best deal for Brits.

It tops a ranking of places with the best value for money in which Ethiopia is second, Nigeria third, Egypt fourth and Malawi fifth.

Countries where the pound is weakest include Kenya, Sri Lanka and Thailand, according to the study, conducted by Net Coupon Codes.

The internet marketing service explained that it put together the tables by extracting monthly data from the exchange rates of every major currency in the world and comparing its strength with the pound.

He explained that the pound is up 199 percent in first place. ArgentinaThat is to say, for every pound you can get 1,276 Argentine pesos. NetVoucherCodes added: “The country has seen multiple cases of its currency devaluation due to economic problems, so Brits looking for a cheap holiday where they can taste some of the world’s best wines and go on stunning walks need look no further.”

In second place Ethiopiathe pound has risen 130 percent against the Ethiopian birr. Third place Nigeria estimates that the pound will rise by 120 percent against the Nigerian naira.

Fourthly Egyptthe pound is up 67.7 percent against the Egyptian pound, NetVoucherCodes explained. It added: “Egypt has long been a hotspot for Brits looking to soak up the winter sun and boasts some of the best historical monuments in the world. Data reveals that now could be a good time to visit.

Fifth place Malawione of “Africa’s top safari locations”, is also offering a “best value holiday” in 2024, with the pound rising 60.6 per cent against the Malawian kwacha. NetVoucherCodes added: “The country has 11 national parks and wildlife reserves, making it one of the best places on the planet to see African animals.” However, he warned: “Travelers are unlikely to see the benefit of a strong pound when booking a safari with a UK provider, and would be better off booking their own itinerary to see real savings.”

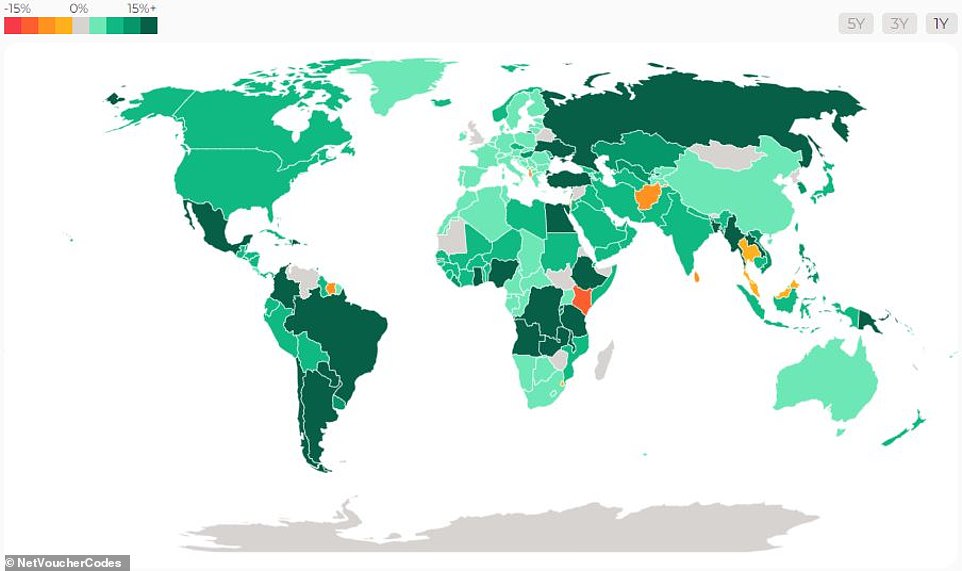

The holiday destinations around the world where sterling will stretch the most and the least are revealed in a study by NetVoucherCodes. This map is a color-coded guide to where the pound is strong and weak, with the darkest green indicating where the pound has had the strongest rise and the yellows and reds indicating where the pound is weakest.

The pound is up 199 percent in first-place Argentina, meaning that for every pound you can get 1,276 Argentine pesos.

Turkey It lands inside the top 10 at eighth place, with the pound rising 28.2 percent against the Turkish lira. NetVoucherCodes explained: ‘Türkiye has seen the strength of the lira collapse against the pound over the past year. This makes it the perfect time to visit the vibrant city of Istanbul, with its mix of cultures and delicious food.’

Meanwhile, the pound has also risen in other popular tourist destinations, such as USA (an increase of five percent compared to 2023), Australia (3.36 percent) Mexico (19 percent), Brazil (24 percent), India (six percent), Hungary (nine percent) and Czechia (five percent). The pound has also gained minimal strength against the Euro (two percent).

Where the pound is weakest

The biggest drop in the pound’s strength over the past year has occurred in Kenya – It is down nine percent against the Kenyan shilling. NetVoucherCodes explained: ‘The Kenyan shilling has been gaining strength against the British pound over the past year. This appreciation means that British tourists will find that their pounds will not stretch them as far as before, meaning that the cost of travel-related expenses such as accommodation, meals and activities in Kenya will be higher for Brits.

Sri Lanka “It’s also starting to get more expensive for Brits,” NetVoucherCodes warned, as the pound has fallen five percent against the Sri Lankan rupee. It explained: “Over the past year, the pound’s strength has declined against the Sri Lankan rupee, seeing an initial rise in recent months but falling sharply again in early November.”

The pound has also fallen 0.6 percent against the Thai baht, making popular Thailand slightly more expensive for Brits in 2024. NetVoucherCodes explained: ‘From November 2023 to November 2024, the Thai baht has increased in value against the pound by 0.69 per cent. While this is only a slight increase, does this mean a trend for the tropical paradise to become more expensive for Brits?

If you’ve booked a holiday to a destination where the pound has fallen, NetVoucherCodes personal finance expert Rebecca Bebbington has shared her top tips for keeping costs down while travelling.

She said: ‘My final piece of advice for travelers is to consider using a credit card that doesn’t charge you when you’re abroad, such as a Wise card. These cards allow you to keep multiple currencies in a single account, avoiding high conversion fees when spending money at restaurants or withdrawing money from an ATM. It uses real exchange rates and comes with an easy-to-use app to track expenses and set budgets.

‘Travelers should also be aware of misleading ATM charges when withdrawing cash. Always opt for withdrawals in local currency and decline the conversion rates offered, which often include hidden fees. Use Google Maps to find ATMs that have good reviews and offer lower fees, and try to withdraw larger sums less frequently to reduce fixed ATM fees.

Thailand has become slightly more expensive for Brits over the past year, with the pound falling 0.6 per cent against the Thai baht.

‘One of the best things you can do is avoid exchanging money at airport kiosks, which can give you a terrible exchange rate and charge you astronomical fees. Instead, exchange money at banks or reputable services in the city, or use ATMs in less touristy areas.

‘It’s a good idea to understand the exchange rate before you travel to avoid excessive charges and make informed financial decisions. Currency conversion apps can provide real-time updates.

‘Before buying something, find out in advance about possible card charges. Some merchants may impose surcharges for card payments without telling you, so knowing this can help you decide whether to use your card or pay with cash.

“Staying informed about potential fees helps you manage your budget effectively and avoid unnecessary expenses.”