Jeremy Hunt is set to deliver long-awaited personal tax cuts when he presents his Budget tomorrow, but don’t be fooled by any grandiose measures – your tax bill is likely to remain higher than ever.

The Chancellor has promised to ease the strain on millions of households facing the highest tax burden in more than 70 years.

Hunt is expected to cut national insurance by 2p for the second time in six months, saving the average worker £450 a year, after facing intense pressure from Conservative MPs to loosen the purse strings ahead of the general election.

But even if you do, your income will continue to be eroded by the pernicious stealth taxes working hard behind the scenes.

A series of threshold freezes have left households paying thousands more in taxes on their income, savings, dividends and capital gains. Savers should also keep an eye on a handful of tax increases already in the works for the new tax year starting April 6.

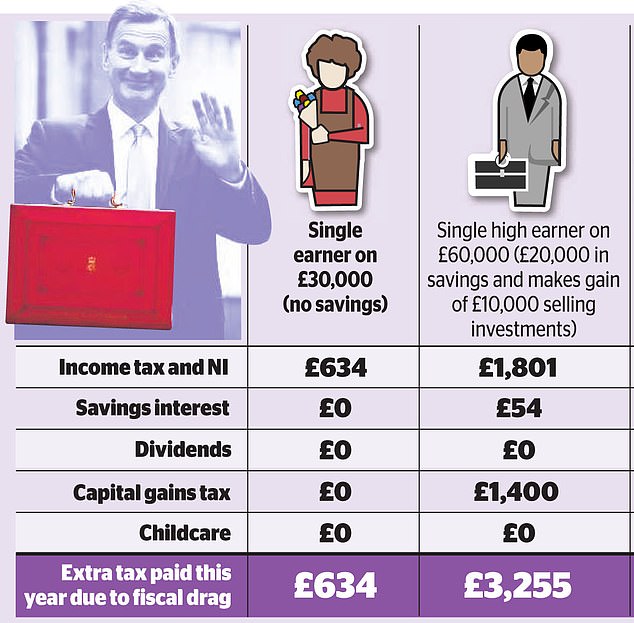

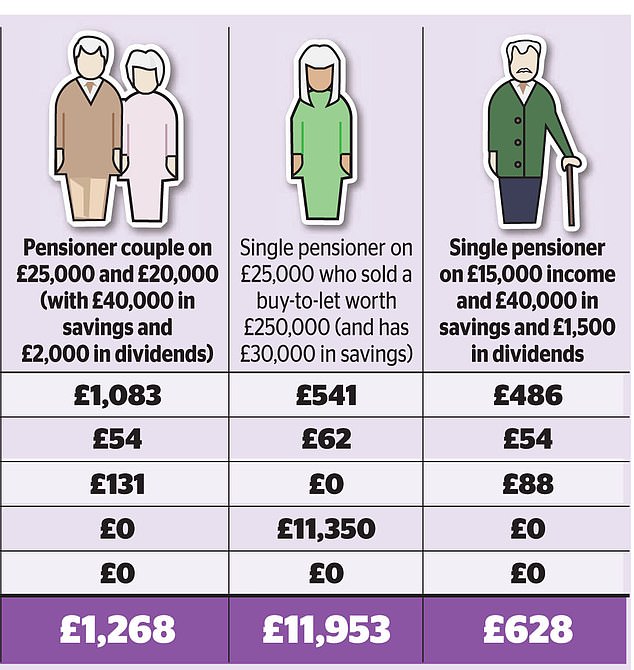

The average household is losing an extra £2,056 in tax this year thanks to frozen thresholds, according to calculations for Money Mail from investment platform Interactive Investor. Anyone earning £60,000 will have an outlay of more than £6,100 this year alone.

Overall, taxpayers are on track to pay an extra £40 billion in tax by 2028, and until the deep freeze on thresholds is unfrozen, the Government’s tax stealth will continue to trap millions of families.

The impact of frozen income tax thresholds is the most severe on household budgets, and they are expected to remain unchanged until 2028.

This freeze includes personal income tax relief (the amount of money you can earn before you start paying tax) amounting to £12,570.

As incomes rise, frozen subsidies have pushed people’s incomes into higher tax bands, a process known as fiscal creep. In good times, thresholds have typically risen with inflation, protecting workers from paying proportionately more taxes as their wages rise.

The fiscal burden is especially punishing when wages rise sharply while tax thresholds remain unchanged, which is exactly what has happened in recent years.

Workers earning between £20,000 and £50,270 (the highest threshold) will pay an extra £541 in income tax this year as a result of the freeze. They will also pay an extra £92 in national insurance, according to Interactive Investor’s Alice Guy.

The average household is losing an extra £2,056 in tax this year due to frozen thresholds, according to calculations for Interactive Investor’s Money Mail (file image)

Mrs Guy says: ‘The Government plans to freeze income tax and National Insurance thresholds until 2028, making us feel poorer in real terms even as our wages rise with inflation.

‘Frozen tax thresholds are a ruthlessly efficient way to increase the tax burden because they largely go unnoticed, gradually increasing our tax burden.

“They have a painful impact on our finances because over time we pay taxes on more of our income, leaving less to cover living costs.”

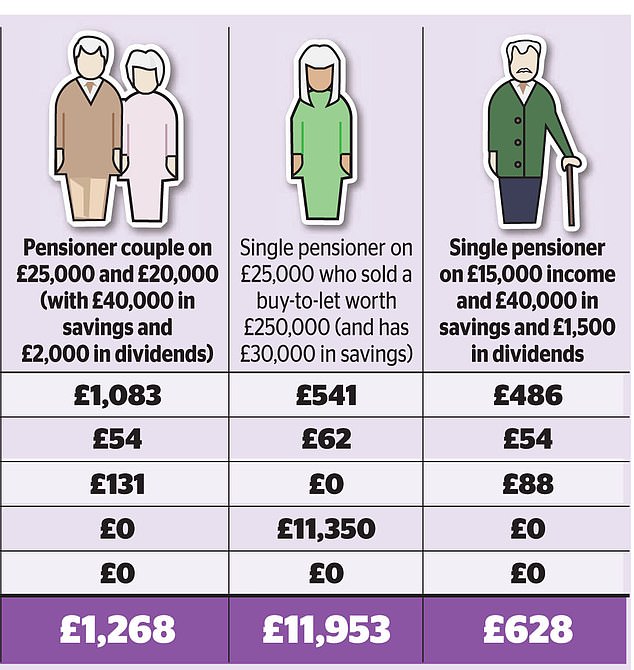

Even some pensioners have to negotiate the self-assessment minefield as their income (including the state pension) takes them into income tax territory.

The Government’s tax stealth means that if someone’s income exceeds £12,570, they will be liable to pay income tax at a rate of 20 per cent.

The cost is even higher for taxpayers with higher rates. Anyone earning £60,000 will pay an extra £1,801 in income tax and national insurance, while those earning between £70,000 and £100,000 will have to pay an extra £1,934, Mrs Guy estimates.

Millions of taxpayers are also likely to face a bill on their savings accounts for the first time.

Savers will pay £6.6bn in tax this year – more than five times more than two years ago – as rising interest rates mean even those with modest savings are pushed over the tax threshold.

Basic rate taxpayers can earn up to £1,000 of interest each year tax-free, outside of an Isa; Higher rate taxpayers can earn £500 tax free and higher rate taxpayers get no tax free relief.

But these limits, known as the “personal savings allowance”, were introduced in 2016, when the Bank of England base rate was just 0.5 per cent and savings rates were dismal.

Chancellor Jeremy Hunt is expected to cut national insurance by 2p for the second time in six months, saving the average worker £450 a year.

Today, savers can earn more than 5 percent by keeping their money for a year.

A basic rate taxpayer earning £2,000 in interest on their savings this year would pay £200 in tax, £63 more than if their allowances had risen with inflation.

The cost is even higher for those earning more than £50,270, because they pay a higher rate of tax and only have half the allowance. For example, a higher rate taxpayer earning £4,000 in interest would pay £656 more than if her allowance had increased in line with inflation.

Those who have invested their savings in dividend-paying stocks or funds also face rising charges.

The annual dividend allowance will be halved from April to £500. The cut will reduce the amount you can earn in dividends without paying tax to just a tenth of what it was in 2018. It was reduced from £5,000 to £2,000 in 2018, and halved to £1,000 in 2023. Estimates HMRC that, as a result, more than 1.1 million additional people will be forced to pay tax on dividends.

Someone earning £2,000 in dividends will pay £131 more in tax than if the threshold had risen with inflation. Meanwhile, winnings of £4,000 will result in an additional bill of £656.

Ms Guy says: ‘Investors need to be alert. If you own shares or funds then it is important to consider protecting your dividends and any future gains by keeping them in a tax-free wrapper, such as an Isa or a pension.

The annual capital gains tax exemption will also be halved, from £6,000 to £3,000 from April. This will mean that anyone who makes a profit selling assets or investments in excess of this amount will face a tax bill.

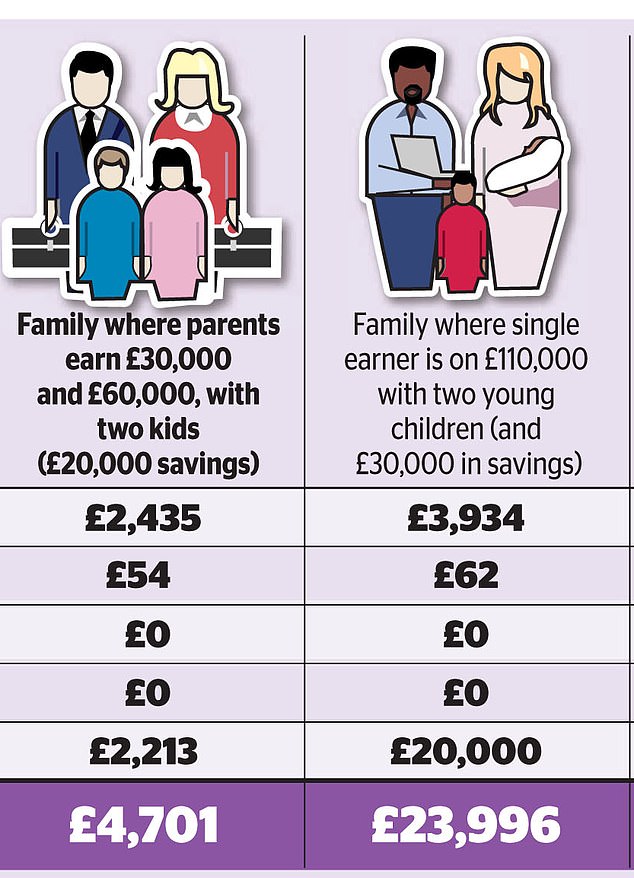

Working parents with young children are especially hurt by stealth taxes.

Child benefit, which helps with the costs of raising children, starts to decrease when a parent earns £50,000 and withdraws completely once they earn £60,000 a year.

However, the threshold at which the high-income tax comes into force has been frozen since 2013, dragging 600,000 families today to tax rates on the brink.

The gradual reduction of child benefits has meant that households where the highest earner earns between £50,270 and £60,000 can face marginal deduction rates of 55 per cent for one child, 63 per cent for two children and 71 percent for three children.

For example, families with two children and one parent earning £60,000 are £2,213 worse off because of the frozen threshold, Ms Guy calculates.

Hunt announced last spring that parents with children between nine months and two years old will be entitled to 30 hours of free childcare a week starting in September this year.

However, if only one parent has a taxable income of more than £100,000 a year, they will not be entitled to anything.

This threshold has been frozen since 2017 for parents who have older children.

Parents of two young children, living in London and earning just below the threshold, would miss out on up to £20,000 of free childcare a year if they earned just 1p more than they currently earn, according to the Institute think tank for Fiscal. Studies.

This means a parent earning £105,000 a year could have an outlay of £20,000 due to the frozen thresholds.

j.beard@dailymail.co.uk

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.