Table of Contents

- Apparel and footwear sales leadership declines as shoppers tighten wallets

British retailers suffered a disappointing start to the sector’s important “golden quarter” as pre-autumn budget jitters caused shoppers to postpone spending.

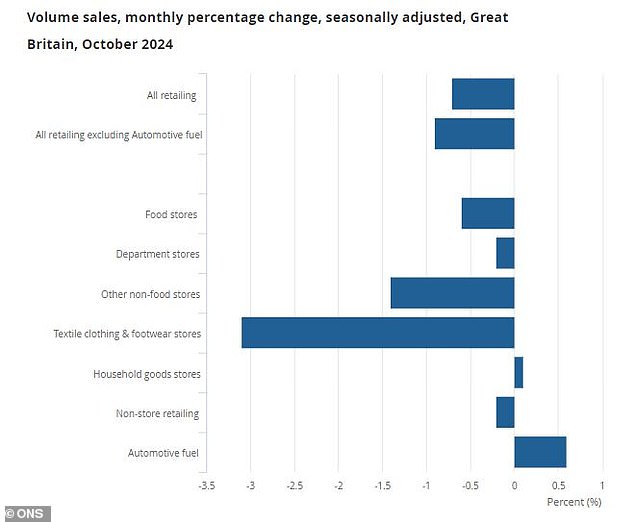

Retail sales volumes followed a 0.1 percent rise in September with a 0.7 percent drop in October, driven by a 3.1 percent drop in clothing and footwear, and a 0.1 percent drop in 4 per cent in food, data from the Office for National Statistics showed. Friday.

Sales volumes increased 2.4 percent year-on-year during the month, but remain 1.5 percent below their pre-Covid level in February 2020.

Silvia Rindone, EY UK and Ireland retail leader, attributed October’s decline to weak consumer confidence, driven by “uncertainty around the Autumn Statement, rising energy bills and looming costs.” of Christmas”.

He added: ‘The coming months are a critical time for many retailers. The retail sector faces significant headwinds with upcoming changes to National Insurance and increases to the minimum wage.

Many retail companies have already warned that the impact of higher labor costs, which come into effect in April 2025, will lead to higher prices and possible job cuts.

Retailers hope to recover ahead of key festive trading period

They will hope to bounce back as Black Friday and the crucial holiday shopping season looms.

Danni Hewson, head of financial analysis at AJ Bell, said: “It could be that people were simply keeping their powder dry, saving their pennies for the final half-term or to treat themselves at Christmas.”

‘It could also be that the unusually mild weather has simply delayed the purchase of winter wool coats that were needed over the past week.

“But with retailers like JD Sports keeping a lid on sales expectations for the year, the crucial next few months could prove incredibly difficult for the sector.”

Clothing and footwear sales led the decline, while gasoline was the only outlier.

Friday’s separate data could be a silver lining for retailers, with evidence of an easing of consumer pessimism.

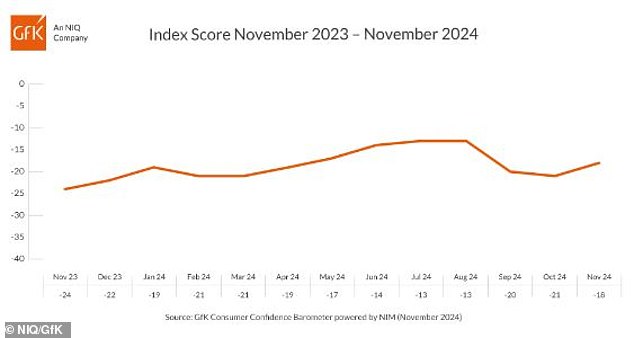

The GfK consumer confidence index rose to -18 in November, up from -21 in October and well ahead of economists’ forecasts for a deterioration to -22.

Retail sales volumes remain depressed

Thomas Pugh, economist at RSM UK, said: ‘Looking ahead, retail sales should grow until 2025 as higher consumer incomes and growing consumer confidence… translate into higher spending volumes.

‘What’s more, while headline inflation jumped from 1.7 percent in September to 2.2 percent in October, retail prices fell at a rapid pace.

“Indeed, retail inflation fell from -1.3 to -1.6 percent, meaning lower prices will help an increase in spending translate into further increases in sales volumes.”

Consumer confidence improved this month

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.