Chipotle’s sales have once again exceeded Wall Street expectations, driven by price increases and an increase in the number of loyal customers.

Even as menu items became more expensive, more Americans visited the Mexican restaurant chain in the first three months of this year.

That created a double whammy: More burritos were sold, each at a higher price. In some cases, they are a dollar more than a year ago, about $12.

While most U.S. restaurant and fast-food chains have seen customer numbers (and spending) weaken in recent months, Chipotle has been bucking the trend.

Announcing its results for the first quarter of 2024, the company reported total sales of $2.7 billion, up 14.1 percent from a year earlier.

Chipotle has once again exceeded market estimates in its quarterly results, driven by increased traffic to its restaurants

This was due to new restaurant openings, he said, and a 5.4 percent increase in restaurant traffic from the previous year.

In the first three months of this year, the burrito chain opened 47 new locations in the United States, he said.

For the remainder of 2024, the company reiterated its goal of opening between 285 and 315 stores.

In February, Chief Financial Officer Jack Hartung told analysts that “unusually cold weather” had deterred visitors and hurt January sales. CNBC reported.

Demand is likely to have picked up again in the rest of the quarter to offset a slower first month.

Unlike other food chains, Chipotle is seeing an increase in visitors despite its price increase.

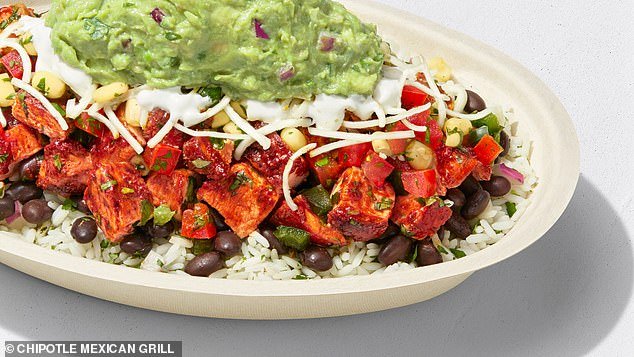

The California-based company raised the price of its burritos and rice bowls by 3 percent in October of last year.

It was the fourth time the chain raised prices in the past two years and attributed the rise in costs to persistent inflation.

According Business InsiderBefore the October price increase, a chicken burrito bowl was priced at $10.95 at a location in Brooklyn, New York.

After the increase, the same dish was $11.35 without extra guacamole or cheese, according to Chipotle’s website. These can add up to $2.95 and $1.80, respectively.

In the first three months of this year, the burrito chain opened 47 new locations in the US.

Even though menu items have become more expensive, more Americans visited the Mexican restaurant chain in the first three months of this year.

Earlier this month, Chipotle raised prices in California to offset the higher minimum wage for fast food workers in the state.

Prices rose 7.5 percent, according to a report from Kalinowski Equity Research, meaning an $11 burrito bowl, for example, would end up costing closer to $12.

CEO Brian Niccol told CNBC on Wednesday that the company has no plans to make any further price increases.

Following the earnings results, the company’s shares rose in extended trading.

In its latest results in January, Chipotle admitted that charging more for burritos helped boost profits 37% to $1.2 billion last year, and the chain was also helped by lower costs for avocados.

He said improvements in store efficiency also helped attract more customers.

Following the earnings results, the company’s shares rose in extended trading

Chipotle noted that customer transactions in the quarter were 7.4 percent higher than a year earlier, while the average amount spent per order increased 1 percent.

While Chipotle experienced higher costs for some ingredients such as beef and cheese, costs for other commodities such as paper and some vegetables have moderated in recent months, helping to shore up the company’s margins.

While Chipotle has seen an increase in visitors, food companies McDonald’s and Starbucks reported a decline in traffic during the final three months of last year.

Traffic at McDonald’s U.S. stores fell 13 percent in October last year, according to data from Placer.ai cited by Wells Fargo.

It decreased 4.4 percent and 4.9 percent in November and December, respectively.

Despite this, the fast food giant managed to increase its profits by 7 percent as a result of charging customers more for McMuffins, Big Macs, McNuggets and French fries.