Rhode Island has become the top state for first-time homebuyers, according to Freddie Mac’s latest market outlook.

The state saw a 14.3 percent increase in the share of mortgages issued to first-time buyers since 2019, the highest increase nationally.

The trend is surprising, given the state’s high housing prices. In September, the median home price in Rhode Island reached $569,950, well above the national average of $425,000.

However, with only 1,465 active listings last month, the state’s small market magnifies the impact of first-time buyer activity.

Rhode Island leads the country in first-time homebuyer activity, with a 14.3 percent increase in the share of mortgages issued to first-time buyers since 2019, according to Freddie Mac.

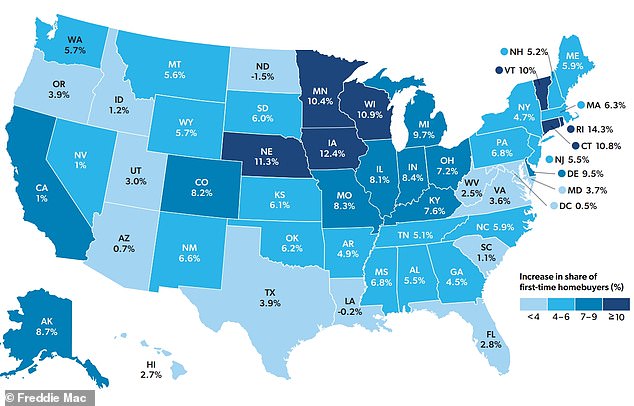

Change in the proportion of first-time buyers from 2019 to 2024

Freddie Mac’s monthly report for October also reveals that the share of mortgages issued to first-time buyers nationwide has increased: from about 20 percent in 2004 to more than half this year.

Experts attribute this to a wave of millennials reaching prime home-buying age and fewer transactions by those who already own a home.

Many of them are locked into lower rates before the rise in mortgage costs since the pandemic. As a result, they have stayed put rather than moving home until mortgage rates drop.

Meredith Whitney, dubbed the ‘Oracle’ of Wall Street, said in August that the mortgage rate needs to fall below five percent to really revive the housing market and get those stuck in cheaper deals to consider moving.

Meanwhile, Freddie Mac’s report shows that first-time buyers are making the biggest gains in the Northeast and Midwest, where slower markets are driving down prices.

In addition to Rhode Island, states with the largest increases in first-time buyers include Iowa (+12.4 percent), Nebraska (+11.3 percent), Wisconsin (+10.9 percent) and Connecticut (+ 10.8 percent).

In contrast, retirement hotspots like Arizona and Florida have seen slower growth in first-time buyer participation as retirees and older buyers dominate home purchases and drive up prices.

Only two states, Louisiana and North Dakota, have reported declines in first-time buyer activity over the past five years.

Freddie Mac’s report highlights several challenges these buyers face. Entry-level home prices have risen 63 percent more than high-end properties since 2000, intensifying affordability problems.

Meanwhile, the current housing shortage, rooted in a slowdown in new construction after the 2008 financial crisis, has left the United States short of at least 1.5 million homes.

Despite the rebound in construction, it has not been enough to meet demand, leaving many would-be buyers scrambling to enter the market.

The report highlights stiff competition, with around 30 tenants for every home currently available for sale.

“Those looking to purchase their first home, especially those who do not have substantial wealth at their disposal, deeply feel that housing is becoming less affordable,” the Freddie Mac report says.

A separate report from August named the top markets for first-time buyers, and half were in the Midwest,

St Louis has been named the top destination for Americans looking for their first home.

St Louis was named best overall, where buyers will see tHeirs’ dollars will go further, and affordable housing is widely available.

Of the ten main markets named in the New analysis of the home sales site. Zillowhalf are in the Midwest, including Detroit, Minneapolis, Indianapolis and Kansas City.

First-time buyers accounted for half of all homebuyers last year, according to Zillow, the highest share since at least 2017.

Last year’s high mortgage rates meant many homeowners were incentivized to stay because of the low rate on their current mortgage, keeping some potential repeat buyers on the sidelines.