- White House lawyers sent angry letters to the Justice Department complaining about the nature of the report.

- A letter from the White House complained that the comments about the president’s memory were “unnecessary and unfounded.”

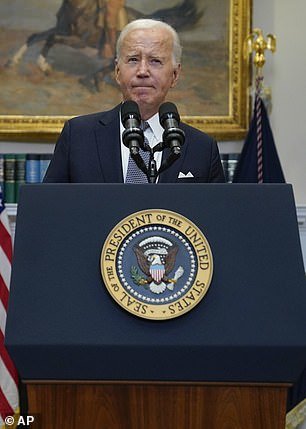

The White House sent an angry letter to Attorney General Merrick Garland a day before the special counsel’s report on President Joe Biden’s mishandling of classified information was released.

White House counsel Ed Siskel complained in a Feb. 7 letter that special counsel Robert Hur’s report included “multiple disparaging statements” about Biden’s memory. Details of White House letters between Justice Department officials were first published by political.

“A blanket and pejorative judgment on the president’s recall powers generally is unnecessary and unfounded,” the letter said.

The latest development in the special counsel saga was when Congress confirmed that Hur will testify on Capitol Hill on March 12 in a blockbuster experience that could spell more trouble for Biden.

Siskel said Hur “openly, obviously and blatantly” violated Department policy and practices by commenting on Biden’s memory and behavior during the interview.

The White House rejected special counsel Robert Hur BEFORE the report was released.

The letter also noted that Biden’s five-hour interview with the special counsel took place after the “serious international crisis” of the October 7 terrorist attacks on Israel, which he said was a “crucial context” for the Biden’s hesitant responses.

The letters reveal the White House’s effort to influence the report before its publication, as it was considered politically damaging to the president.

The Justice Department defended Hur, as Deputy Attorney General Bradley Weinsheimer told the president’s lawyers in a letter that the report was “consistent with legal requirements and Department policy.”

Attorney General Merrick Garland speaks during a press conference at the Department of Justice.

Attorney General Merrick Garland watches as US President Joe Biden speaks in the Rose Garden.

The White House responded strongly to the Justice Department after the report was released, culminating in the president himself angrily condemning Hur for reporting that Biden “did not remember, even after several years, when his son Beau died.”

“How the hell dare you bring that up?” Biden shouted during a press conference Tuesday. “Frankly, when they asked me the question, I thought: It was none of their business.”

Later NBC reports revealed It was Biden, not Hur or Justice Department lawyers, who first mentioned his son during the interview.

Biden has personally expressed frustration with Attorney General Merrick Garland for not doing enough to rein in the report, even though he cleared him of wrongdoing and ultimately recommended against filing charges against Biden for mishandling classified information.