Rents have increased by 29 percent since just before the pandemic began, new research has found.

Although the rate of growth in rental prices has slowed over the past year, they remain significantly higher than four years ago, according to figures from Zoopla.

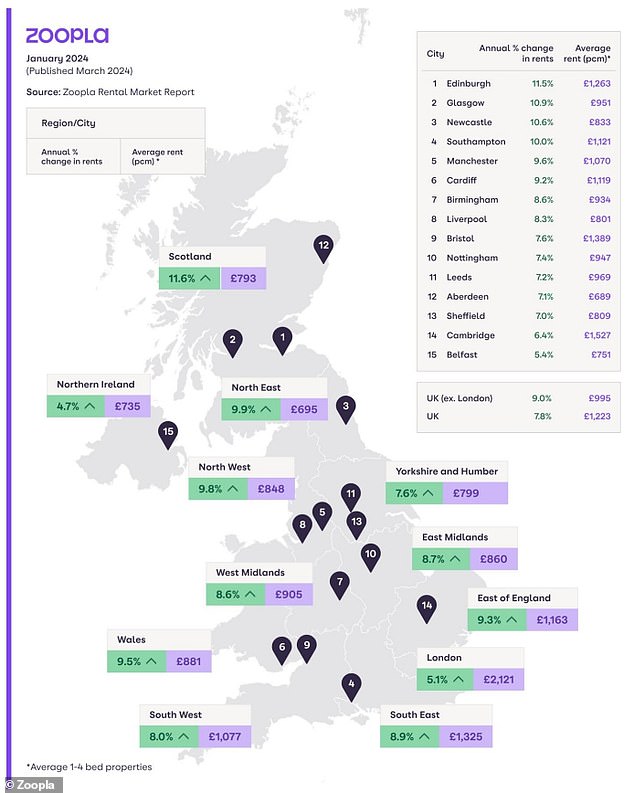

The average rent in Britain was £948 per month in January 2020 and has risen to £1,223 today, according to the property portal.

We reveal how quickly they have increased over the past year and what the average rent is.

The overall growth rate has slowed from the double-digit pace recorded a year ago.

Rent inflation in Britain has slowed to 7.8 percent, from 11 percent a year ago.

Although this slowdown will bring some relief to tenants, the scale of the rise in rents over the past four years reveals the scale of Britain’s rental crisis.

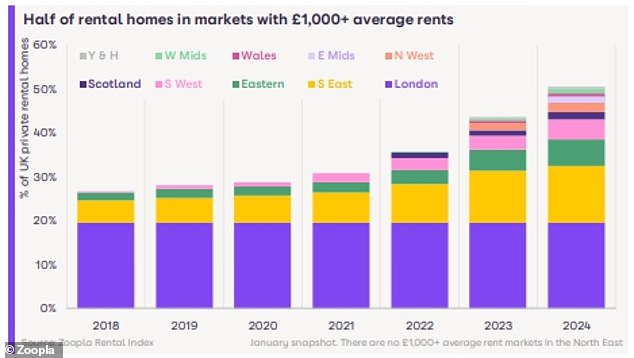

Zoopla says sharp rise in rents during the pandemic helped push more than half of rental homes above £1,000 a month for the first time, almost double the level five years ago .

The trend is clear in the East where 24% of rented homes were in local authorities with average rents of £1,000 per month or more in 2020.

This figure has increased significantly to 70 percent today.

The situation is similar in the South East, where less than half of privately rented housing in this area was in the upper bracket in 2020, compared to almost all today.

Growth in areas where average rents exceed £1,000 per month revealed by Zoopla

Zoopla went on to warn that growth in £1,000 per month areas is now extending into regional markets outside the south of England, where rents historically tend to be higher.

It said new city center rental markets were emerging, with a fifth of homes rented in Scotland, the North West, the East Midlands and the West Midlands in areas of more than 1 £000 per month.

This is despite only three years ago no local market offering rents above 1,000 per month outside of the south of England.

The North East is the only region where no market exceeds this level, while Yorkshire and the Humber have just 4 per cent.

The average rent in Britain was £948 per month in January 2020, and now stands at £1,223, according to Zoopla

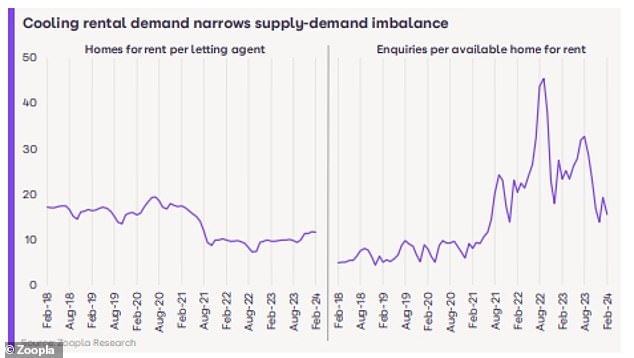

It reveals a harsh reality of the rental market in Britain, where high demand and low supply of rental housing has dominated the sector.

Although this has continued to be the case over the past year, the growth rate has slowed, due to the imbalance between supply and demand readjustment.

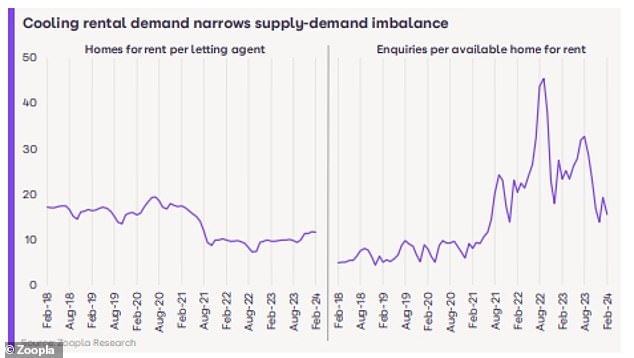

Zoopla said the average letting agent currently has around a dozen homes available to rent, a fifth more than this time last year.

However, it remains more than a quarter lower – at 28 percent – than the pre-pandemic average.

At the same time, a typical rental home receives 15 requests, compared to 40 requests per property in 2021.

However, this figure also remains higher than – or even double – the level before the pandemic.

Demand for rental properties has eased, with the typical rental accommodation receiving 15 applications, compared to 40 applications per property in 2021.

Zoopla suggested that the moderation in rental growth is mainly due to weakening demand and increasing pressures on affordability rather than a major expansion in available supply.

He insisted that only a sustained expansion of rental supply would ease the pressure on tenants due to rising rents.

One of the regions where rental growth has slowed the fastest is the capital, where rents increased by 5.1 percent compared to 15.3 percent a year ago.

There is, however, variation across areas of London, with rent inflation lower in the wealthier areas of the capital, such as Westminster, at 3.2 per cent.

Rents, however, continue to rise by double digits in London’s most affordable areas, such as Havering, at 14 per cent.

Across the rest of the country, rent inflation is around the same level as a year ago, although rent inflation continues to rise fastest in Scotland, at 11.6 percent, the only region where it remains in double digits.

Rental values continue to rise by double digits in the capital’s most affordable neighborhoods

Jeremy Leaf, north London estate agent and former chairman of RICS Residential, says: “Although the 29% increase in rents since January 2020 seems high, we are surprised it is not greater.

“As with all averages, this figure will mask considerable differences between rents above and below this level, as they soared post-Covid at a time when many potential buyers were unwilling or unable to commit to purchases.

“Others didn’t know where they wanted to live long term, because no one knew how long the pandemic would last. More and more people were willing to pay a lot for the rental flexibility offered.

“At the same time as demand for rental properties was off scale, supply lagged and continues to do so as landlords sold primarily due to the tax and regulatory burden, despite rising rents and reduction of voids.

“The net result was an increase in rents, although since then the market has stabilized and the gap has narrowed, particularly in response to the rising cost of living. In the short term, we don’t expect much change.

Rent inflation is slowing rapidly in London but remains stable across the rest of the UK, according to Zoopla

The slowdown in rents is expected to continue, halving this year to 5 per cent, while Zoopla added that there is no immediate prospect of rental affordability improving during 2024.

Richard Donnell, of Zoopla, said: “The last two years have been characterized by a persistent imbalance between rental supply and demand.

“This has caused rents on new lets to increase by 30% since 2021, adding to cost of living pressures for tenants.

“The imbalance between supply and demand has started to reduce, but it is far from resolved. Rents for new rentals will continue to increase in 2024, but at a slower rate.

“Rents remain at their highest level relative to average incomes in over a decade. Only a rapid and sustained expansion of rental housing will begin to improve affordability for UK renters.