Table of Contents

- Rents have fallen in cities such as Brighton, Glasgow and London.

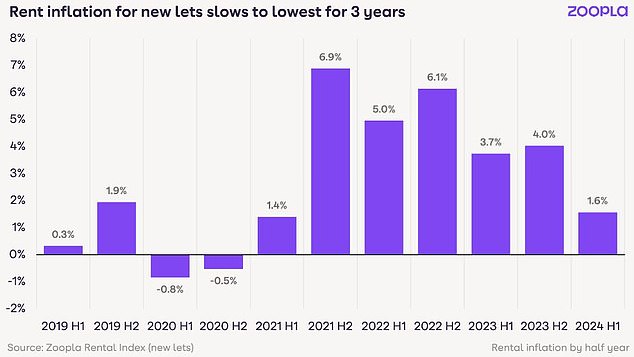

The booming rental market appears to be cooling off after three years of rising prices, according to Zoopla.

The property website has revealed that rental growth has slowed to its lowest level in 33 months.

While average rents for newly leased properties are 5.7 percent higher than a year ago, rents have risen just 1.2 percent in the first six months of 2024.

Relief: Rent increases have been lower in the first six months of 2024

The average house rent now costs £1,232 a month, meaning prices have risen by £66 a month compared to this time last year.

In fact, rents in some major cities have fallen during the first half of this year, including Nottingham, London, Brighton and Glasgow.

In London, rents are falling in inner-city areas, led by Tower Hamlets, Newham and Greenwich.

More than a third of London boroughs (12 out of 33) saw rents fall in the first half of 2024, well below levels seen a year ago.

However, in outer London areas, where rents are cheaper, above-average rental growth rates have been recorded in the first half of the year.

Rents continue to rise at an above-average rate in more affordable markets adjacent to major cities and where rent remains a better value.

Renters in Rochdale have seen rents rise by 6.9 per cent during the first half of the year, while average rents have also increased by 5 per cent in Doncaster and Southend.

What is causing the rental market to cool down?

The increase in rents recorded in recent years has occurred because there are not enough homes available to meet demand.

The supply of properties available to rent per estate agent is slowly increasing, according to Zoopla, which could be taking some pressure off the market.

However, while agents have 17 per cent more properties to let than a year ago, the average estate agent still has a third fewer properties to let compared to the pre-pandemic average recorded by Zoopla between 2017 and 2019.

The modest improvement in supply is being driven by two factors, according to Zoopla.

Lower mortgage rates have made it a little easier for first-time homebuyers to buy and move out of renting, while more new homes are being sold to corporate landlords for rent.

A small but not insignificant number of private landlords are still selling rented properties despite rising mortgage rates and tighter restrictions, which is holding back the overall number of properties available for rent.

Richard Donnell, chief executive of Zoopla, said: ‘Tenants will welcome the fact that rents for new leases are rising at their slowest pace in three years.

‘Rents have risen so quickly that they have breached limits in some cities and we are seeing modest declines in rents in some cities as rents adjust to weaker demand and modest increases in the availability of rental housing.

‘Rents continue to rise most rapidly in more affordable areas adjacent to major cities as tenants seek better value for money.

‘Rents are on track to be 3-4 per cent higher through 2024, which is more than half the level recorded last year and below earnings growth, providing modest relief for UK private renters.’

However, Tom Bill, head of UK residential research at property firm Knight Frank, warns that if the government is seen to penalise landlords with tax changes and legislation, more properties could be sold, leading to further supply-side pressures.

“Rental value growth remains high by historical standards after several landlords sold their properties in recent years due to the proliferation of red tape and taxes,” Bill said.

‘Just when there are signs that supply is recovering and upward pressure on rents is easing, there is renewed uncertainty surrounding further legislative changes by the new government.

“If any new rules prove too punitive for landlords, they could push up rents as more landlords sell.”