Table of Contents

- The cost of public debt has skyrocketed during the last month

- Economists say this largely reflects growth-driven reflationary expectations.

- They warn that spending plans must avoid generating even higher inflation

Rachel Reeves must proceed with caution ahead of the Budget if Britain is to avoid another bond market crisis, economists have warned.

The rising cost of public borrowing over the past month has raised fears that bond markets are already punishing the country ahead of October 30, with many still feeling the impact of the disastrous September 2022 budget.

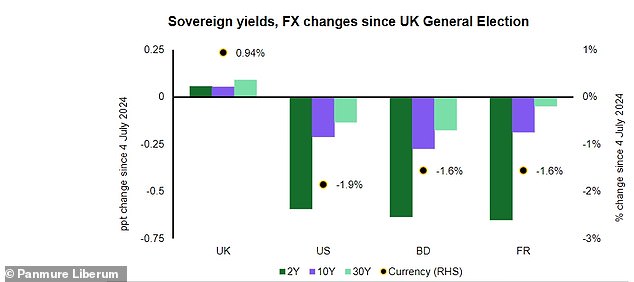

Yields on two-, five- and 10-year UK government bonds have risen 40, 47 and 45 basis points respectively in the past month as investors shed their exposure to British debt.

Chancellor Rachel Reeves must convince markets her budget plans will not reignite inflation, economists say

Bond yields have risen since the general election, while peers in the struggling US, France and even Germany have seen their sovereign yields fall.

Panmure Liberum economist Simon French said: “Given the experience of the Mini Budget in September 2022, when Gilt yields experienced a similar decoupling, albeit in the context of rising inflation and interest rates across the world, there is an understandable anxiety about a repeat.

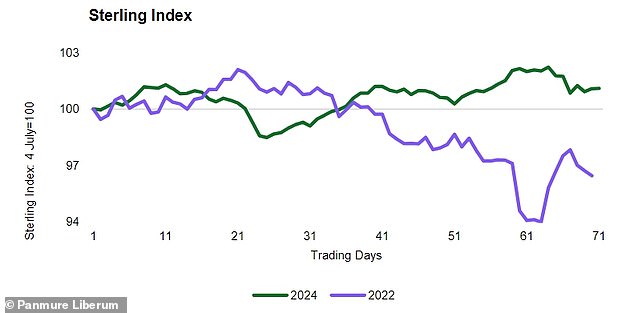

However, French said the current strength of sterling ($1.31 as of this morning compared to its low of $1.08 in 2022) demonstrates that the “appetite for UK sovereign assets” is not “is facing a similar waning moment.”

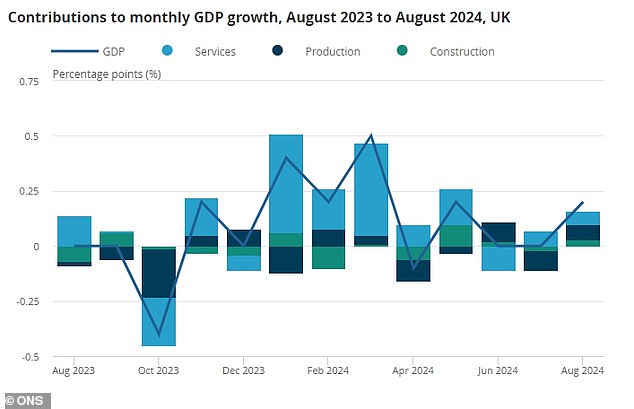

He added: ‘There have been plenty of geopolitical crosswinds to contextualise this move in bond yields, including UK economic data which has remained remarkably strong in recent months.

‘It would not be a far-fetched interpretation of the recent movement in government bond yields to conclude that they are responding to a reflationary pick-up in growth expectations for the UK compared to its international peers.

‘Likewise…the Bank of England has adopted a more hawkish tone than its international central bank counterparts, both in its short-term outlook for the UK’s official interest rate and in its active sales of sovereign debt to the market. open.’

However, the pound is currently much stronger than in 2022, showing that investors are not entirely negative on the UK.

Bond yields have risen since the UK general election, while international peers have seen the cost of borrowing fall sharply.

Bond yields soared in the wake of the Truss-Kwarteng budget as investors reacted to a series of unfunded tax cuts, with 30-year yields rising 120 basis points in just three days.

Bullish moves over the past month have substantially narrowed the gap between current yields from their 2022 peak, but a gap remains.

The 10-year bond yield hit a high of 4.338 percent in the wake of the Truss-Kwarteng budget, compared with its current level of around 4.2 percent, although the gap largely reflects rate cuts of interest.

Reeves received a boost from data on Friday showing the UK economy strengthened in August.

French warned that “careful management of the next three weeks is key” for the Treasury, which needs to demonstrate to investors that its spending plans will not be overly inflationary.

Peel Hunt chief economist Kallum Pickering said: “With a deficit of 3 to 4 per cent of GDP and public debt at almost 100 per cent, Reeves has little room for manoeuvre, no matter how he tries to frame the economic situation. and fiscal”.

He added that Reeves’ decision to strengthen the OBR’s powers in July “has helped but only at the margin”, and rumors of changes to the Government’s fiscal rules to allow greater borrowing to finance investments may have minimal impact.

Pickering said: ‘While these adjustments better orient fiscal policy towards promoting long-term growth and may create room for additional investment, they ultimately amount to accounting acrobatics.

“The UK’s tax obligations remain the same regardless of how they are counted.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.