Table of Contents

- The value of gold has increased more than 100% in the last decade

- Gold watches, engagement rings and chains could have increased in value

- Making a claim based on a previous insurance assessment could leave you losing out

Jewelery owners could risk losing thousands of pounds through theft or damage by not revaluing their property, data suggests.

Many Britons could be unknowingly sitting on a gold mine, following a decade-long trend of growth in the value of the precious yellow metal.

And the value of engagement rings, watches and gold chains will have risen in the last 10 years, with some pieces rising in value by thousands of pounds, according to Admiral Home Insurance.

The insurer said the average price of a gold chain, for example, has risen to £2,631, rising by £485 from just £2,146 in 2018.

Up-to-date appraisals are important to ensure you get an accurate payment when making an insurance claim.

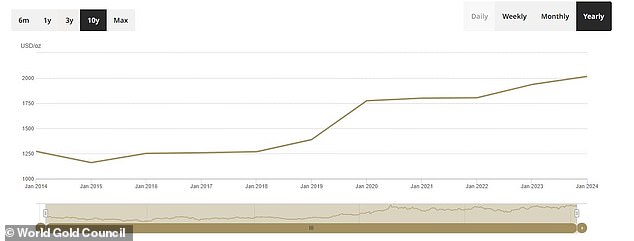

Gold prices have risen 112 per cent in the last ten years, according to Admiral, and will rise in value to £575 in 2023 alone, according to Admiral.

Gold averaged £2,401 per ounce in 2023, up from an average of £1,826 in 2022.

Many people may not realize the value of some of their possessions. This not only means that they are likely to lose out if they plan to profit from the items, but it could also put them at risk of losing thousands of pounds out of pocket if their items are stolen, lost or damaged.

“Watches and jewelery are often valuable, both financially and sentimentally, so it is very important that people ensure they are adequately covered in case the worst happens and they have to make a claim.” says Noel Summerfield, Head of Family at Admiral Insurance.

The price of gold has skyrocketed over the last decade

What to consider when reevaluating

However, when it comes to purchasing insurance for your valuables, it is important to ensure that the valuation you use to purchase your policy is up to date.

If you file a claim based on a previous valuation, you may only recover part of the value of your possessions due to rising prices.

‘The price of gold has been on an upward trajectory for the last 10 years, so if your jewelery and watches have been insured for a long time and you never thought to check if the value has increased, now is the time to ‘Make sure you have the level of coverage you need,” Summerfield added.

“In fact, we have even received complaints from customers who have not updated the value of their items since the 1980s, and some pieces of jewelry have increased in value by more than 700 percent.”

“Providing updated item values to your insurer is vital to ensure that if you do have to make a claim, you will be covered for the full value of your items.”

When looking to value your gold, it is best to shop around to find the best price; Don’t just accept the first offer you receive.

The Institute of Registered Appraisers, regulated by the National Jewelers Association, is a good starting point for finding an accredited appraiser near you. Alternatively, the Association of Independent Jewelry Appraisers is also a good place to start.