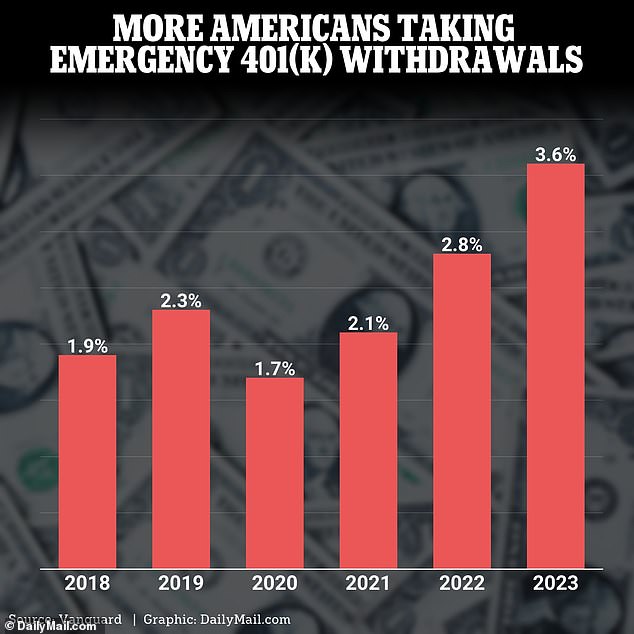

A record number of Americans took money out of their 401(K) plans last year for a financial emergency, stark new figures show.

Data from Vanguard Group, one of the largest U.S. retirement plan providers, reveals that 3.6 percent of participants took early withdrawals from their accounts in 2023.

Vanguard manages nearly five million retirement accounts, meaning about 180,000 of their clients were forced to dip into their savings last year alone.

It is the second year in a row that emergency withdrawals have hit record highs as higher costs for everything from groceries to gas and soaring interest rates have taken their toll on households.

In 2022, about 140,000 — or 2.8 percent of participants — took emergency withdrawals from Vanguard 401(K) accounts.

Data from Vanguard Group, one of the largest U.S. retirement plan providers, reveals that 3.6 percent of participants took early withdrawals from their accounts in 2023

401(K) plans are designed to keep savings out of reach until you reach retirement age.

The Internal Revenue Service (IRS) allows withdrawals in cases of ‘immediate and great financial need’. This includes incidents such as flood damage to your home, avoiding eviction or a significant medical bill.

But Americans will have to pay income taxes on withdrawals from 401(K)s or traditional IRAs — plus often a 10 percent penalty if they’re younger than 59½ years old.

According to Vanguard data reported in The Wall Street Journalmore than 75 percent of the distributions last year were for $5,000 or less.

And nearly 40 percent of those who took money out of their 401(K) did so to avoid foreclosure — up from 36 percent the year before.

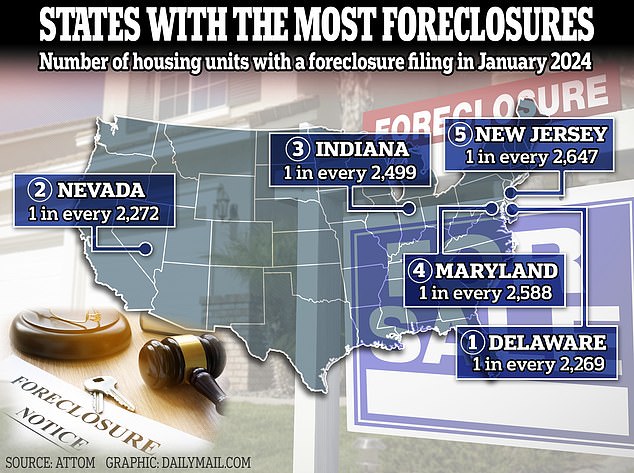

It comes as a separate study revealed that home foreclosures are on the rise across the United States as Americans continue to struggle with rising interest rates and rising costs.

In January, 37,679 properties had a foreclosure, according to fresh figures from the real estate data provider ATOM – up 10 percent compared to the previous month.

Foreclosures are on the rise across the U.S. as Americans continue to struggle with rising interest rates and rising costs — with some states faring worse than others

In recent years, federal law changes have made it easier for Americans to withdraw from their retirement accounts.

In 2018, for example, Congress removed a requirement that savers take out a 401(K) loan before they would be able to withdraw.

A 401(K) loan is overseen by a participant’s plan and lets them borrow money from their retirement savings and then pay it back over time with interest.

According to Vanguard, about 13 percent of participants had a 401(K) loan outstanding at the end of last year, up from 12 percent in 2022.

Financial planner Marissa Reale told DailyMail.com last year how taking out a loan is better than a withdrawal – as you can pay it back slowly and stay on track for retirement.

“But before that, I’d recommend trying a credit card loan first with a 0 percent APR — this is a good option if your credit is good,” she said.

‘Otherwise, home owners can always consider taking out an equity loan on their home – it’s an option many people don’t think about.’

Americans must pay income tax on withdrawals from 401(K)s or traditional IRAs — plus often a 10 percent penalty if younger than age 59½

But it’s not all bad news.

Even as an increasing number of Americans are being forced to take money out of their retirement savings, the average 401(K) balance also increased last year.

According to Vanguard, the average balance increased 19 percent last year, primarily driven by a strong stock market.

The stock market soared in 2023 — with the S&P 500 index of America’s largest companies ending the year up 24 percent.

That’s a welcome change from 2022, when the big averages suffered, wiping an average of 20 percent off the average 401(K) account balance.