Table of Contents

Fund manager Bryn Jones describes himself as a “glorified lender” but “without access to a baseball bat when people don’t pay.”

All in jest, of course, but in layman’s terms, it goes a long way to explaining how he makes money for investors with the investment fund he runs: Rathbone Ethical Bond.

“What we do as fixed income fund managers is lend money to large companies and governments around the world,” he explains. ‘In exchange, they pay us interest each year until their bonds mature.

‘Hopefully, if we have chosen good quality bonds, especially on the corporate side, we will get our money back. We are happy and so are our fund investors.

“The trick (and it’s key) is to avoid bonds from companies that could be about to run into trouble, like Thames Water.”

He adds: “The goal of our fund is simple: to provide our investors with a little more than they would get in cash and to offer something that acts as a kind of insurance policy on their investment portfolio when the stock markets fall.”

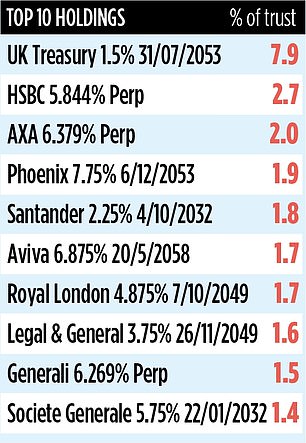

It’s a diversification proposition that has attracted money from wealth managers, networks of financial advisors and private investors. The fund has assets worth £2bn and holdings in 217 bonds from 24 companies.

While wary of inflationary pressures that could be unleashed by a combination of Labour’s budget attack on UK businesses and Donald Trump’s threat to impose tariffs on imports to the US, Jones believes bond markets currently offer “a lot of opportunities.” “.

He says bond yields of between five and six percent are currently “attractive,” especially if interest rates decline steadily as expected, driving up bond prices.

“Of course, if inflation were to approach 7 percent in the coming years,” he adds, “investors would be better off buying gold or short-term indexed government bonds.”

The portfolio comprises a large number of bonds offered by large companies, such as Aviva, HSBC and Santander. However, its largest holding is in British bonds (or, more specifically, green bonds). A specialist division of Rathbones, Greenbank, ensures that all bonds held in the fund meet strict social and environmental criteria.

“We can only buy UK government bonds where the proceeds are used to improve the country’s environment or infrastructure,” says Jones. “We cannot buy bonds that are used to finance nuclear power plants or buy weapons.”

In line with its ethical investment approach, Rathbone Ethical Bond is an investor in the World Bank’s Amazon Reforestation Linked Performance Bond, which provides financing to help reforest the Brazilian Amazon rainforest.

It also has holdings in bonds that help finance the development of wind and solar farms. Among them is a share in a bond issued by community interest company Burnham and Weston to finance a local solar farm. “These bonds don’t make up a large part of the fund’s portfolio,” Jones says, “but they offer good returns.”

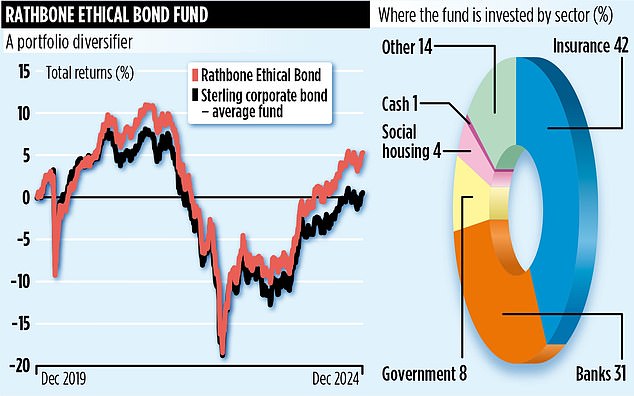

In terms of investment earnings, Rathbone Ethical Bond has generated an overall return of 9.5 percent over the past year and 38 percent over the past ten years. It has outperformed the average return of its sterling bond group over the past one, three, five and ten years.

Like all bond funds, it suffered a wobble in the fall of 2022, when bond prices fell sharply in response to unfunded tax cuts announced by then-chancellor Kwasi Kwarteng. Annual charges are reasonable: 0.67 percent.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.