More than two million GP appointments could be at risk due to rising National Insurance (NI), analysis suggests.

While the NHS and the rest of the public sector are protected from the increase, GP practices – which mostly operate as small businesses under government contracts – will have to pay.

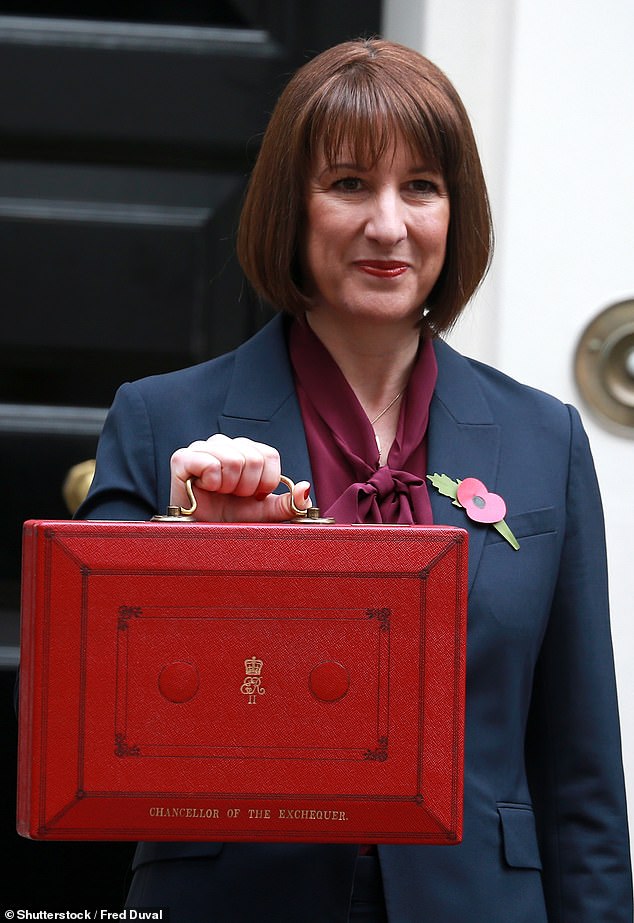

In last month’s Budget, Chancellor Rachel Reeves increased NI contributions for employers on wages from 13.8 per cent to 15 per cent, starting in April.

This will increase the average tax bill for a surgery by £20,000 a year, or approximately £125.5 million across England’s 6,275 practices.

And with each patient appointment costing £56 per surgery, it is feared that to cover the tax increase some 2.24 million appointments could be at risk of being scrapped – an average of 357 per surgery each year.

Rachel Reeves’ decision to increase employers’ NI contributions could put more than two million GP appointments at risk, analysis suggests

The NI increase will increase the average surgery tax bill by £20,000 a year, or an estimated £125.5 million across the 6,275 practices in England (file photo)

Professor Kamila Hawthorne, president of the Royal College of GPs, said the health service needed “significant investment” rather than “further worry and financial insecurity”.

GPs have already warned that they will be forced to cut staff and reduce the number of appointments they can offer (or even close).

The analysis was carried out by the Liberal Democrats, who believe GP surgeries should be exempt from the tax rise.

Dentists, pharmacists, social care providers and charities have also expressed fears that Ms Reeves’ rise at IN could force them to close.

Helen Morgan, health and social care spokesperson for the Liberal Democrats, said: “Hitting GPs with higher taxes makes no sense at a time when many people are already struggling to get an appointment.”

‘Clinics are also struggling, and this rise in costs will leave GPs no choice but to cut services and staff. Ultimately, it is the patients who will pay the price. The Chancellor urgently needs to rethink these proposals and exempt GPs from this misguided tax rise.’

NHS hospitals will be protected from the rise by back payments from the Treasury. But GP surgeries, which operate mainly as trade associations and provide NHS care under government contracts, are not included.

And many GPs are already “working to rule” in protest at their current contract, limiting the number of patients they see.

Professor Kamila Hawthorne, President of the Royal College of GPs, said: “GP teams are working hard to provide care for their patients against a backdrop of significant budget constraints.

‘The Government has ambitious plans to move much more care into the community and we want to work with them to make this happen, as we know this is what patients want. “But we need significant investment, not more worry and financial insecurity.”

A government spokesperson said: ‘We have made difficult decisions to lay the groundwork so that a £22bn boost for the NHS and social care can be announced in the Budget. The employer NI increase will not take effect until April, and we will present further details on the funding allocation for next year in due course.’