Table of Contents

If you put your 2p National Insurance savings into your pension, you could get tens of thousands of pounds more in retirement, a new study reveals.

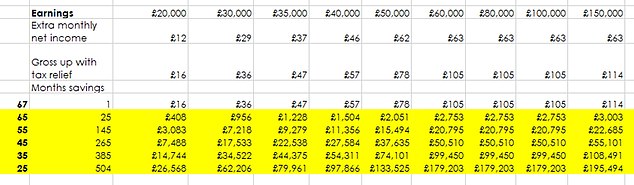

A 25-year-old on an average salary of £35,000 using this simple savings tactic could increase their pension by £80,000 by age 67 without sacrificing any of their current salary, it shows.

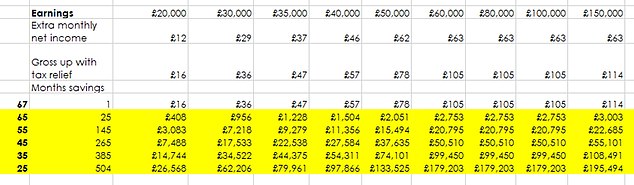

It may seem “dry and boring” to pass up a pay rise, but it will reward you in the long term, especially if you take advantage of not just the 2p cut but the full NI 4p cut this year in your pension, calculations experts say by Evelyn Partners. .

NI savings; The simple tactic of transferring this money into your pension can reap big rewards.

What seems like a small savings now gives you more pension tax relief from the Government, plus potentially higher compound growth on the investment and higher matching contributions if your employer allows it and they’re not already maxed out.

The move could also mitigate income tax increases if the current freeze on thresholds is about to push it higher.

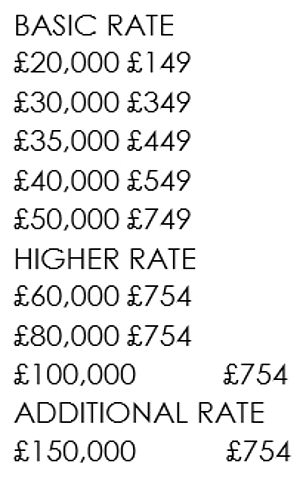

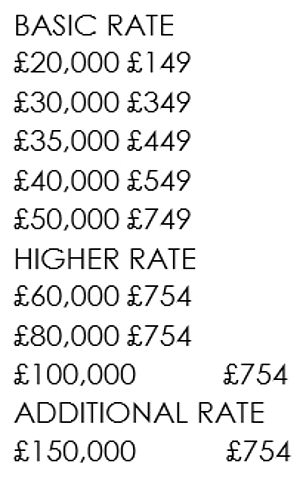

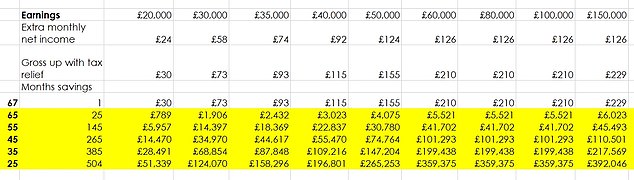

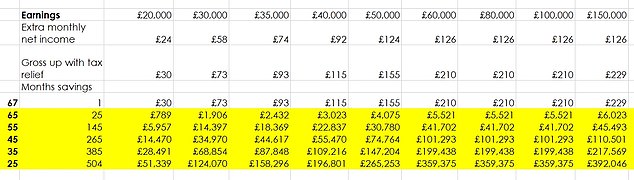

The IN’s latest 2p cut in the budget will save a worker an average of £35,000 more than £37 a month, says Evelyn; See the full summary of savings at different income levels below.

Putting your NI savings into a pension means at age 67:

How much 2p NI savings are worth at all income levels (Source: Evelyn Partners)

– A 25-year-old with £35,000 could earn £80,000;

– A 35-year-old earning £60,000 could end up earning £100,000;

– A 45-year-old with £40,000 will benefit more than £27,500.

>What does that mean to you? See tables below

“That could equate to retiring a few years earlier than planned or a much more comfortable retirement than you ever anticipated,” says Lucie Spencer, director of financial planning at Evelyn Partners.

‘Given the cost of living pressures we’ve all had to endure in recent years, it wouldn’t be surprising if most earners gratefully pocketed the January cut and let it roll into the current account balance.

‘But astute savers can use this latest measure in a way that helps them overcome the fiscal burden of rising income taxes and boost their retirement savings, all without sacrificing take-home pay.

‘Those whose overall financial situation is decent – with clear unsecured debt and a cushion of cash savings – could significantly increase their long-term wealth simply by investing it in their pension, without changing their take-home pay.

“The benefits are particularly significant for younger savers because increases in pension contributions early in the retirement saving process can have a profound effect on the final fund size thanks to the power of compounding returns.” .

How much could putting NI savings into a pension boost YOUR fund?

Evelyn’s figures assume workers increase their monthly pension contribution by the amount their take-home pay will increase after the 2p budget cut to NI, or by the full 4p cut from the start of this year.

The amount is then increased again by pension tax relief and grows with an annual investment return of 5 percent.

Impact of applying a 2p NI budget cut to your pension (Source: Evelyn Partners)

Impact of taking a 4p IN cut from the Autumn Statement and Budget to your pension (Source: Evelyn Partners)

Pension payments mitigate the increase in income tax

Lucie Spencer says this pension saving tactic is especially powerful right now due to frozen and falling income tax reliefs and thresholds from 2022.

‘Millions of people are paying more in income taxes – although rates have not changed – and this trend will continue at least until 2028.

“This effect will wipe out the gains from the NI cuts for many taxpayers within a year or two, meaning the overall direct tax burden will be increasing.”

However, Spencer points out that one of the few ways to mitigate the income tax increase is to contribute to a pension.

This is because contributions benefit from tax relief at the marginal (or highest) rate of the recipient’s income tax.

HEATHER ROGERS ANSWERS YOUR QUESTIONS ABOUT TRIBUTES

‘Depending on their pension scheme, the saver will automatically receive basic rate tax and claim the rest if they are a higher or additional rate taxpayer. Or they pay contributions out of their gross income and automatically get all tax relief.’

“In any case, the effect is practically the same: you legitimately avoid paying income taxes on a part of your income and at the same time increase your pension fund.

“That’s why when someone receives a pay raise, a financial advisor often advises them to put some or all of it toward their pension.”

How can the pension be topped up with the NI cut?

You need to calculate how much your monthly take-home pay will increase in April thanks to this latest 2p IN cut, Spencer says.

You can also check the full impact of the 4p NI cut, if you plan to boost your pension with the full reduction this year.

Spencer says you can then determine what adjustment you need to make to your contribution rate for that amount to go toward your pension; He can ask his human resources department or pension provider for help if necessary.

The take-home pay that hits your bank account each month may remain unchanged, he explains. And you can also benefit from higher matching contributions from your employer, further boosting your pension fund.

‘“This reflects a net pay scheme, where employees pay gross income tax contributions. However, the principle applies to anyone who contributes a pension.’

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.