Table of Contents

Almost half of people are more confident in property than pensions as a long-term investment, new research reveals.

One in six believes that pensions are the best investment, and the rest are undecided or not convinced of any of the options.

Londoners, young adults, workers earning more than £50,000 and people who already own homes were most likely to favor property ownership, according to the survey by financial services firm Abrdn.

Property vs pensions: the people’s verdict is that bricks and mortar are a better long-term investment

A recent independent study showed that more young people believe they will use property to fund their old age rather than a pension, although few had a mortgage yet.

All generations aged 27 and over said they were more likely to rely on pensions as their main source of wealth in retirement.

Abrdán points out that property and pensions are not mutually exclusive investments. The firm also points out that pensions come with tempting ‘nudges’ such as free cash boosts from tax relief and employer contributions.

Are you in favor of property or a pension as an investment?

The debate between property and pensions has been going on for a long time, with supporters of the former pointing to the huge capital gains from booming house prices and the lack of access to retirement funds until age 55 (which will rise to 57 at from 2028).

Pension advocates argue for tax advantages, cash incentives, and the desirability of arm’s length oversight of investments.

Meanwhile, people still need a home to live in when they reach retirement, which means they need to downsize, move somewhere cheaper, or free up equity to tap into the value of their own property.

Buy-to-let investing can involve a lot of work, periods when properties are empty and increasingly onerous regulations and taxes.

The Abrdn survey found that 48 per cent of UK adults think property is a better long-term investment than a pension and 16 per cent the opposite.

The company has launched a new campaign called ‘The Savings Ladder: A Manifesto for Getting Britain to Invest’.

Recommendations include simplifying ISAS, removing stamp duty on UK shares and investment trusts and improving financial education.

Another is to increase minimum pension contributions under automatic enrollment from 8 percent of qualified earnings to 16 percent.

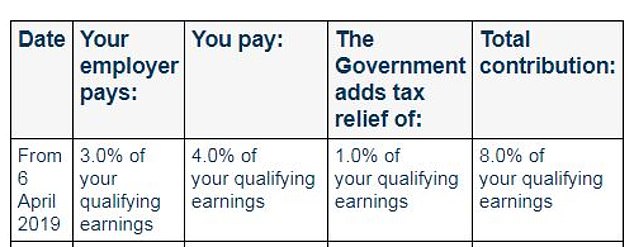

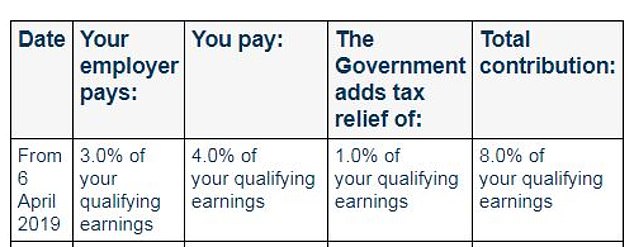

Qualifying income is between £6,240 and £50,270 salary, divided between personal contributions and free employer and government top-ups.

Who pays what: breakdown of minimum pension contributions by automatic enrollment

What are people’s savings habits and attitudes?

Abrdn’s survey of 2,000 UK adults, conducted earlier this year and weighted to be nationally representative, returned the following findings.

– One in five people owns shares outside their pension.

– Three quarters of adults are savers, and three quarters of these savers prefer cash.

– About 64 percent own their own home, 37 percent of them directly.

– Of those who do not own their own home, 51 percent want to own one and 17 percent are actively saving to achieve this goal.

– Among those who have no intention of buying a house, more than a fifth are resigned to the fact that it is not financially realistic.

– Around 22 percent have no pension savings.

– Among self-employed workers, 38 percent have never saved for a pension.

– External pensions, 75 percent save in checking accounts and 72 percent in cash savings accounts.

– Those who invest are almost twice as likely (19 percent versus 11 percent) to own direct stocks rather than more diversified funds that help spread risk.

Stephen Bird, chief executive of Abrdn, says: ‘With pressure on how far governments can go to support an aging population, retirement funds will become further and further away from what people need and deserve.

‘The sale of NatWest shares could be a unique opportunity for the government to launch a broader campaign.

‘Just as the concept of the “property ladder” has infiltrated cultural consciousness, we need to develop the same enthusiasm for a ‘savings ladder’ where people can see the benefits of starting early, building their own fund and investing to do so. grow.

‘Minimum contributions to defined contribution pensions must still be increased radically, and ideally doubled. This is not easy, but neither is the constant increase in the state pension age.’

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.