Table of Contents

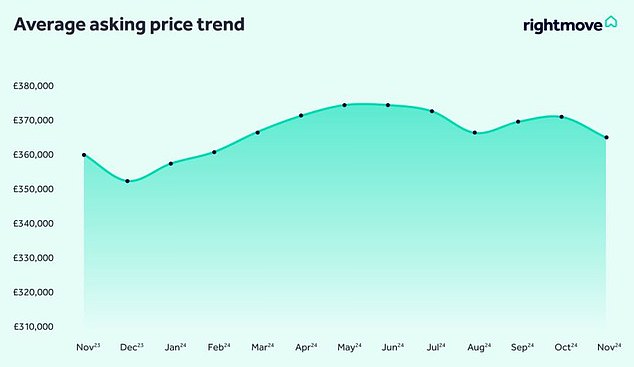

Property sales prices have fallen by more than £5,000 on average this month, according to Rightmove.

The price of a typical home newly put on sale fell 1.4 per cent in November, to an average of £5,366, the property website revealed.

The drop represents a larger drop than normal for this time of year, which Rightmove attributed to pre- and post-Budget jitters.

He said the average house now goes on sale with an asking price of £366,592.

Despite the drop in sales prices this month, the real estate market is much more active than last year, according to the real estate website.

The number of agreed sales is 26 percent ahead of the calmer market at this time in 2023, he said.

Buyer interest is currently 23 percent higher than last year, while The number of new sellers putting their home on the market has increased 6 percent over the same period last year.

Getting up again? Rightmove says lower mortgage rates will release some pent-up housing demand and upward pressure on prices

Calling for prices to rise next year

The average sales price will rise by 4 per cent next year, according to Rightmove. This is the most optimistic prediction since 2021.

Its real estate experts believe lower mortgage rates will release some pent-up housing demand and put modest upward pressure on prices.

They are also expecting an increase in the number of completed sales in March next year, as buyers look to get in ahead of the stamp duty increase at the end of that month.

Tim Bannister, one of Rightmove’s property experts, said: ‘There has been a lot of news for removal companies to digest in recent weeks and it looks like the market may still be digesting it.

“We had been seeing a drop in demand from buyers, both in the run-up to the budget and immediately afterwards, as it was confirmed that there will be an increase in stamp duty charges for most removal companies and second buyers housing and some first-time buyers.

‘However, a second bank rate cut and increased optimism about 2025 appear to have reversed this trend, at least temporarily.

“This sets us up for what we predict will be a stronger 2025 in both prices and numbers of homes sold, particularly if mortgage rates fall enough to significantly improve affordability for more of the mass market.”

However, Rightmove also says the market remains price sensitive and competition between sellers is at its highest level for a decade.

More homes on the market mean buyers can afford to be more discerning and potentially haggle over prices.

It is also difficult to judge the impact Rachel Reeves’ new stamp duty surcharge on second home purchases will have on property prices.

These buyers were already facing a 3 per cent surcharge on top of what those buying a property to live in currently pay.

However, from October 30 that figure rose to 5 per cent, adding thousands of pounds to the cost of buying rental homes and second homes.

Fewer buyers combined with a glut of homes on the market could be a recipe for prices to fall, rather than rise.

What will happen to mortgage rates?

Fixed mortgage rates have also risen in recent weeks despite the Bank of England cutting interest rates earlier this month from 5 per cent to 4.75 per cent.

Market expectations about how fast and low interest rates will be in the future have changed lately, and this is having a direct impact on fixed mortgage rates.

The Bank of England’s base rate is still expected to fall over time, but markets are now wondering if the pace will be as fast.

Rightmove’s Tim Bannister forecasts a stronger 2025 both in terms of prices and numbers of homes sold.

However, most real estate agents are optimistic.

Kevin Shaw, managing director of national sales at Leaders Romans Group, said: ‘There is some uncertainty following the increases in national insurance and the minimum wage.

‘There have been a lot of changes in the last few weeks, so I think time will tell.

“It’s definitely an interesting time in the market, but as we get closer to 2025 we expect market sentiment to improve further.”

Alex Caddy, manager at Clarkes Estate and Letting Agency added: “There are still many sellers who are planning their moves and are searching despite not yet having a buyer.”

“There is certainly optimism that as first-time buyer activity recovers, this will create the much-needed knock-on effect to get us started next year.”

Estate agents warn that buyers could bag a bargain before Christmas.

“Decisions are being made now, ahead of Christmas, as buyers are more likely to get pricing flexibility from sellers now than in the New Year,” said Kevin Shaw of Leaders Romans Group.

“This presents a good opportunity to negotiate as there will surely be more people searching in January after the Christmas holidays and the usual Boxing Day surge in inquiries.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.