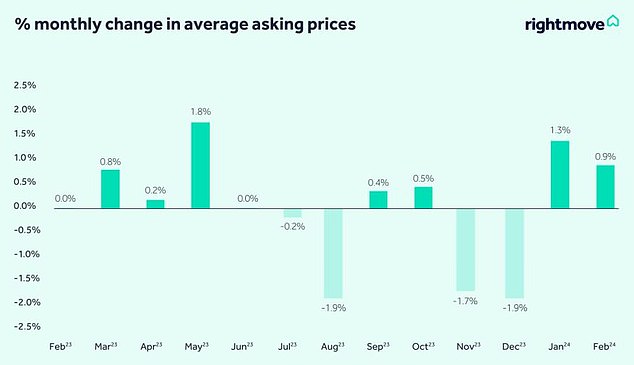

Average asking prices rose 0.9 per cent this month to £362,839, according to the latest data from Rightmove.

The data, which analyzes prices of homes newly put up for sale, reported a 1.3 percent increase in January. This means the typical asking price has risen almost £8,000 since December.

It was also up 0.1 percent from this time last year, which is the first time in six months that the year-to-date figure has not been negative.

The change was driven by more buyers and sellers coming to the market, according to the property’s website.

Good start to the year: the typical home just put up for sale has risen almost £8,000 since December, according to Rightmove

It reported that 7 percent more new listings came to market in February of this year than last year, and a 7 percent increase in the number of buyers making inquiries.

It also said agreed sales in the first six weeks of 2024 were 16 percent higher than during the same period last year and 3 percent higher than before the pandemic in 2019.

Rival website Zoopla reports similar findings in its data. He said homebuyer demand in January was 12 percent higher than the same time last year.

Where are the hot real estate markets?

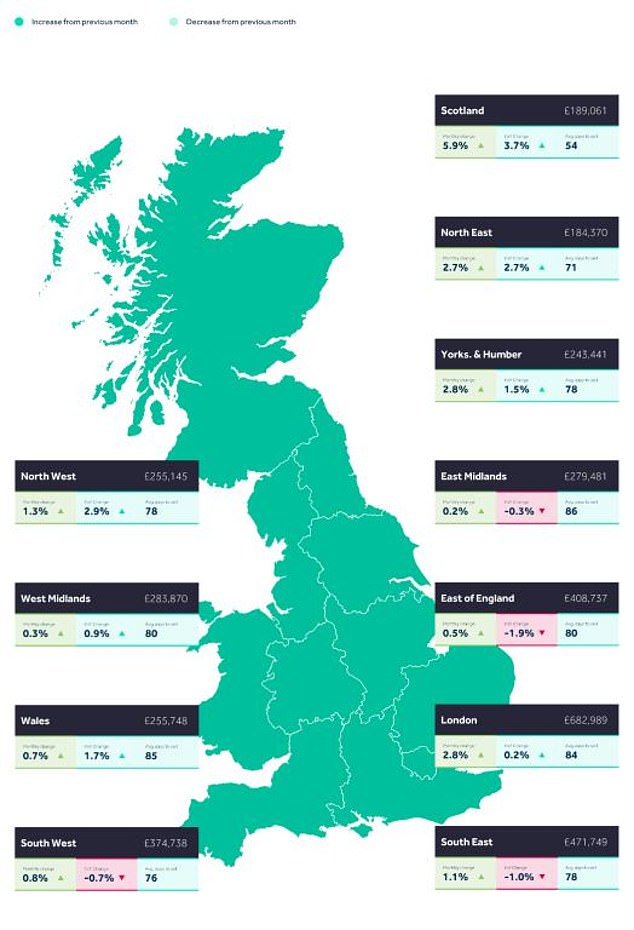

Rightmove said buyer numbers increased everywhere in the UK, but London was firmly in the lead, followed by the north-east and north-west regions.

It also said the flow of new homes for sale was 10 percent higher than a year ago and the highest since 2020.

Optimism breeds confidence, and confidence is translating into more sellers and buyers entering the market.

Michelle Niziol, Estate Agent at IMS Property Group in Oxfordshire

It reported that new sellers are listing their homes at the fastest rate in the East of England, the South West and the North East.

On the ground, real estate agents also support these results, with many of them reporting a positive start to the year.

Michelle Niziol, chief executive of IMS Property Group in Oxfordshire, said: ‘The start of this year has seen renewed optimism and positive sentiment following a further pause in interest rates and January inflation remained at 4 percent.

“Optimism breeds confidence, and confidence is translating into more sellers and buyers entering the market.”

The average number of properties newly listed for sale is 0.1 per cent higher than this time last year, which is the first time in six months that the figure so far this year has not been negative.

Kate Eales, deputy director of residential at estate agency Strutt & Parker, adds: “We are seeing a good start to the year in the London property market, with buyers acting earlier than usual.”

‘The current momentum is further underlined by an increase in the number of registered buyers so far this year compared to the same period last year.

“This positive trend suggests renewed confidence in the market and, as we approach spring, we anticipate a continued upward trajectory in both buyer interest and real estate transactions.”

The February data follows Rightmove’s report last week that a record number of homeowners contacted an estate agent to have their home valued in January.

Meanwhile, the latest housing market study by the Royal Institution of Chartered Surveyors (Rics) also showed that estate agents and surveyors are seeing an increasing number of inquiries from buyers, as well as more sellers coming to the market.

Tim Bannister, head of property science at Rightmove, said: “We said February would be an important indicator for next year, and the question was whether Rightmove’s Boxing Day bounce in buyer activity would maintain its spring into March or lose impulse”.

«It has been proven that it is the former: the number of agreed sales continues to considerably exceed last year.

“Early Boxing Day buyers got a head start on picking up a record level of new property choice and have now been joined by many other buyers who also believe 2024 offers the right market conditions to move in.”

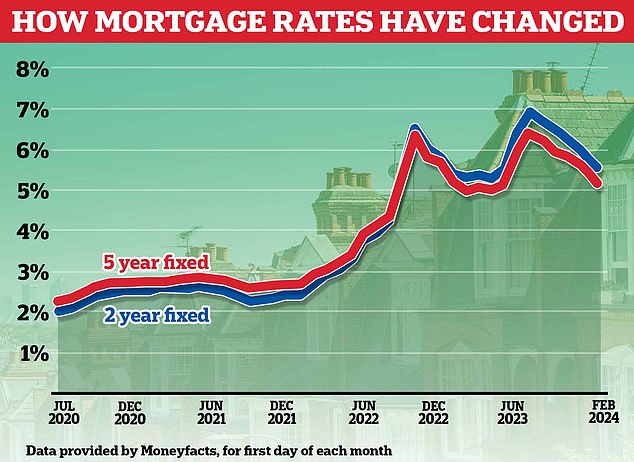

Bannister is one of many real estate industry experts who believe mortgage rates have now reached low enough levels to encourage buyers and moving companies to return to the market.

Although average two- and five-year fixed mortgage rates remain above 5 per cent, according to Moneyfacts, the cheapest five-year fixed deals for those with more equity remain just below 4 per cent.

Falling Rates: Real estate industry experts who believe mortgage rates have now reached low enough levels to encourage buyers and moving companies to return to the market.

The lowest rate for someone buying with a 20 per cent deposit is currently 4.34 per cent, while the lowest rate for someone buying with a 10 per cent deposit is 4.47 per cent.

Someone requiring a £200,000 mortgage, buying with a 10 per cent deposit and getting the lowest rate over 25 years, could expect to pay £1,108 a month.

“Mortgage rates have fallen considerably from their peak and are now broadly stable following the uncertainty of late 2022 and 2023,” adds Bannister. “Momentum to advance in 2024 continues to grow.”

Are home sellers’ prices too high?

However, while the housing market appears to be heating up, many sellers may be pricing their homes a little too optimistically, meaning many homes are failing to attract interest.

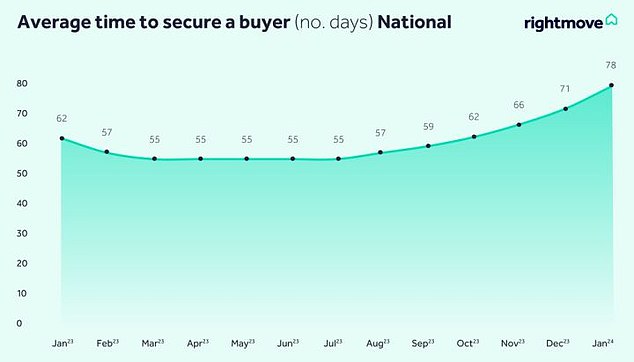

It is taking more than two weeks longer to find a buyer than this time last year, and the average time to sell is the slowest since 2015, excluding the initial pandemic lockdown months of April and May 2020.

Potential sellers should not get carried away. Buyers now have more choice of properties for sale and many are still very price sensitive.

Tim Bannister, Right Movement

Sellers are advised to set the right price from the beginning if they want to sell quickly.

“Potential sellers should not get carried away,” says Bannister. ‘Buyers now have more choice of properties for sale and many are still very price sensitive as mortgage rates remain high.

“Sellers who are serious about moving this year would do well to ride this wave of increased buyer confidence with an attractive sales price before any pre-election jitters or unexpected events dampen momentum.”

Rightmove says estate agents are reporting that competitively priced properties are being snapped up by budget-conscious buyers looking to make 2024 their year to move, having taken a pause during the uncertainty of 2023.

However, if they are overpriced, they are likely to remain on the market and require a drastic reduction in the selling price.

It’s taking more than two weeks longer to find a buyer than this time last year, and the average time to sell is the slowest since 2015.

Hamptons agents revealed earlier this week that a whopping 48 per cent of homes sold in January in England and Wales had been subject to a price reduction.

Michelle Niziol of IMS Property Group said: ‘The market remains price sensitive.

‘Motivated sellers need to be realistic with selling prices and receive advice on how to effectively position their sale in the current market.

“Buyers’ budgets are still largely constrained by expensive mortgage products, so it’s a careful balance.”

Regional differences: Average sales prices increased this month in all regions of the UK. However, in some locations the average price of new listings is still below last year’s price.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.