Fewer Australians are now taking up working from home in regional areas and building approvals are falling outside capital cities, new data reveals.

Qi Chen, CEO and founder of land sales site OpenLot, said professionals were no longer embracing the shifting lifestyle as they did during the pandemic.

This happened despite a drastic reduction in construction costs, which are now growing at the slowest pace in two decades after some dramatic post-Covid spikes.

“There is a shift of gravity toward big cities,” Chen said.

‘The Covid-era dream of living in a city where trees or the sea change has lost its luster.

‘Nowadays people want to live as close to the capital as possible, but without losing their home.’

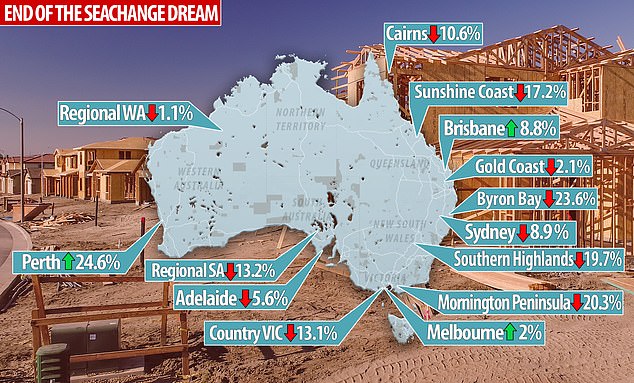

New home approvals plummeted in regional areas across all states in the last financial year.

Popular hotspots for sea change, such as Byron Bay and the Sunshine Coast in Queensland, were among coastal spots that suffered double-digit declines.

Fewer Australians are adopting home working in regional areas and building approvals are plummeting outside capital cities, new data shows

New housing approvals plummeted in regional areas across all states during the last financial year (Byron Bay pictured)

But new home approvals rose in almost all mainland state capitals except Sydney and Adelaide.

“Housing approvals growth was significantly faster in capital city metropolitan areas last year than in regional areas,” Chen said.

In Queensland, Brisbane saw an increase of 8.78 per cent to 12,774 new dwelling approvals, but in regional areas, approvals fell 8.99 per cent to 8,779 dwellings.

The Sunshine Coast, which encompasses Noosa and Caloundra, saw a 17.22 per cent drop in new housing approvals to just 2,129 projects.

Qi Chen, CEO and founder of land sales site OpenLot, said professionals were no longer embracing the radically changed lifestyle they did during the pandemic.

Cairns, in the tropical far north of the state, saw a 10.56 per cent drop to 983 new homes.

Even the Gold Coast, a popular city for those escaping Sydney, saw a drop: housing approvals fell 2.09 per cent to 1,122 homes.

Sydney, by far Australia’s most expensive property market, saw demand decline 8.89 per cent to 12,474 new homes, with demand expected to slow in 2024-25.

“The Sydney metropolitan area has a land supply problem because its topography does not allow for a large number of new homes to be built,” Chen said.

‘The market is opting for medium and high density development, so we expect to see a slowdown in new home sales.’

But in regional New South Wales, housing approvals fell 9.33 per cent to 10,037.

The Richmond-Tweed area, which covers Ballina and Byron Bay, was among the worst hit areas in the state, with a dramatic drop of 23.59 per cent, with just 502 new homes approved.

The Shoalhaven region, which encompasses Nowra on the south coast, and the towns of Bowral in the Southern Highlands, had a combined drop of 19.7 per cent, to 583 new housing approvals.

The disparity between city and country was greatest in Western Australia.

Perth, a city that receives a large influx of interstate migration, saw 12,575 housing approvals in the year to June, marking a 24.63 per cent increase.

But in WA’s regional areas, there was a 1.05 per cent decline to 2,449 homes.

Fewer Australians are adopting home working in regional areas, with building approvals plummeting outside capital cities, according to new data (pictured, an Adelaide professional)

Melbourne has been Australia’s weakest state capital market since the pandemic.

But there was still a 2 per cent rise in new home approvals to 24,352, with migration from abroad adding to demand.

However, regional Victoria saw a dramatic 13.09 per cent decline in building approvals to 9,085.

On the Mornington Peninsula, an hour’s drive from Melbourne, approvals fell 20.31 per cent to 675.

In South Australia, new dwelling approvals in Adelaide fell 5.62 per cent to 6,942, but outside the state’s only major population centre there was a decline of 13.2 per cent to 1,999.

OpenLot analysed Australian Bureau of Statistics data on new housing approvals, comparing the 2022-23 period with 2023-24.

The figures mainly cover private homes that need permission from local councils to continue.

Housing approvals are declining in regional areas despite the Cordell Construction Cost Index showing construction costs grew by just 2.6 per cent over the last financial year, marking the smallest annual increase since 2002.

An earlier post-Covid surge in construction costs crippled the construction sector, with construction companies accounting for more than a quarter of all insolvencies in 2023-24.

The Reserve Bank’s 13 interest rate hikes in 2022 and 2023 have been the most dramatic since the late 1980s; in August, the cash rate stood at a 12-year high of 4.35 percent.