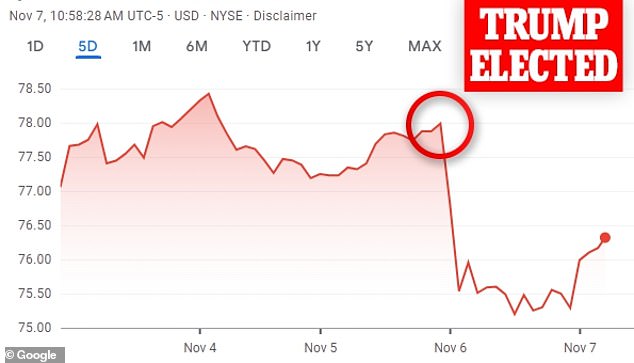

Nike shares sank 3 percent yesterday after Donald Trump’s victory, on fears that his tariffs will cause prices for imported sneakers and sportswear to skyrocket.

While Trump, a self-proclaimed “believer in tariffs,” calls them necessary, experts warn they could backfire for companies like Nike. Tariffs are government taxes on imported goods and generally lead to higher prices in stores unless companies reduce profit margins.

“The tariff proposals represent a serious threat to many businesses and brands,” Global Data’s Neil Saunders told DailyMail.com.

“If enacted at the levels President Trump has talked about, they would cause some financial damage to Nike, which still makes most of its products overseas.”

During his recent campaign, Trump proposed imposing tariffs of 60 percent or more on Chinese imports, stating in a Fox News interview, “We have to do it.”

Nike shares sank 3 percent yesterday following Donald Trump’s victory over Kamala Harris in the 2024 presidential election.

Companies are beginning to fear that prices for Chinese imports will increase after Trump’s victory.

Much of Nike’s products come from China.

The Oregon-based sportswear giant has already faced multiple declines in its stock this year, dealing with weak sales and challenges in the Chinese market.

Saunders added that Trump’s threats could be a negotiating position for the president-elect.

‘Trump has a tactic of making threats as a negotiating position, so there is no guarantee that tariffs will reach such a high level.

“That said, there will likely be some tariffs in some form, and Nike will have to adapt their supply chains or pricing in response.”

This 60 percent tax on Chinese imports, along with a 20 percent global tariff, could also raise average American household costs by $3,000 in 2025, according to an October analysis by the Tax Policy Center.

One of the notable drops in Nike stock this year was its 20 percent price drop on June 28 after the company announced it expected sales to decline.

This drop was the worst day in its 44-year history as a publicly traded company, according to Forbes.

UBS analysts led by Jay Sole wrote to clients that Nike’s “fundamental trends are much worse than we thought” and that “there will not be a quick recovery in Nike’s earnings.”

Nike shares sank more than 6 percent again on Oct. 2 after its third-quarter revenue of $11.59 billion missed analysts’ $11.65 billion revenue estimate.

“A comeback on this scale takes time and while there are some early victories, we still have to turn the corner,” said Nike CFO Matthew Friend. Yahoo Finance last month.

“Nike has actually been warning us since late last year that the sportswear market wasn’t very strong and that its innovation cycle didn’t look particularly good for the start of fiscal 2025 either,” said Morningstar equity analyst David Swartz, to Yahoo Finance.

“Right now, Nike is in a situation where there aren’t a lot of new products coming out and they’re pulling some other products.”

Nike shares rose 10 percent that same month after the company announced that Elliot Hill would replace John Donahoe as CEO on October 14.

In 2024, only 16 percent of Nike’s clothing and 18 percent of its footwear will be made in factories in China.according Oregon live.

Only 16 percent of Nike shoes were made in China this year

Trump proposed at least a 60 percent tariff on Chinese imports

One of Nike’s notable stock declines was its 20 percent price drop on June 28, 2024, the worst day in its 44-year history as a publicly traded company.

Nike shares rose 10 percent in October 2024 after the company announced that Elliot Hill would be its new CEO.

“Nike has reduced its exposure to China in recent years, which is positive as this is one of Trump’s main potential target countries,” Saunders told DailyMail.com.

“All of this is scaring investors, but it’s important to understand that at the moment these are just words and not firm policy proposals.”

If these tariff proposals are approved, this would also affect the prices of products from companies like Columbia Sportswear.

Columbia Sportswear CEO Tim Boyle explained that he expects prices to increase if the rate is raised to Washington Post in October 2024.

“We’re buying things today to deliver next fall,” Boyle said.

‘So we’re going to fix it and just raise the prices. … It’s going to be very, very difficult to keep products affordable for Americans.”