Table of Contents

Of all the tax rise ideas contained in Rachel Reeves’ “running out of options” budget, one stood out for its widespread rejection: charging employers’ national insurance on pension contributions.

The row over taxing workplace contributions to our retirement funds accelerated this week when it emerged that part of such a plan would involve reimbursing public sector pension plans for the extra cost.

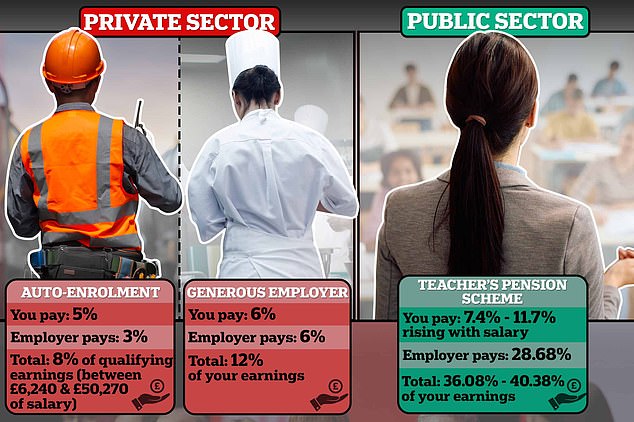

This would leave only private sector employers exposed, their workers’ pensions could be affected and taxpayers would foot the bill to protect more generous public sector plans.

This plan – called “disastrous” by pension campaigner Ros Altmann – has hopefully been shelved, but it raises another important question: how can we avoid a race to the pension bottom?

Public sector defined benefit pension plans are much more generous than their private sector equivalents, but surely the answer is not to sink the former as well, but to raise the quality of the latter.

In this podcast, Georgie Frost, Lee Boyce and Simon Lambert discuss the difference between public and private sector pensions and how we can try to improve our retirement savings rather than reduce them.

Also in this episode, the two sneaky taxes Lee hates, is it worth it for a 39-year-old to get a lifetime Isa before it’s too late, and whether Goldman Sachs or Santander are right with interest rate predictions substantially different, and what does it mean? does it mean for your mortgage?

And finally, where are Britain’s new property hotspots and why have things changed dramatically in some areas?

In private sector defined contribution plans, employers and workers pay the money and invest it to build a fund; in public sector defined contribution plans, contributions are higher, but the employer guarantees an income in retirement; in the Teacher Plan, it is 1/57 of the average career income for each accumulated year.