Table of Contents

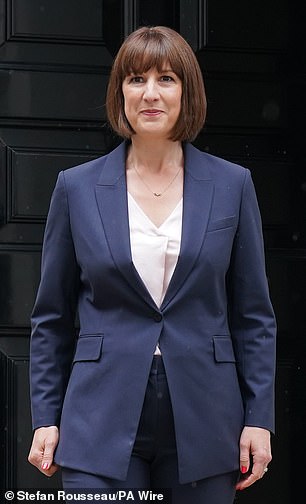

Tax time: Chancellor Rachel Reeves

Private equity firms are bracing for a shake-up ahead of the Autumn Budget as Labour takes aim at takeover barons’ bonuses.

Chancellor Rachel Reeves is expected to announce that executives will have to pay a higher rate of tax on their profits.

Yesterday saw the end of the Labour Party’s consultation on how carried interest – the share of investment returns shared by fund managers – will be taxed.

Sir Keir Starmer has pledged to “close the private equity loophole” which sets out taxing interest at 28 per cent rather than the top income tax band of 45 per cent. This comes as Labour races to fill a so-called £22bn “black hole” in the UK’s finances.

The government has said that raising the tax on carried interest could bring in an extra £565m a year, but City experts have warned that the tax increase could discourage investment in the UK and push private equity executives to move to places like Milan.

A change could have a knock-on effect on banks, law firms and consultants serving the private equity industry in London.

The sector has been lobbying the government on the issue. The ultra-rich Britons have also been spooked by possible increases in capital gains and inheritance taxes in the Budget on 30 October.

Mike Hinchliffe, head of private equity at City law firm Addleshaw Goddard, said: “The risk of talent flight is very real – we are seeing and hearing evidence that UK private equity fund managers are seriously considering other jurisdictions.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.