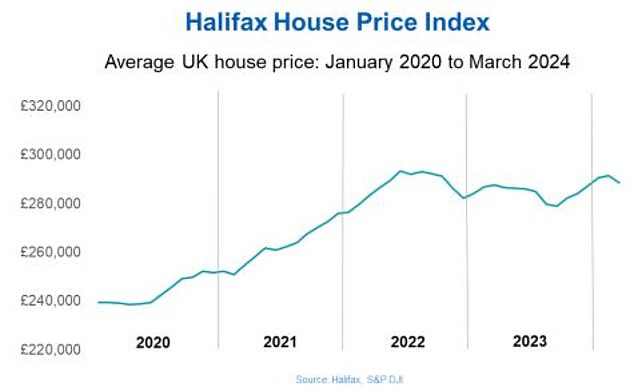

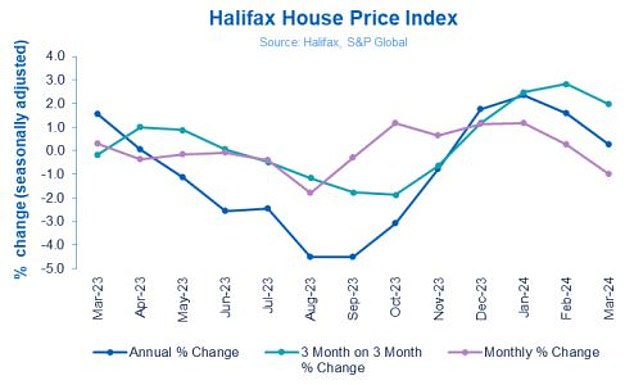

Property prices fell in March, reflecting the first monthly decline since September 2023, according to the latest figures from Halifax.

The major mortgage lender revealed that the average house price fell by 1 percent last month, after five consecutive months of increases.

Halifax says the typical house now costs £288,430, which is around £2,900 less than in February.

The latest decline means that average house prices are effectively flat annually and 0.3 percent higher than this time last year.

March drop: Compared to last month, the price of a property in Britain fell by 1 percent or £2,908 in cash terms, with the average property now costing £288,430, according to Halifax

Halifax’s figures are largely in line with those from Nationwide, which also reported earlier this week that house prices fell slightly in March.

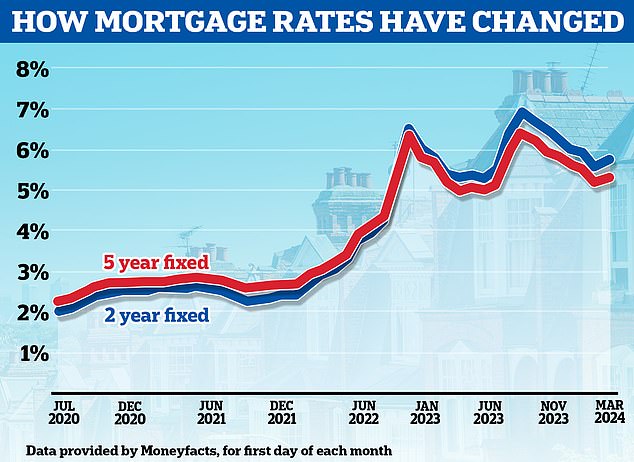

A slight increase in mortgage rates could be the reason the real estate market got off to such a dull start in the spring, experts suggest.

Mortgage rates fell in the five months between September and January this year and house prices rose at the same time.

But since the beginning of February, the average two-year mortgage interest rate has risen from 5.56 percent to 5.8 percent, according to Moneyfacts.

Meanwhile, the average five-year interest rate has risen from 5.18 percent to 5.39 percent.

Kim Kinnaird, director at Halifax Mortgages said: ‘Affordability constraints remain a challenge for potential buyers, while existing homeowners on cheaper fixed-term deals are yet to feel the full impact of higher interest rates.

‘This means the housing market is yet to fully adapt, with sellers likely to price their properties accordingly.

‘Financial markets have also become less optimistic about the extent and timing of key rate cuts, as core inflation proves to be more persistent than widely expected.

“This has halted the decline in mortgage rates that had helped stimulate market activity at the turn of the year.”

Is the worst behind us? Mortgage rates have started to rise again after falling back from the highs they reached in the summer

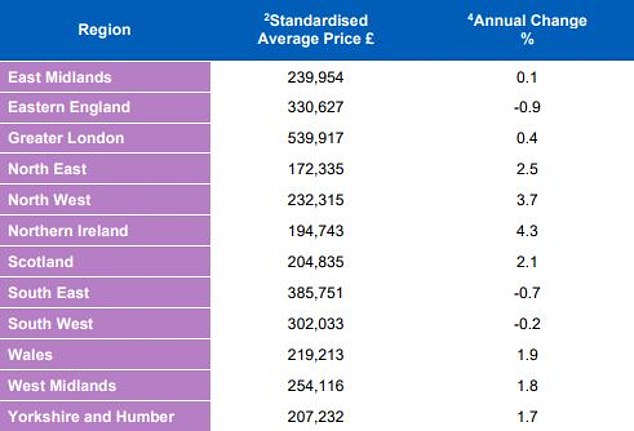

What’s happening across Britain?

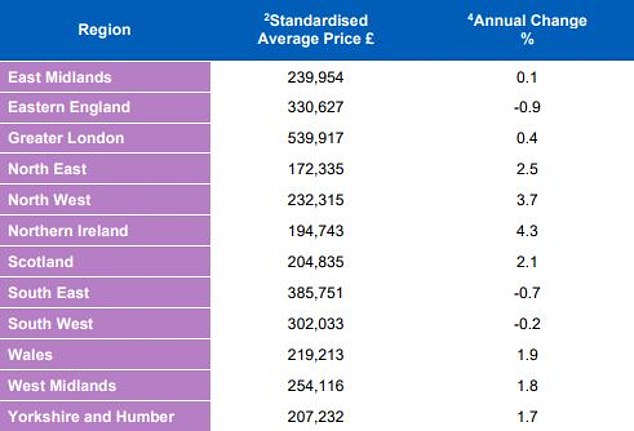

Something of a north-south divide has emerged across Britain, with the northern regions performing the strongest and the southern regions seeing the biggest declines.

In England, house prices in the North West have risen by 3.7 percent year-on-year, while house prices in the East of England have fallen by 0.9 percent year-on-year.

Northern Ireland remains the best-performing region in Britain – with house prices up 4.3 percent year-on-year.

On average, houses in Northern Ireland now cost £194,743, which is £7,972 more than a year ago.

In Wales, annual property price growth slowed to 1.9 percent in March, down from 3.9 percent in February, with the average house now costing £219,213.

Meanwhile, Scottish house prices rose by an average of 2.1 per cent year-on-year to £204,835.

Jonathan Hopper, CEO of Garrington Property Finders, said: ‘All buyers remain very price sensitive and affordability is still a major obstacle for many potential first-time buyers.

‘For them, the figures simply don’t add up yet – even though houses in many parts of the country are cheaper than they were a few years ago, borrowing the money needed to buy them costs much more.

‘That is why we see prices rising fastest in regions where affordability is better.

‘Regional price differences are creating some strong buying opportunities, but across Britain as a whole we are likely to see price growth weaken over the coming months as we wait for mortgage rates to start falling again.’

What next for house prices?

Late last year, Halifax had forecast average prices would fall by 2 to 4 per cent by 2024.

The mortgage lender appears to have changed its tune somewhat in the intervening months.

Kim Kinnaird of Halifax Mortgages added today: ‘Looking at the slightly longer term, prices have not changed much in recent years. They have been trading within a narrow range since spring 2022 and are still almost £50,000 above pre-pandemic levels.

‘Looking ahead, that trend is likely to continue. Underlying demand is positive as more people buy homes, reflected in the recent rise in mortgage applications across the sector and supported by a strong labor market.

‘And with rental costs rising at record rates, home ownership remains an attractive option for those who can afford the sums.

‘However, the housing market remains sensitive to the size and pace of interest rate changes, and with only modest improvements in affordability on the horizon this is likely to limit the scope for significant house price growth this year.’

Average house prices rose 2 percent quarter-on-quarter in March, with annual growth slowing to 0.3 percent from 1.6 percent in February

Real estate analysts and agents in the real estate market seem to broadly agree that house prices are more likely to rise than fall in the future.

Anthony Codling, head of investment bank RBC Capital Markets’ European housing and building materials business, said: ‘Mortgage applications are increasing, wages are rising and in our view mortgage rates are more likely to fall than rise in the coming months, so we are looking ahead. We believe that the glass in the housing market is half full rather than half empty.

Sam Mitchell, CEO of online estate agent Purplebricks, added: ‘In March there was an expected slowdown in the housing market, prompted by a small increase in mortgage rates at the start of the month.

‘We have already seen this trend starting to reverse and expect an improvement in house prices in the coming months.

“In the coal market, we are seeing robust viewing figures and growth in offers that buck the trend of the painful last six months of 2023.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.