Table of Contents

- The Treasury-backed Savings Bank also cut the prize fund rate last month.

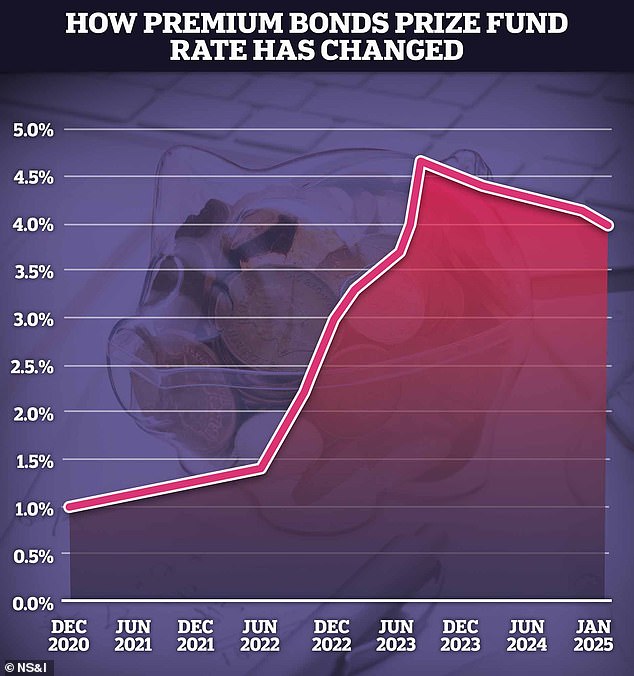

The Premium Bond prize fund rate will be drastically reduced starting with the January 2025 draw, National Savings and Investments announced.

The prize fund rate, which represents the average return a premium bond saver would earn in a year, will be reduced from 4.15 per cent to 4 per cent.

It comes just a month after NS&I announced it would cut the prize fund rate to 4.15 per cent in a blow to savers.

The odds of winning a premium bond prize will remain at 22,000 to 1. They widened from 21,000 to 1 when NS&I announced the prize fund rate would be reduced to 4.15 per cent.

Instead of paying a monthly or annual interest rate, Premium Bond holders have the opportunity to win monthly prizes from £25 to £1 million.

Below: The Premium Bond prize pool has been cut again. It will stand at 4% from January 2025 after having been reduced to 4.15% last month.

What does this mean for Premium Bond prizes?

The number of £1m jackpots will remain the same in January, with two each month.

But there will be fewer top prizes of £100,000 and £50,000.

Overall, there will be more smaller prizes of £25, rising to 1.8 million in the January 2025 draw from 1.5 million in November 2024.

NS&I say there will be 82 prizes of £100,000, seven fewer than the most recent draw, and 166 prizes of £50,000, 11 fewer than the November draw.

NS&I once again said the change in the reward fund rate was in response to “changes in the savings market” as well as the need not to overshoot its net funding target, as set by the Treasury.

In early November, NS&I announced it had raised £3.3bn in the current financial year.

It has a net funding target for 2024/25 of £9bn, with headroom of plus or minus £4bn.

It is a sign of the times for the savings market as a wave of providers acted to reduce savings rates since the Bank of England cut the base rate from 5 per cent to 4.75 per cent.

Laura Suter, personal finance director at AJ Bell, said: “NS&I has joined the troops of other savings providers cutting interest rates, as the savings market cools after a couple of boom years.”

In August 2023, NS&I raised the premium bond prize fund rate to a 24-year high of 4.65 percent from 4 percent, a level not seen since 1999.

But since then it has been falling steadily. Before the December cut to 4.15 percent, the prize fund last cut to 4.4 percent from 4.65 percent in March this year.

NS&I cuts revenue bond rates

As well as cutting the rewards fund, NS&I announced a series of rate cuts on its other savings accounts.

It will cut the rate on its Direct Savings Bonds from 3.75 percent to 3.5 percent starting December 20.

Income bonds will also fall from 3.75 percent to 3.49 percent.

In October, NS&I cut interest rates on direct savings bonds and income bonds for the first time since November 2020.

Direct savings bonds and income bonds were reduced from 4 percent to 3.75 percent.

In November 2020, the rate was just 0.01 percent. Income Bonds have had 11 increases since then.

Anyone with money in easily accessible NS&I accounts should weigh up whether it would be better to switch to a rival to earn some extra interest.

Andrew Westhead, retail director at NS&I, said: ‘We carefully review our savings rates in response to changes in the wider market.

“These adjustments help us meet our net funding target while balancing the interests of our savers, taxpayers and the broader financial services sector.”

Suter said: ‘Rates are now significantly below the highest market rates, meaning savers are paying a decent premium for the security and NS&I brand.

“Anyone with money in easily accessible NS&I accounts should weigh up whether it would be better to switch to a rival to get some extra interest.”

Prizes won through the Premium Bond drawing are tax-free, unlike money saved in a savings account, which is one of the attractions for savers.

All money held in premium bonds is backed by a 100 per cent government guarantee, while money held in regular savings accounts is protected up to £85,000 under the Financial Services Compensation Scheme.

SAVE MONEY, MAKE MONEY

1% refund

1% refund

About debit card expenses. Maximum £15 per month*

Energy bills

Energy bills

Find out if you could save with a fixed rate

free share offer

free share offer

No account fee and free stock trading

4.5% Isa 1 year

4.5% Isa 1 year

Hampshire confident of Hargreaves Lansdown

Sip Rate Offer

Sip Rate Offer

Get six months free on a Sipp

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence. *Chase: Refund available during the first year. Exceptions apply. Over 18 years of age, resident in the United Kingdom.