- The 32-year-old Muslim convert was initially given a more lenient prison sentence of 10 years.

- The court said Wednesday it had rejected his appeal as “manifestly unfounded.”

<!–

<!–

<!– <!–

<!–

<!–

<!–

A German federal court said Wednesday it had rejected a woman’s appeal against her 14-year prison sentence for letting a 5-year-old Yazidi girl die of thirst that she and her husband had enslaved when they were members of the Islamic State group in Iraq. sun.

The accused, a German convert to Islam, was convicted in October 2021 of, among other things, two counts of crimes against humanity by enslavement – one case resulting in death – and membership in a terrorist organization abroad.

She was initially sentenced to 10 years in prison, which was overturned by the Federal Court of Justice on the grounds that the judges had erred in convicting the accused for a “less serious case” of crimes against humanity and had neglected the aggravating circumstances.

A new sentencing hearing for the woman, identified only as Jennifer W. under German privacy rules, ended in August with a 14-year prison sentence.

The court said Wednesday it had rejected his appeal as “manifestly unfounded.” The press release on the decision does not specify on what grounds she appealed.

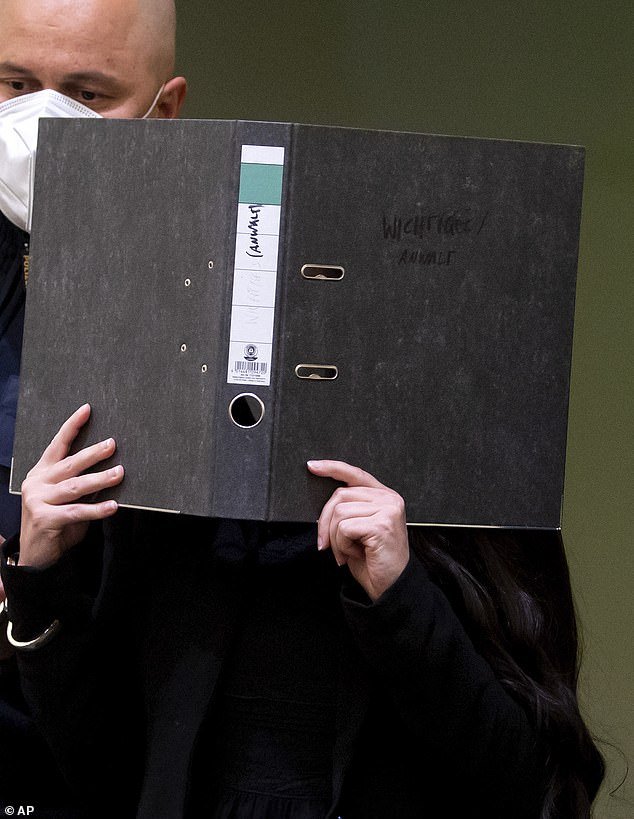

The defendant, ashamed to show her face, hid behind her legal file in court in 2021

She was convicted in October 2021 of, among other things, two counts of crimes against humanity by enslavement and one count resulting in death in connection with ISIS.

The girl died in Fallujah, Iraq, in August 2015. During the initial trial, the court found that the accused did nothing to help the girl – who had been chained by her husband in their yard – even if it would have been ‘possible and reasonable’. The couple also enslaved the girl’s mother.

Jennifer W., now 32, was arrested while trying to renew her identity papers at the German embassy in Ankara in 2016 and deported to Germany.

Her former husband, an Iraqi citizen identified only as Taha Al-J., was convicted by a Frankfurt court in November 2021 of genocide, crimes against humanity, war crimes and assault and battery. leading to death.

He was sentenced to life imprisonment.