Table of Contents

Manufacturers like Ford, GM and Toyota are failing to meet electric vehicle buyers’ expectations in four key areas, new research reveals.

Buyers want lower prices, longer ranges, electric SUVs and cars instead of the pickup trucks manufacturers have focused on, and more electric vehicles from trusted brands like Toyota, according to a survey from Edmunds.

This disconnect, which we examine in detail below, is blamed for declining sales and the buildup of vehicles on lots.

The report is another blow to Joe Biden’s attempt to phase out gas-powered cars, and also to the eight states seeking to ban them entirely.

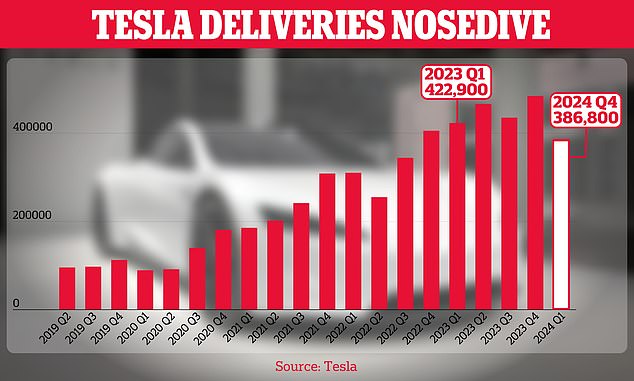

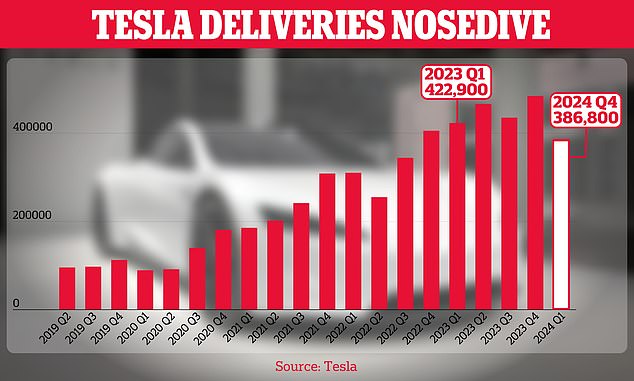

Tesla shares plunged on Tuesday after the company reported its first year-over-year sales decline since 2020. The 386,810 delivered in the first three months of the year were nearly 9 percent less than the same period in 2023.

Tesla sales plunged 7 percent after the electric vehicle maker reported its first drop in deliveries since the pandemic. In the photo: CEO Elon Musk

Supply chain disruptions, anxiety over vehicle range and frustrations around charging infrastructure have hampered widespread adoption of electric vehicles in recent years.

Deliveries were significantly lower than Wall Street projected, as Tesla faced increased competition in China and lower demand for electric vehicles in the US.

But there’s also a big gap between what car buyers want and what’s actually on offer, Edmunds found.

Sales of electric vehicles grew in 2023 to represent a 6.9 percent share of new vehicles, up from 5.2 percent in 2022.

But Edmunds predicts this growth rate will slow until 2024, with electric cars accounting for just 8 percent of the market share.

“The electric vehicle market is growing, but consumers have enough reservations about current options and charging infrastructure challenges to limit more significant growth in the near term,” said Jessica Caldwell, head of analytics at Edmunds.

These are the biggest differences in consumer expectations compared to market realities.

1. EV buyers want prices well below current EV costs

Edmunds found that 47 percent of buyers said they were looking for an electric vehicle cheaper than $40,000, while 22 percent said they were interested in purchasing an electric car priced under $30,000.

But there are currently no new electric vehicles on sale with an average suggested retail price below the $30,000 threshold, Edmunds found, and only four below the $40,000 mark.

Last year, the average price of an electric vehicle was $61,702, while that of all other vehicles was $47,450.

The electric truck market appears inflated, according to Edmunds (Pictured: Ford F-150 Lightning Pro)

2. EV buyers want cars and SUVs, not electric trucks

Among respondents who already own a vehicle, truck drivers are the least likely to consider purchasing an electric vehicle, according to the survey, and 39 percent said they would not consider switching to an electric vehicle.

While among those who would consider purchasing an electric vehicle, 43 percent would be interested in purchasing a car, 42 percent would consider an SUV or crossover and only 10 percent would opt for a truck.

In reality, according to Edmunds, the electric truck market appears inflated.

He cited the Rivian R1T, Ford F-150 Lightning, GMC Hummer EV, Tesla Cybertruck and the possibility of the Chevrolet Silverado EV, GMC Sierra EV and Ram 1500 Rev arriving in the not-too-distant future.

“Not surprisingly, Detroit automakers acted quickly to protect their core profitable products from the threat of EV startups, but at least for now it appears this fear was unwarranted as EV pickup trucks remain largely niche products with a limited consumer base,” Edmunds said.

Tesla remains most trusted EV maker in U.S., Edmunds survey finds

3. Favorite brands do not offer electric vehicles in volume

The survey found that Tesla remains the most trusted electric vehicle manufacturer in the U.S., but Toyota and Honda ranked third and fourth among brands drivers would trust to make the best electric vehicle.

However, Toyota has only one electric vehicle in the US market, while Honda began selling its first purely electric car last month.

“As these automakers ride the wave of success with their hybrid products, they have earned a reputation for quality over decades, instilling consumer confidence in new technologies,” Edmunds said.

On the other hand, brands like Hyundai and Kia are not receiving the same kind of recognition from consumers for their electric vehicle offerings.

Nearly a quarter of respondents said they would be happy with a range of 100 miles or less.

4. Variety expectations are met, but buyers just don’t know it

When asked what the desired range would be for an electric vehicle they would consider purchasing, 46 percent of consumers said they were comfortable with 200 miles or less. About 24 percent said they were comfortable with 99 miles or less.

In reality, 200 miles is a goal that is easily achieved by the vast majority of electric vehicle models on the market today, Edmunds said.

The fact that nearly a quarter of respondents indicated they would be comfortable with a range of less than 100 miles indicates a knowledge gap about realistic range expectations, Edmunds said.