Kanye West deleted his social media accounts amid backlash to his plans to launch a Yeezy Porn studio.

The rapper, 46, who previously revealed he had a porn addiction that “destroyed his family,” deleted his accounts shortly after teasing that his studio would be arriving soon with a lewd post.

The Grammy-winning artist, whose career has foundered amid a torrent of anti-Semitic comments he has made since the fall of 2022, received dozens of responses from fans who were disappointed by his foray into adult entertainment.

Several fans brought up West’s previous spiritually driven projects, including his 2019 album Jesus Is King and his Sunday Services, in comparison to the porn project.

‘I thought you gave your life to Christ, what happened man? Did you remove it or what? said one fan.

Kanye West deleted his social media accounts amid backlash to his plans to launch a Yeezy Porn studio.

The rapper, 46, who previously revealed he had a porn addiction that “destroyed his family,” deleted his accounts shortly after teasing that his studio would be arriving soon with a lewd post.

Another said: “Return to Christ, this is not all,” while another advised: “Find God.”

One user told the rapper, “You sold your soul to the devil,” while another asked, “Weren’t you selling Jesus albums a year ago?”

A fan shared a clip of Natalie Portman as Padmé Amidala opposite Hayden Christensen’s Anakin Skywalker.

“JIK Ye Fans watch this,” the fan said with a broken heart emoji, referring to the 2019 album.

Several users threw West’s previous comments about porn back in the face, sharing the anti-porn sentiments he expressed on his Twitter in December 2022, according to news week.

One said: “Pornography use destroyed my family, but Jesus will heal everything.”

Another said: ‘Remove any and all forms of pornography from Twitter and all platforms.’ Pornography is a product of [pedophilia]. When adult men watch pornography, they are watching someone’s daughter relive trauma for money.

One user posted the old tweets and added, in reference to the turn to pornography: “We just got your files back.”

One user said West was being poorly advised regarding the possible pivot to adult entertainment.

More recently, however, he is believed to have been behind his wife Bianca Censori’s stunning outfits that leave her private parts exposed to view.

Now a rep for Kanye has reported TMZ that the rap star hopes to add an adult entertainment arm to his Yeezy empire, possibly this summer.

He is said to be reaching out to adult film producer Mike Moz, who was previously married to Stormy Daniels, in hopes of having Mike run his studio.

The Grammy-winning artist, whose career has foundered amid a torrent of anti-Semitic comments he has made since the fall of 2022, received dozens of responses from fans who were disappointed by his foray into adult entertainment, seen last month. spent in Los Angeles.

He is said to be reaching out to adult film producer Mike Moz, who was previously married to Stormy Daniels (pictured in 2018), in hopes of having Mike run his studio.

Mike’s history in porn dates back to at least 2007, when he was art director on Operation: Desert Stormy, whose star he married that year; he and Stormy photographed in 2007

Mike and Stormy are pictured in 2008, a year after they got married.

Kanye is pictured with his wife Bianca Censori attending Milan Fashion Week this February.

Mike’s history in porn dates back to at least 2007, when he was art director on Operation: Desert Stormy, whose star Stormy Daniels married that year.

Although Kanye has reportedly been considering entering the porn industry for some time, he is now said to be in serious negotiations to start a studio.

Kanye described himself as a porn addict in 2019 and said his fixation with adult entertainment began when he was just five years old.

‘For me, Playboy was my gateway to pornography addiction. My father was left with a Playboy when he was five years old and that affected almost every decision I made for the rest of my life,” he told Zane Lowe on the Apple Music show. Radio Beats 1.

“From the age of five until now, I have to kick the habit and it’s just openly presented as if it’s okay and I stand up and say, ‘No, it’s not okay.'”

Three years later, during a bitter dispute with his ex-wife Kim Kardashian over their children’s schooling, he claimed that pornography had “destroyed” their family.

The former couple have two daughters, North, 10, and Chicago, six, as well as two sons, Saint, eight, and Psalm, four.

Kim married Kanye in 2014 and filed for divorce in February 2021 after months of speculation that their marriage was on the brink of collapse.

In 2022, during a bitter dispute with his ex-wife Kim Kardashian over their children’s schooling, he claimed that pornography had “destroyed” his family; he is photographed that October

Kanye, who is pictured with Kim in 2016 during their marriage, confessed in 2019 that he had suffered a ‘full-blown porn addiction’ brought on by watching Playboy at the age of five.

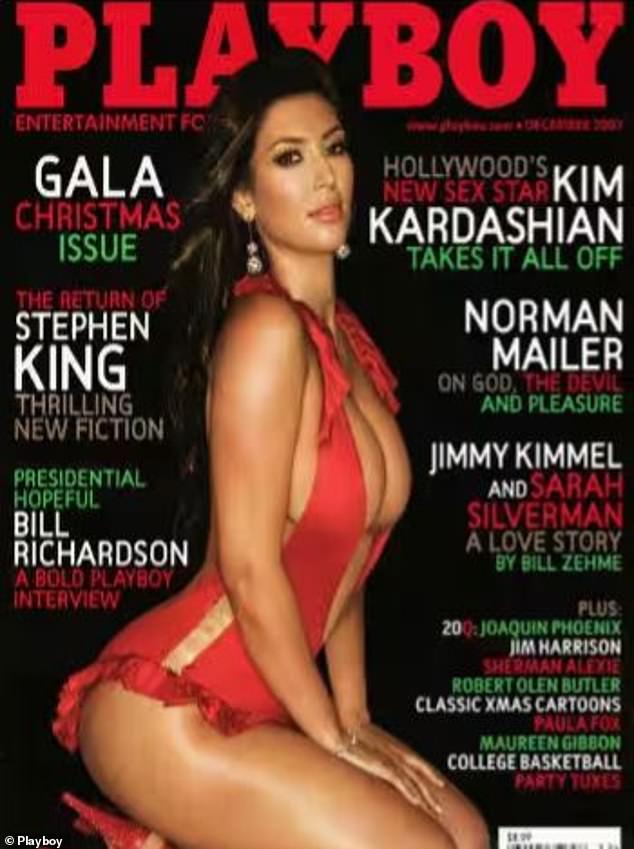

Kanye urged Kylie Jenner’s former assistant Victoria Villarroel: ‘Don’t let Kris force you to be a playboy like she made Kyle and Kim do’; Kim appeared on the cover of Playboy in 2007.

Kylie appears on the cover of Playboy’s Fall 2019 Pleasure Issue.

The following year, Kanye claimed to have an ‘addiction’ to pornography while calling out his former mother-in-law Kris Jenner, in a furious Instagram caption directed at Kylie Jenner’s former assistant Victoria Villarroel.

“Don’t let Kris force you to be a playboy like she made Kyle and Kim do,” he urged Victoria: “Hollywood is a giant brothel. Pornography destroyed my family. I deal with the addiction that Instagram promotes. I will not allow What happens to Northy and Chicago.” .’

Kim starred in a Playboy photo shoot in 2007, while her younger half-sister Kylie covered the magazine’s Pleasure issue more than a decade later in 2019.

In October 2022, Kanye’s career imploded after he launched a series of anti-Semitic rants, including vowing to do a ‘death with 3 against the JEWS’.

Shortly after, Kanye faced accusations that he had presided over a “sexualized” work environment rife with pornography at Yeezy.

He was accused of showing his employees photographs and images of Kim naked in an alleged attempt to intimidate them, in an exposé published by Rolling Stone.