<!–

<!–

<!–

<!–

<!–

<!–

Shark Tank star Kevin O’Leary has downplayed Biden’s proposed raid on the super-rich, saying it will “never happen.”

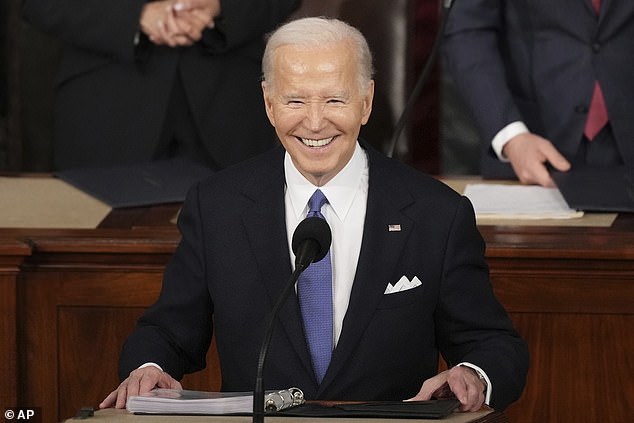

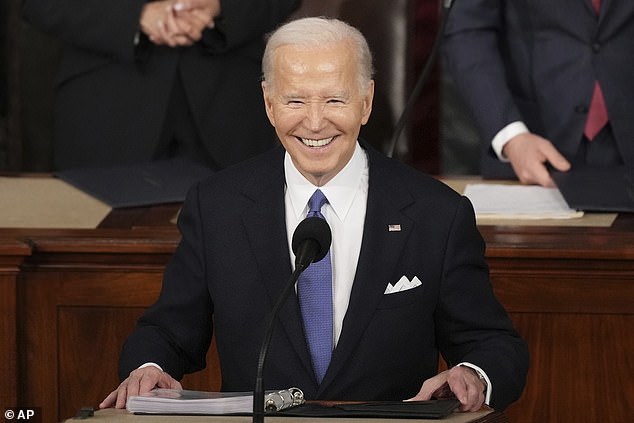

The President used his State of the Union address Thursday night to announce a sweeping series of measures targeting large corporations and Americans worth more than $100 million.

But O’Leary said the proposal was simply a “campaign speech” and “great material” that will “fade away in 48 hours.” He added that the biggest obstacle to the president’s re-election was inflation, something his speech did little to address.

The 69-year-old businessman also expressed concern that overtaxing billionaires would cause them to leave the country.

Shark Tank star Kevin O’Leary has criticized Biden’s proposed raid on the super rich, claiming it will “never happen”

Speaking exclusively to DailyMail.com, he said: “None of this will ever become law, and everyone knows it.” But it’s great campaign rhetoric. There wasn’t much in terms of substance.

‘I’m not being critical, I’m just saying he did the right thing: he rallied the troops by raising issues like ‘tax the rich!’ That worked for him last time.

‘It will fade away in 48 hours and we’ll be back to where we were. It does not move the needle in any direction.

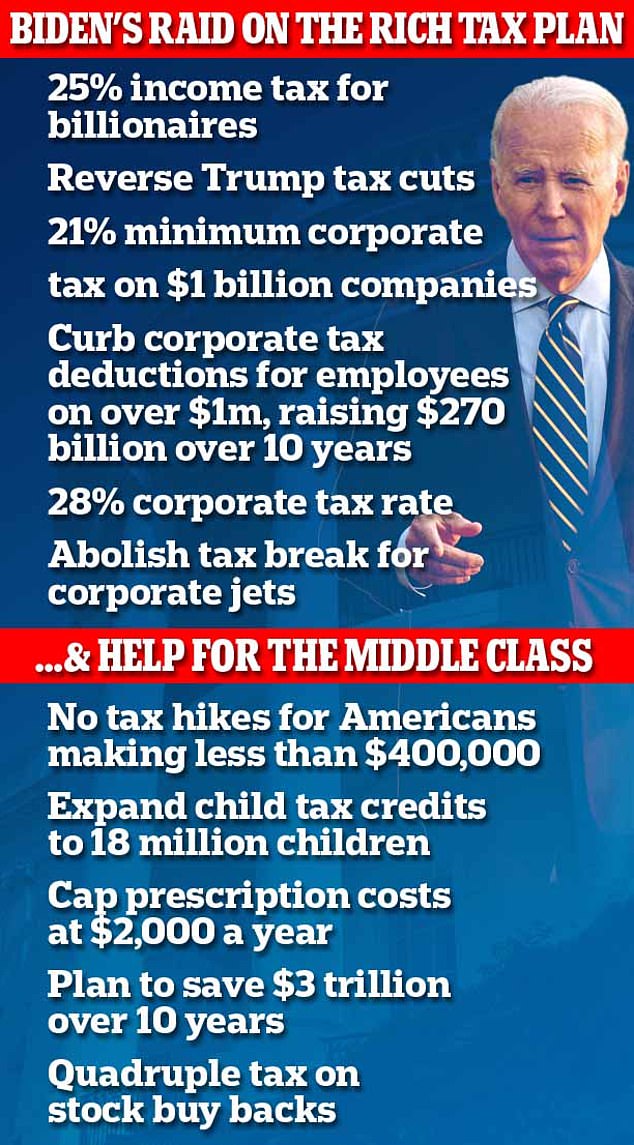

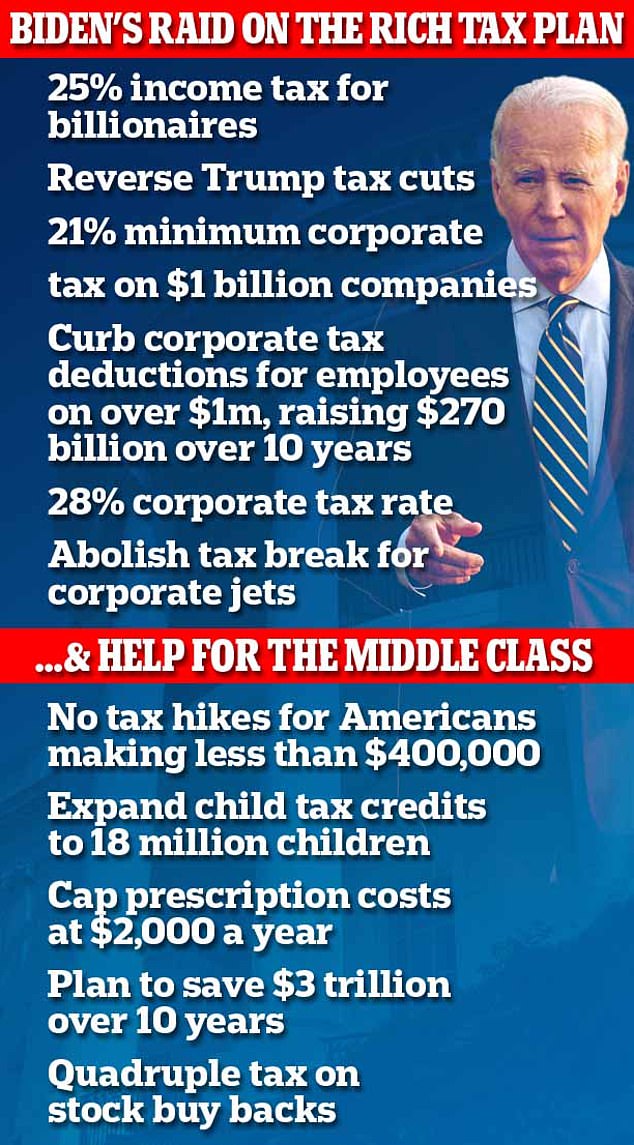

President Biden turned heads last night when he promised to reduce the federal deficit by $3 trillion through a series of relentless fiscal appropriations.

The biggest headline was raising the corporate tax rate to 28 percent and the minimum corporate rate to 21 percent, six percentage points higher than its current 15 percent.

On top of that, the White House is proposing a new 25 percent minimum tax on Americans with more than $100 million.

President Biden raised eyebrows last night when he promised to reduce the federal deficit by $3 trillion through a series of relentless fiscal appropriations.

But O’Leary, who has an estimated net worth of $400 million, warned: “The problem with estate taxes is that they’ve already been tried.” They have been tried in Britain and France and they don’t work. People just leave.

‘Now these people pay 46 percent of taxes, so you have to be careful. You don’t want them to leave the country.

‘We have already seen some interesting measures by states that have tried to implement these types of wealth taxes. Bezos left Seattle and went to Florida, for example.’

I was quoting a report of the National Taxpayers Union which found that the top one percent of earners in the United States paid 46 percent of all income taxes.

Other proposals outlined by the White House included reviving an expansion of the Covid-era child tax credit.

The measure increased benefits from $2,000 to $3,600 for children under six years old and $3,000 for children under 18 years old.

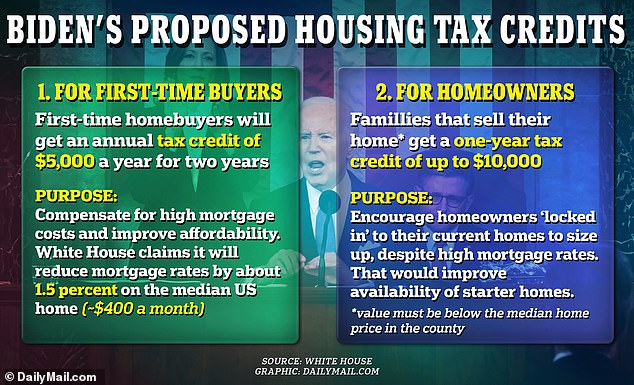

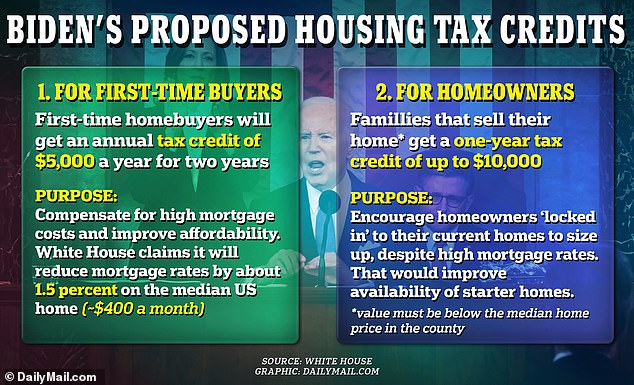

At the center of the housing initiatives were two tax credits. The first would help mitigate the current cost of a mortgage, the other would aim to increase the supply of housing.

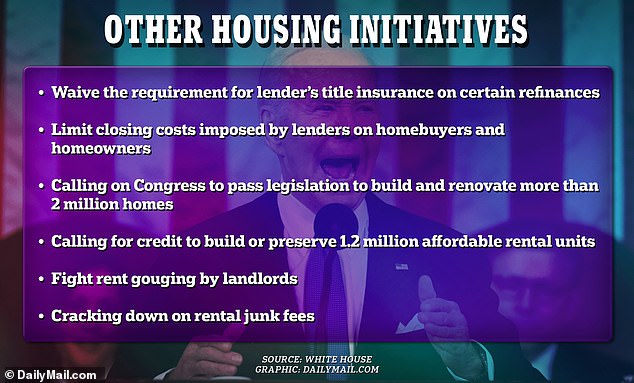

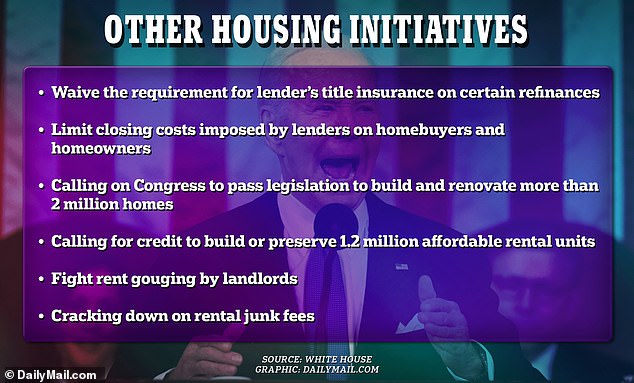

Biden also discussed reducing the cost of refinancing a mortgage by eliminating lender title insurance on some refinances.

And the announcement also included a plan to offer $10,000 tax credits to first-time buyers and homeowners who sell their properties for less than the median home price in their county.

However, it was short on details and did not outline key criteria that buyers would need to meet.

O’Leary warned that such measures did little to alleviate concerns about inflation, which is at the forefront of voters’ minds.

He said: ‘Inflation is always the enemy of the ruler. It doesn’t matter who you are in the White House when there is inflation. People go to the voting booth remembering what it cost them to get cornflakes and milk in the morning, and what it cost them to fill up the tank of their car to get there.

“And they vote against it.”