<!–

<!–

<!– <!–

<!–

<!–

<!–

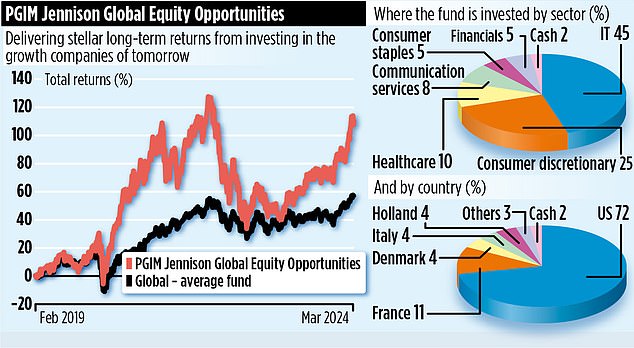

The modus operandi behind the PGIM Jennison Global Equity Opportunities investment fund is to identify companies that are likely to dominate the business world in the next decade and then invest in them in a big way.

It is a bold investment strategy, based on growth and not free of risks, especially in the short term.

But it is a fairly compelling investment proposition given its emphasis on interesting themes such as the rise of artificial technology (AI); new pharmacological developments; the demand for luxury goods (especially in Asia); and the digitalization of financial services in Latin America.

“We try to spot unique business models that will generate strong earnings growth in the future,” says Mark Baribeau, who manages the £580m fund from Jennison’s offices in New York and Boston; Jennison Associates is one of several investment companies he owns. by PGIM.

‘Invariably, companies have identifiable competitive advantages that allow them to maintain their position in the market. And they can make huge profit margins.”

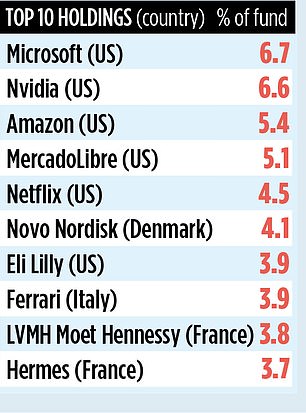

The result is a portfolio comprising just 36 stocks, most of which are listed in the United States, but all of which have a global reach.

Many are household names, including AI specialist Nvidia, Microsoft and Amazon, the fund’s three largest holdings. All of them are members of the “magnificent seven” club: technology-based companies that have been mainly responsible for the good performance of the stock market in the United States.

The fund’s performance figures are good, although they also highlight how volatile some of the share prices it holds can be. Over the past year, it posted a return of 35 percent, but over the previous two discrete one-year periods, the fund has incurred losses of 5.5 percent (year to March 2023) and 15.7 percent (year until March 2022). .

“Yes, the prices of many of the growth stocks we were holding in 2022 were affected by rising interest rates and the economic downturn,” Baribeau says. “But its recovery began in 2023 and looks set to continue well into this year.”

Although the fund has more than 70 percent of its assets in the United States, Baribeau says it is not a deliberate policy.

“We don’t take a top-down view of markets,” he says. ‘We take advantage of investment opportunities wherever they arise. It is a coincidence that the majority are in the United States.

An important underlying issue outside the United States is the continued global demand for luxury goods, especially from the burgeoning middle classes in some of the Southeast Asian economies.

“Companies like LVMH, Hermes and Ferrari, all based in Europe, are phenomenal companies,” says Baribeau. “They can’t be replicated, which makes them attractive from an investment point of view.”

He is also enthusiastic about the digitalization of financial services in Latin America: one of the top ten fund holding companies is the Argentine company MercadoLibre, which is listed in the United States. The manager says a concentrated portfolio (built around the best companies) is the only way to deliver stellar returns to investors.

The fund’s five-year performance figures prove his point. Its overall return of 117 percent compares with the 61 percent gain posted by the average global fund.

The fund’s annual charges are reasonable at 0.83 per cent and the fund can be purchased on most major investment platforms.