The first patient to receive an organ transplant from a genetically modified pig has been discharged from hospital and doctors say he is “recovering well.”

Richard Slayman, 62, of Boston, was living with end-stage kidney disease when he received a pig kidney in what experts say will herald a new era in organ transplantation.

Two previous pig heart transplants failed, but Slayman returns home just two weeks after his groundbreaking procedure with “one of the best health outcomes I’ve had in a long time.”

Doctors at Massachusetts General Hospital said the new kidney It performs all of its crucial functions: producing urine, removing waste products from the blood, and balancing body fluids.

There are more than 100,000 patients on the waiting list for a new kidney in the United States, and most face delays of at least three years.

Richard Slayman, 62, is the first patient to survive after an organ transplant from an animal. Two previous heart recipients died

Slayman, who had surgery on March 16, said he is in “the best health I’ve been in a long time.”

Mr. murderer saying: ‘This moment, leaving the hospital today with one of the best health outcomes I have had in a long time, is one I have wanted to come for many years.

“Now it is a reality and one of the happiest moments of my life.”

He said his care was “exceptional” and thanked his medical team.

The ‘milestone’ four hour procedure It took place on March 16.

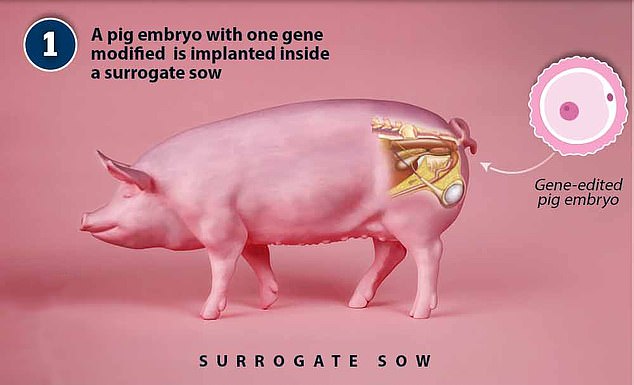

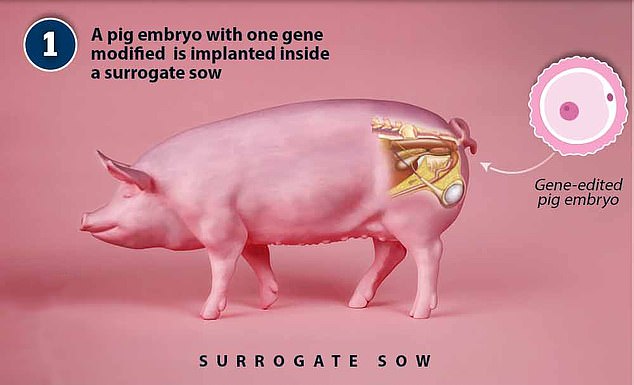

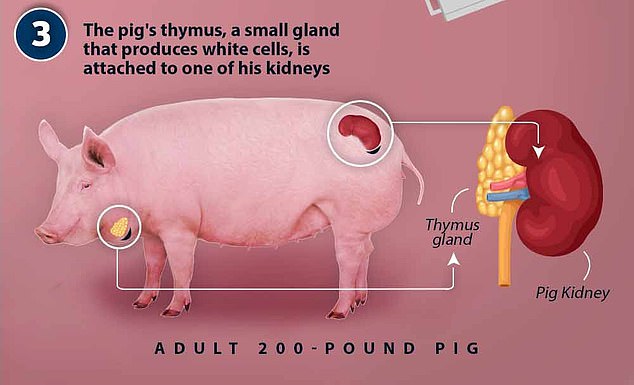

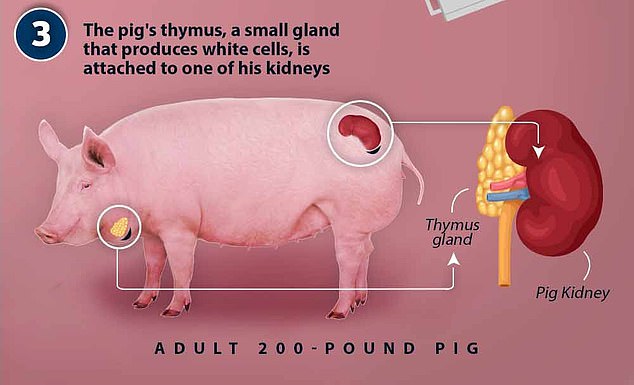

Mass Gen doctors had genetically altered a pig using 69 DNA modifications to prepare it for transplant.

Those modifications would protect against a virus that infects pigs, in addition to removing porcine genes and adding human genes to make the organ compatible with humans.

Mr. Slayman said, “I have been a patient at Mass General Transplant Center for 11 years and have the highest level of confidence in the doctors, nurses and clinical staff who have cared for me.”

“I saw it not only as a way to help myself, but also as a way to provide hope to the thousands of people who need a transplant to survive.”

Slayman had been on dialysis for seven years before the transplant.

He had previously received a kidney transplant from a deceased human donor in December 2018, performed at MGH, but it failed five years later and Mr. Slayman resumed dialysis in May 2023.

Each year, approximately 5,000 people on the kidney waiting list die before receiving the organ, while one in ten patients on the liver waiting list die before their transplant.

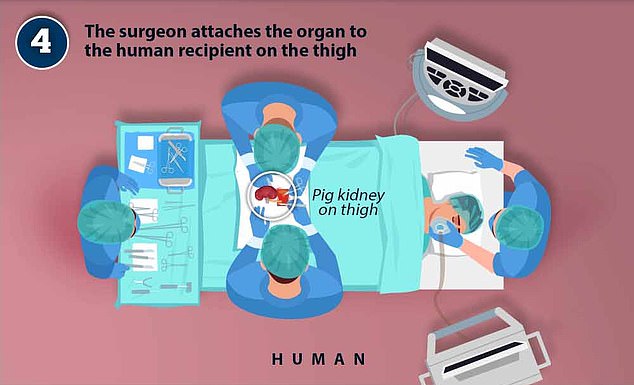

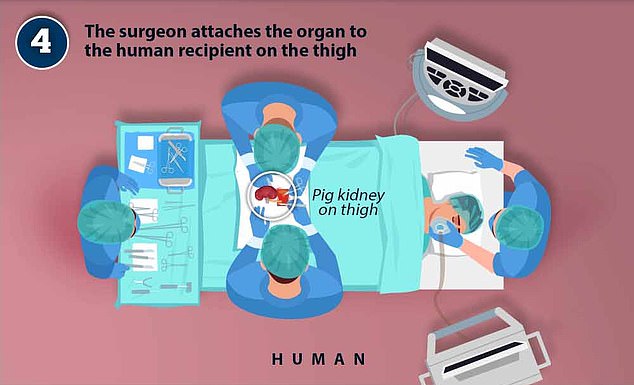

Doctors make an incision in the thigh and, using instruments, can make a tunnel to the area where the kidney is located.

Dr Winefred Williams, one of Mr Slayman’s doctors, said: “The continued success of this innovative kidney transplant represents a true milestone in the field of transplantation.

“An abundant supply of organs resulting from this technological advancement can go a long way toward ultimately achieving health equity and providing the best solution to kidney failure—a well-functioning kidney—to all patients who need it.”

Meanwhile, Dr Leonardo Riello, who led the transplant team, said: “Seventy years after the first kidney transplant and six decades after the advent of immunosuppressive drugs, we are on the verge of a monumental advance in the field of transplants”.

‘At MGH alone there are more than 1,400 patients on the waiting list for a kidney transplant. Unfortunately, some of these patients will die or become too sick to be transplanted due to the long wait time on dialysis. I am firmly convinced that xenotransplants represent a promising solution to the organ shortage crisis.’

The two previous surgeries in which pig hearts were transplanted into humans failed after their bodies began rejecting the organs.

The field of xenotransplants, or transplants from an animal, is an exciting new development in the field of organ transplants.

Mike Curtis, chief executive of the company that provided the pig, eGenesis, said: “This represents a new frontier in medicine and demonstrates the potential of genomic engineering to change the lives of millions of patients around the world suffering from kidney failure. “.

With immunosuppressive drugs, doctors at MGH showed that it is possible. Every day about 17 people die while languishing on the transplant waiting list.

All U.S. transplants of animal organs into living humans have been approved by the FDA on the grounds of “compassionate use,” that is, in cases where the person’s life is at risk and no comparable treatments exist.

But until now, no clinical studies have been carried out in humans to verify its effectiveness.