Peloton CEO Barry McCarthy will resign, the company said Thursday, announcing a 15 percent cut to its global workforce.

The company’s shares, hit by falling demand for its expensive home fitness products after a pandemic boom, rose 14 percent. Investors hope a new boss can turn his fortunes around.

Millions of Americans bought Peloton for $1,500 enclosed fitness bikes – make actions will rise to $170 and give the company a value of $45 billion.

But this morning the stock was at $3.22, even after a rally when the news broke, making the company once likely to kill off gyms valued at just $1.18 billion.

McCarthy, a former Netflix and Spotify executive, took the helm in 2022 from founder John Foley and has taken several steps to cut costs. The company is looking for a replacement.

The announcement of his departure comes as the company reveals it will cut its global workforce by 15 percent, or 400 employees.

It’s unclear whether it will affect any of Peloton’s instructors, some of whom, like Jess Sims, have a large following.

Barry McCarthy (left), former Netflix and Spotify executive, will step down as CEO of Peloton

Peloton has millions of fans, who tune in to classes from instructors like Jess Sims, but its shares are now at their lowest level ever as bosses admitted sales of cycling equipment are slow.

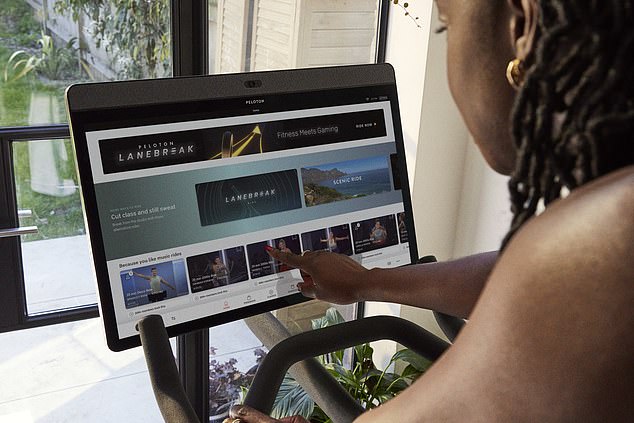

McCarthy also led Peloton’s rebranding into a software-focused company, leaning on its exclusive content to drive subscriber growth and offset lower equipment sales.

The news leaves Peloton’s legion of fans wondering if high-octane online classes will continue or if their bikes will end up as expensive hangers.

Peloton President Karen Boone and Director Chris Bruzzo will serve as interim co-CEOs. Additionally, the company appointed director Jay Hoag as chairman of the board.

The board has begun a search process to identify the next CEO. The future of the company will be clearer from then on.

“Peloton has found that fitness trends come and go, and staying ahead of the curve is incredibly difficult,” said Zak Stambor, senior retail and e-commerce analyst at research firm Insider Intelligence.

Peloton said it now also intends to reduce its retail presence, which could force it to again delay its goal of returning to positive cash flow.

“This restructuring will position Peloton for sustained positive free cash flow, while allowing the company to continue investing in software, hardware and content innovation, improvements to its member support experience, and optimizations of marketing efforts. to scale the business,” the company said. saying.

The announcement comes as the company reveals it will reduce its global workforce by 15 percent.

Millions of Americans bought $1,500 Peloton fitness bikes during the pandemic, but demand has since declined

It has also taken several cost-cutting measures, such as changing bike prices, offering its products through third-party retailers, focusing on digital subscription plans, and cutting jobs in an effort to return to profitability.

Still, demand for its equipment has remained weak as customers, tired of inflation, cut spending due to high inflation and rising borrowing costs.

Peloton said Thursday that it expects year-round connected fitness members to be between 2.96 million and 2.98 million members, down 30,000 from a previous forecast.

Peloton has not made a profit since December 2020.