Kansas City Chiefs players have joined calls for gun control reform after the team’s Super Bowl victory parade turned into a tragedy with a fatal mass shooting on Wednesday.

What was supposed to be a purely joyful day for many, celebrating the Chiefs’ second consecutive NFL championship, ended with one dead and about two dozen injured in the shooting.

Justin Reid and Charles Omenihu took to social media to call for reform after the city they represented was deeply affected by the shooting.

Three suspects are detained after the incident.

While many players across the NFL offered their thoughts and prayers to Kansas City following the incident, Omenihu and Reid went a step further.

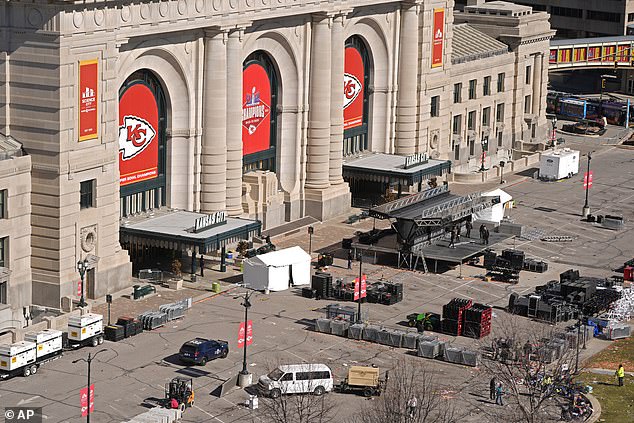

Kansas City’s Union Station was the site of the mass shooting after the championship parade.

The Chiefs were supposed to be celebrating the first NFL championship repeat in 20 years.

“Prayers for those affected in today’s parade,” Omenihu said. ‘A moment of celebration ends in tragedy. When are we going to fix these gun laws?

‘How many more people have to die to say enough is enough? “It is too easy for the wrong people to obtain guns in the United States and that is a FACT,” Omenihu added.

‘This is a SAD man!’ Reid posted on X. ‘Kids are being shot and someone didn’t come home tonight. We cannot allow this to be normal. We can’t remain numb and chalk it up to “just another shooting in America” and reduce people to statistics and then move on (tomorrow).’

‘This is a serious problem!! I pray that our leaders enact real solutions so that our children’s children do not know this violence,’ Reid concluded.

Chiefs star Trey Smith said Thursday that he and his teammates hid in a closet with civilians attending their teams’ championship parade.

Star Trey Smith spoke out about the horror of Wednesday’s shooting that left one dead and 21 injured at the Super Bowl victory parade, revealing that he and his teammates hid with civilians in a closet.

“Right before I ran in, there was a little kid in front of me, so I just grabbed him and pulled him, ‘You’re going to jump with me, buddy,'” Smith said. “I don’t know how many people were in the closet, maybe more than 20?”

Smith credited long snapper James Winchester for helping everyone stay calm in the locker. “One of my teammates, my long snapper James Winchester, was instrumental in helping me stay calm,” Smith continued. ‘We ended up getting the green light to get out of there. We ended up walking to the buses.

Chiefs fans panicked after the shooting at the end of the championship parade.

Reid had posted a longer statement on social media about the situation on Thursday.

“In the wake of the tragic events that unfolded during the Chiefs’ victory parade, our hearts ache for everyone affected by the senseless violence,” Reid wrote. ‘Our deepest condolences go out to the families and friends of the victims, and our thoughts are with the entire community as we come together to heal.

‘As a member of the Chiefs organization and leader of JReid InDeed, I feel a deep sense of responsibility toward our community, especially our youngest members. Our children, who should feel safe and secure, have been affected by events in ways that are difficult to understand. “It is our duty to ensure they receive the support and care they need during this difficult time.”

‘In times of darkness, it is the strength and resilience of our community that shines brightest. Together we will overcome this tragedy and emerge stronger than ever. Let us lean on each other for support, comfort and hope as we navigate the difficult days ahead.”

Thank you for your unwavering support and for standing together as one community.”