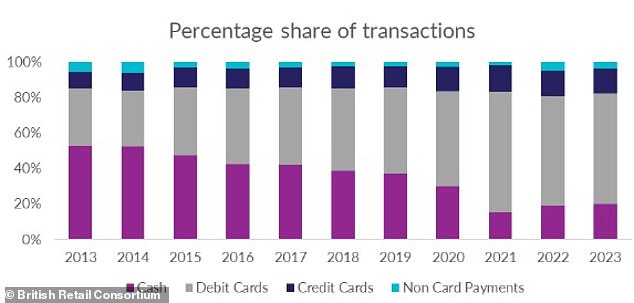

Cash accounted for almost one in five retail transactions last year, according to data from the British Retail Consortium.

After a decade of decline, cash usage increased for the second year in a row in 2023, accounting for 19.9 percent of transactions, up from 18.8 percent in 2022.

As banks and building societies continue to fixate on the digital push, a growing number of people are turning to notes and coins to help them stick to a budget and track their spending, data suggests.

It should be noted that the increase in cash usage may also have been partially related to the lifting of Covid-19 restrictions, and is also much lower than a decade ago.

Last week the Treasury Committee heard from charities working with vulnerable groups and organizations promoting financial inclusion, as part of an inquiry into the physical acceptance of cash.

The committee is exploring the barriers some consumers may face if they rely on cash to access certain services.

Rise of cash: Coins and notes accounted for nearly one in five retail transactions last year

Chris Brooks, head of policy at Age UK, told the hearing: “There are still a couple of million pensioners who don’t use the internet at all, and many more who lack the skills to use it competently.”

“And managing your money online is really a challenge for a lot of people.”

He added: “People just trust cash, so it’s a question of trust.”

Deidre Cartwright, policy and public affairs manager at the charity Surviving Economic Abuse, said: “Victims and survivors of economic abuse and domestic abuse generally rely on cash for their safety and survival.”

Meanwhile, Conor D’Arcy, deputy chief executive of the Money and Mental Health Policy Institute, told the committee: “When we talk to people with mental health problems, it is often for those same reasons that people really rely on cash.”

The Financial Conduct Authority has introduced tougher rules to ensure banks and building societies offer access to cash.

It said its new rules would require banks and building societies to consider closing branches to fill gaps in access to cash with measures such as banking centres, ATMs and post office facilities.

Ron Delnevo, chairman of the Payment Choice Alliance, told This is Money: ’15 million adults budget for cash – that’s one adult for every two households in Britain – because they are struggling to stay afloat. With so many people using cash to budget, cash usage was bound to increase.”

He added: ‘There are also an increasing number of people who are becoming aware of the threat of identity theft (almost two million cases last year) and other potential online disasters. These people use cash more because it can’t be hacked and of course it doesn’t crash when computer systems crash.’

Debit cards most common payment method

While cash usage increased for the second year in a row, debit cards remained the most common payment method, accounting for about 62 percent of transactions in 2023.

Debit and credit cards combined accounted for more than three-quarters of transactions in 2023, the BRC said.

Overall, customers visited stores more frequently but made smaller purchases as the cost of living crisis continued to bite last year, the BRC said.

The total number of transactions rose from 19.6 billion to 21 billion, while the average amount spent per transaction fell from £22.43 to £22.03.

Card fees paid by retailers continued to rise and the total amount paid by retailers to banks and card schemes increased by more than 25 per cent in 2023, bringing the total amount in card fees paid to £1.64 billion pounds.

Chris Owen, payments policy adviser at the BRC, said: ‘Persistent inflation and the cost of living crisis continued to hit households across the country with many consumers using cash to budget more effectively.

‘However, the dominance of card payments continues apace and accounts for more than 85 per cent of spending.

‘Card fees continue to rise at a substantial rate and the PSR must act on the harms it has identified in its current market reviews.

“It must act quickly to reform the market and implement solutions including price caps on fares and price rebalancing measures.”

Graham Mott, chief strategy officer at LINK, told This is Money: ‘More and more people are choosing to pay with contactless cards and therefore the use of their phones and cash is decreasing.

‘Our data shows that transactions at LINK ATMs are falling by about seven percent a year, and total cash withdrawn by about 2 percent.

“Since Covid, we have seen a continuing trend that although people visit ATMs less frequently, they typically withdraw more cash when they do.”

He added: ‘While there is evidence that some people are using cash to meet cost of living challenges, others are reducing their overall spending, including cash.

“The UK is progressively becoming a cash-strapped country, but some cash will still be used and LINK’s job is to protect access for as long as people need it.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.