- Parents support their children financially for much longer than previous generations

- More than half of parents still provide financial support to their adult children until age 40, USA Today study finds

- Experts Recommend Framing Conversations About Gaining Financial Independence Instead of “Cutting Out”

Parents fed up with supporting their children into adulthood have revealed how they finally got them to move out or start paying their own way.

The current economic climate means that many children are receiving financial support for much longer than previous generations.

A recent USA Today study found that more than half of parents still offer financial support to their adult children until age 40, donating an average of $718 a month.

Meanwhile, a Bankrate survey found that nearly 70 percent of parents said they are currently making some sacrifice to help their children financially.

But for Nancy Clark, once her son Reid turned 28, it was time to consider cutting the umbilical cord.

Nancy Clark and her son Reid made an agreement when he was 28 for him to move out within a year.

Her parents told Ashley Kaufman (center) that she could stay with them until she saved a $100,000 down payment for a house.

“I know that becoming financially independent must be a little painful,” he told Wall Street Journal.

The two had talked about moving before, but it was over dinner in June 2022 that she gave him a one-year deadline to find a new place.

They set a date and Reid left his job at his family’s ice cream shops in New Hampshire to move to St Paul. Minnesota, where she works as the hockey team’s mascot in addition to a position at the M&M store.

His mother initially bought food when he first moved and still gives him about $50, but Reid has stopped depending on her.

“I want to chart my own path in life,” he told the WSJ.

According to Census Bureau data, about 20 percent of men and 12 percent of women ages 25 to 34 lived at home last year.

This was the case for Ashley, the daughter of the Kaufman family, who was told she would have to leave her Manhattan apartment once she had saved $100,000 for a down payment on a house.

She reached the finish line at age 25, but was still nervous about leaving, worried about losing time with her siblings and the family pets. Her parents encouraged her to find her own place anyway.

About 65 percent of parents still provide money to their children, according to a USA Today survey of parents with children ages 22 to 40.

A recent USA Today study found that more than half of parents still provide financial support to their adult children into their 40s.

And just two years later, she is happily settled in her own apartment.

“I’m glad my parents gave me a little push,” he said.

The pandemic exacerbated many of the challenges young people face when trying to get ahead on their own.

Additionally, the rising cost of food and rent these days means many remain stuck in their family homes.

But Pam Lucina, 52, remembers facing similar problems when her parents first cut off money.

She graduated with $40,000 in student debt after choosing an expensive graduate school that assumed her parents would foot the bill.

The decision meant she would not be able to contribute to her 401(k) for five years and was the basis for her decision to become a financial advisor.

“I know my parents sacrificed to give me what they did and I’m grateful for all their support in the past, but I wish I had been more prepared,” she told the WSJ.

Rocky Fittizzi, wealth strategy advisor at Bank of America Private Bank, told the outlet that a “gradual approach” may work best.

‘Framing the conversation around gaining financial independence puts a positive spin on it. Telling your children that you are excluding them suggests that it is a punishment,” he said.

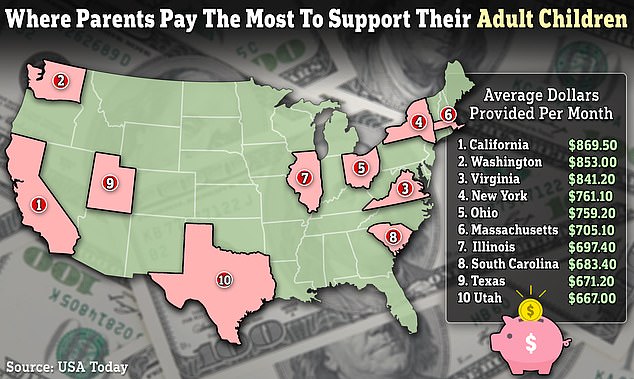

| State | Average dollars provided per month |

|---|---|

| California | 869.5 |

| Washington | 853.0 |

| Virginia | 841.2 |

| NY | 761.1 |

| Ohio | 759.2 |

| Massachusetts | 705.1 |

| Illinois | 697.4 |

| South Carolina | 683.4 |

| Texas | 671.2 |

| Utah | 667.0 |

| Maryland | 665.7 |

| Snowfall | 665.3 |

| New Mexico | 663.1 |

| Kansas | 660.4 |

| Colorado | 642.6 |

| Georgia | 640.6 |

| Florida | 614.5 |

| Minnesota | 597.8 |

| New Jersey | 583.3 |

| Connecticut | 570.5 |

| Louisiana | 552.6 |

| Tennessee | 547.9 |

| Pennsylvania | 517.1 |

| Alabama | 516.6 |

| Indiana | 515.1 |

| Arizona | 512.4 |

| Oregon | 512.0 |

| North Carolina | 451.2 |

| Mississippi | 449.9 |

| Kentucky | 428.8 |

| Missouri | 421.5 |

| Wisconsin | 412.2 |

| Michigan | 401.3 |

| Arkansas | 395.5 |

| Oklahoma | 384.8 |

| Iowa | 349.0 |